As a seasoned crypto investor with a background in financial analysis, I find Block Bull’s prediction for XRP‘s potential growth to be quite intriguing. His use of historical market trends, specifically those related to Bitcoin halving events, adds credibility to his forecast. The consistent upward trajectory of XRP’s price movements and the bullish trendline further strengthen his argument.

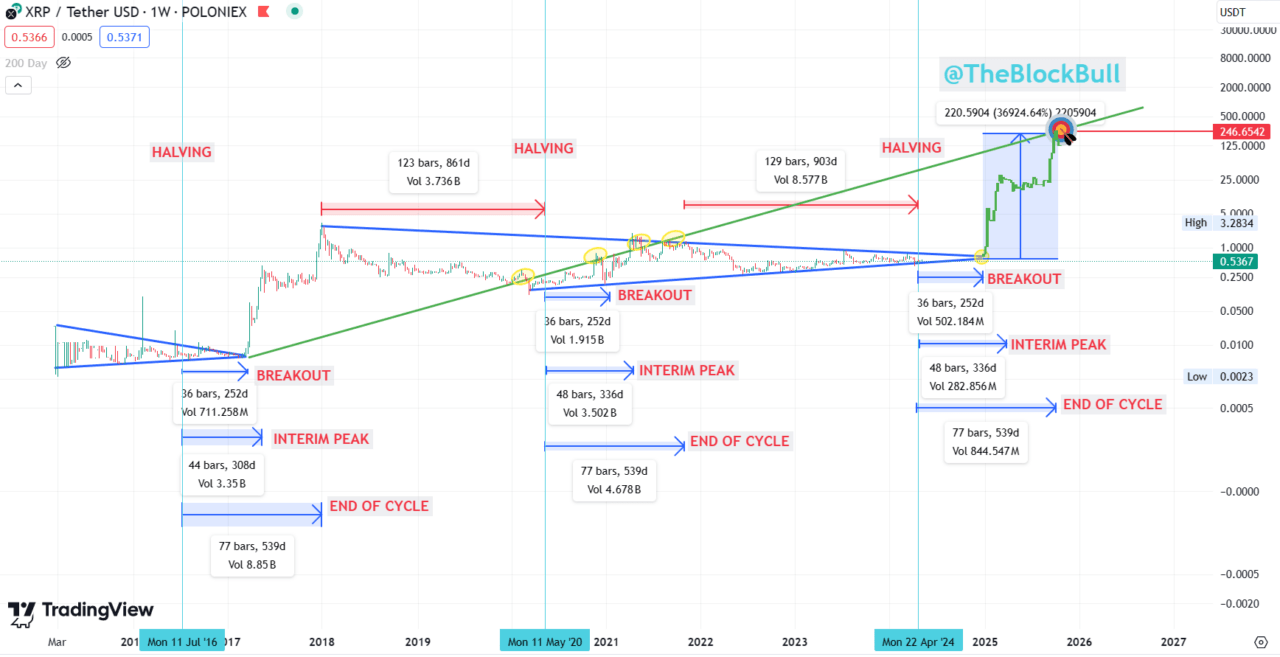

Block Bull, a renowned analyst in cryptocurrencies and content creator, has made an optimistic prediction about XRP‘s future value. According to his analysis, XRP could be worth up to $250 by the year 2025. The foundation of this forecast lies in the study of past market tendencies, with a particular focus on Bitcoin halving events. These significant moments in the cryptocurrency sector occur when the incentive for mining Bitcoin transactions is cut in half, leading to a decrease in newly mined Bitcoins and historically causing price surges throughout the market.

As an analyst, I’ve closely examined XRP‘s price trends since its 2017 surge up to its peak in 2021, highlighting the impact of Bitcoin’s halving events on XRP’s growth. Each market cycle, which lasts around 77 weeks from the breakout point to its peak, has shown a consistent pattern of price escalation for XRP. Notably, I believe that following each Bitcoin halving event, XRP’s value experiences a significant surge due to the reduced supply of Bitcoin and resulting market dynamics.

One significant aspect of Block Bull’s approach involves the “green trendline,” which is utilized in technical analysis to monitor the persistent upward progression of an asset. This trendline signifies a moving average of closing prices throughout the timeframe, giving greater weight to recent data points. The green trendline underscores a robust bullish (upward) tendency for XRP that is expected to persist beyond 2023.

XRP holds the seventh-largest position among cryptocurrencies with a market capitalization approximating $27.2 billion. Although it has experienced a recent decline, analysts anticipate significant future expansion based on their comprehensive assessment. This anticipated growth is supported by various indicators, including the Exponential Moving Average (EMA) and the Relative Strength Index (RSI). The EMA plays a crucial role in crypto markets due to its ability to emphasize current price trends by assigning greater significance to recent prices. On the other hand, the RSI is an essential tool for measuring the intensity and duration of price movements. Values above 70 often signal an overbought market, while readings below 30 suggest an oversold one.

One important measurement used in Block Bull’s evaluation is the actual market value of XRP, currently estimated at around $55.2 billion.

When discussing cryptocurrencies, realized market capitalization refers to a measurement that offers a more authentic portrayal of a digital currency’s worth. It accomplishes this by factoring in the cost at which every coin or token was last transacted, rather than just multiplying the current market price by the entire circulation supply.

Here’s how it works:

- Realized market capitalization is calculated by summing the value of each coin or token at the price it was last transacted on the blockchain. This approach differs from the standard market capitalization, which calculates the total value based on the current price of a cryptocurrency multiplied by its circulating supply.

This metric is particularly useful because it:

- Filters out lost or inactive coins: By only accounting for coins that have recently moved, it excludes lost, forgotten, or hoarded coins that may not be contributing to the current market dynamics.

- Provides insights into the actual economic activity: It offers a view of the market that reflects the prices at which actual trades were made, giving a potentially more realistic view of the market’s valuation.

Understanding market capitalization in the context of cryptocurrencies can differ substantially from its conventional calculation. For cryptocurrencies with an extended history and drastic price fluctuations, realized market cap is a valuable alternative. This metric provides investors with a clearer perspective on the actual capital invested as opposed to relying solely on speculative market values.

Although XRP boasts a positive long-term perspective, its influence in the cryptocurrency market has waned, indicating that its proportion of the entire digital currency market is shrinking. This downturn might be attributed to evolving investor preferences or intensifying competition among crypto assets.

As of this moment (7:30 a.m. UTC on May 13), XRP is priced approximately at $0.4984 on the market, representing a 1% decrease over the last 24 hours, and a substantial loss of 19.62% since the beginning of the year.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2024-05-13 11:11