In the thrilling world of stocks during the first half of 2025, I found myself at the heart of an extraordinary performance – none other than Palantir Technologies! This tech powerhouse not only led the pack in both the S&P 500 and Nasdaq-100, but it also saw a staggering 80% surge in just six months. But here’s where things get really exciting – over the past year, Palantir’s shares skyrocketed by an astounding 427%! This remarkable growth has undeniably drawn attention to the fascinating fusion of artificial intelligence (AI) and defense contracting, making me truly passionate about following its journey ahead.

It’s important to note that Palantir isn’t the only organization aiming to revolutionize defense technology. A lesser-known rival to the company is BigBear.ai (BBAI), whose stocks have seen a significant surge of approximately 357% in the past year.

Could BigBear.ai emerge as the next Palantir? Read on to find out.

BigBear.ai is an exciting company in the world of defense tech, but…

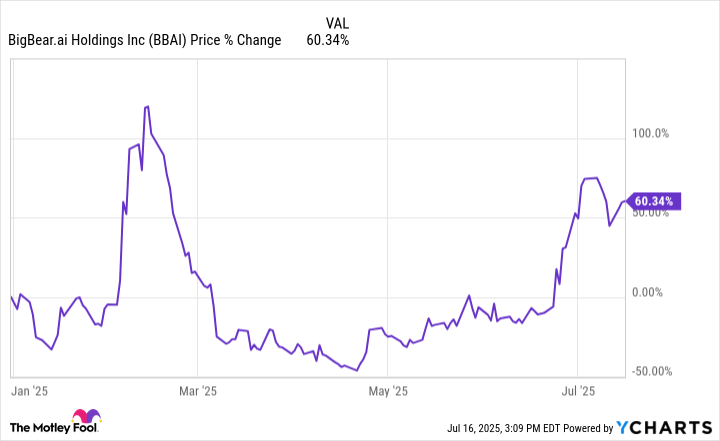

As an excited investor, I must say, the ride with BigBear.ai this year has been akin to soaring on a thrilling rollercoaster! The shares skyrocketed significantly soon after President Donald Trump’s inauguration and the unveiling of Project Stargate – a grand initiative pouring $500 billion into AI projects over the next decade.

Nonetheless, these initial gains were reversed as a result of the Pentagon’s decision to cut its budget by 8% every year.

Initially, it appeared that the cutbacks in defense spending by the Department of Defense (DOD) would significantly impact companies like Palantir and BigBear.ai. However, the trends shown above indicate a swift recovery in their share prices – suggesting that the February sell-offs might have been an overreaction. Why could this be?

From my perspective, it was primarily Defense Secretary Pete Hegseth’s declaration to strengthen the approach known as the Software Acquisition Pathway (SWP) that significantly boosted the rebound in defense stocks.

Essentially, the Defense Department is prioritizing its budget by scaling back on areas considered unnecessary or inefficient. This has led to significant savings, such as the reduction of spending with consulting firms like Booz Allen Hamilton, Accenture, and Deloitte. Moreover, a contract related to an HR software system previously managed by Oracle was also terminated.

Under the SWP (Specific Warfare Program), it seems that the Department of Defense (DOD) aims to liberate funds, enabling them to invest further in technology-oriented projects, as well as finding suppliers capable of managing the Pentagon’s complex processes and tasks.

Given the abundance of opportunities available, it’s quite probable that optimistic investors viewed this scenario as a boost for BigBear.ai. This assumption doesn’t seem overly unrealistic either.

The CEO of BigBear.ai, Kevin McAleenan, is a previous government official who has strong connections to the Trump administration. McAleenan’s strategic links within the government, along with the DOD’s tendency to collaborate with top-tier software service providers, may persuade some investors that BigBear.ai won’t remain inconspicuous for much longer.

…how does the company really stack up beside Palantir?

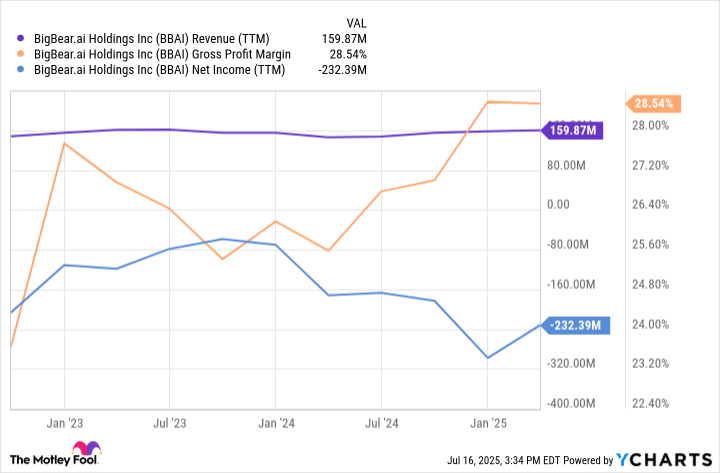

The graph shows the income, profit margin, and net earnings of BigBear.ai for the past year. Despite only earning $160 million in sales, the company often has fluctuating profit margins that barely reach 30%. Given its limited sales volume and modest profit margin, it’s no wonder that BigBear.ai’s losses keep growing.

In the first quarter of 2025, Palantir brought in approximately $487 million from government contracts. To put that into perspective, this is nearly three times the total revenue BigBear.ai generates in a year. Moreover, Palantir’s gross margins are roughly 80%, and their net income over the past year exceeded $570 million.

Is BigBear.ai stock a buy right now?

Currently, BigBear.ai is valued at approximately 11 times its sales price-to-sales ratio. This might seem relatively low compared to Palantir’s 120 multiple, but there are reasons behind the differences in valuation between these two AI defense contractors.

Palantir works with numerous large and rapidly expanding companies in both the public and private sectors, which boast substantial profit margins. On the other hand, BigBear.ai may struggle with growth if they continue to spend money at a rapid pace.

Beyond refusing to invest in BigBear.ai stocks, I don’t foresee the company reaching the heights that Palantir has achieved in the defense technology sector. Palantir stands alone as an industry leader, and I don’t consider BigBear.ai a serious competitor in this domain.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2025-07-20 03:43