Ever since OpenAI introduced ChatGPT commercially on November 30, 2022, I’ve noticed an impressive surge in shares for the semiconductor giant, Nvidia. As I speak, this tech titan stands tall with a market capitalization of a staggering $4.2 trillion, earned through the closing bell on July 16 – a title it now holds as the most valuable company globally.

Though Nvidia seems to be the leading powerhouse in the artificial intelligence (AI) sector, it’s worth noting that the company’s expansion is also due to several strategic partnerships that have significantly boosted its growth.

Let’s delve into some collaborations Nvidia has established and examine the significance of these partnerships. Later, I’ll highlight a specific data center stock supported by Nvidia that I believe is worth watching for growth-oriented investors at present.

What companies is Nvidia invested in?

According to Nvidia’s latest 13F filing, the company has investments in the following businesses:

- CoreWeave

- Arm Holdings

- Applied Digital

- Recursion Pharmaceuticals

- Nebius Group (NBIS)

- WeRide

In the field of data center infrastructure, both CoreWeave and Nebius hold significant positions. Although I believe that both stocks are worthy of consideration, I perceive Nebius as a currently undervalued investment opportunity.

What is Nebius?

Nebius, previously part of Russian internet giant Yandex, gained significance in the AI sector. In late 2024, it went public on the Nasdaq Stock Market. Later, it secured a capital infusion of $700 million through a private offering, with Nvidia among its investors.

In much the same way as CoreWeave, Nebius could be perceived as a modern form of cloud computing, often referred to as a neocloud. By utilizing data centers strategically positioned in Europe and the U.S., businesses can tap into Nvidia’s powerful GPUs via a cloud-based infrastructure services platform. Although the company’s Infrastructure-as-a-Service faces competition from CoreWeave, Oracle, and others, I believe there is ample space for multiple victors in this growing market.

Rising AI infrastructure spend bodes well for Nebius

This year, it’s projected that cloud hyperscalers like Microsoft, Alphabet, and Amazon will together invest approximately $260 billion in capital expenses (often referred to as capex). A significant portion of this investment is expected to go towards building more AI data centers and acquiring additional chip technology.

Furthermore, Meta Platforms has recently injected $14.3 billion into data labeling start-up Scale AI. Additionally, this tech giant in social media and metaverse has been on a massive recruitment spree – luring top researchers from OpenAI and rival companies to establish the Meta Superintelligence Labs (MSL) team.

These investments emphasize that major AI developers are constructing complex environments requiring advanced computing power and seamlessly interconnected service infrastructures.

I view the surge of capital expenditure from hyperscalers as a positive, long-term trend (or wind) that will likely benefit Nebius and the emerging cloud ecosystem.

Is Nebius stock a buy right now?

By the close of Q1, it appeared that Nebius’ AI infrastructure business was thriving, with an estimated annual recurring revenue (ARR) pace hitting $249 million. This marked a staggering 684% increase compared to the same period last year. However, the leadership team is projecting an ARR pace ranging between $750 million and $1 billion by year’s end. To my eyes, this projection underscores Nebius’ readiness to capitalize on escalating infrastructure spending during the second half of the year, as Nvidia continues its rollout of the Blackwell architecture.

In the past few days, Alexander Duval, an equity research analyst at Goldman Sachs, has set a projected price of $68 for Nebius. This suggests a potential increase of 28% compared to the closing prices on July 16. On the other hand, Andrew Beale from Arete Research is extremely optimistic; his predicted price of $84 indicates that Nebius may be undervalued by nearly 60%.

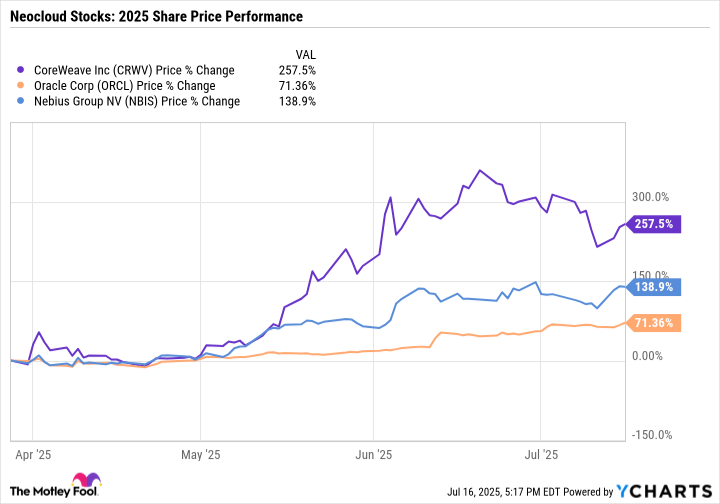

Although Nebius stock’s significant 139% increase in share price might make it seem overpriced, it wouldn’t be wise to dismiss the company just yet. CoreWeave, which recently went public, has been a major talking point in the AI infrastructure sector since then. Furthermore, Oracle’s achievements in infrastructure services strengthen the broader neocloud market narrative and highlight the importance of these businesses as the demand for chip access keeps growing rapidly.

From my perspective, Nebius, a comparatively smaller entity than CoreWeave and Oracle, has largely been swept up by broader market trends. However, taking into account its previously discussed financial expansion, I would argue that its current valuation is less dependent on speculation and is now undergoing a much-needed adjustment that’s long been due.

I find Nebius to be an attractive investment opportunity at the moment compared to its competitors, with potential for substantial growth, as suggested by Wall Street analysts. To my mind, investing in Nebius seems like a no-brainer due to its potential to quickly become a game-changer in the cloud infrastructure and AI data center markets.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 01:08