The S&P 500 index is close to reaching new record highs; talk about a bull market! However, consider PepsiCo (PEP), whose stock has dipped approximately 30% from its 2023 peak as of this writing. This decline places PepsiCo in its own bear market and could make it an enticing choice for investors who prefer contrarian strategies, value investing, or dividend-focused portfolios, including those interested in dividend growth. Here are some key points to consider.

PepsiCo is an industry-leading food stock

One appealing aspect of PepsiCo is its diverse business focus beyond just selling food. Unlike many competitors, it boasts a broad portfolio that includes leading brands in various sectors. For instance, you may recognize its famous soda beverage line, which dominates the company’s beverage division. However, it also stands as the largest manufacturer of popular snack brands (Frito-Lay), and has a substantial packaged food operation under Quaker Oats. Having a variety of growth opportunities and businesses to rely on during challenging times is advantageous.

However, there’s additional detail to consider about this situation. PepsiCo operates on a worldwide scale, boasting impressive capabilities in distribution, marketing, and research & development. It holds its own against other competitors due to these strengths. Furthermore, given its substantial size, it possesses the means to function as an industry consolidator, acquiring smaller brands to maintain its appeal to consumers by keeping its portfolio fresh. Case in point, PepsiCo recently purchased probiotic beverage maker Poppi and Mexican-American food company Siete Foods. To sum up, PepsiCo is a compelling business with a track record of effective management.

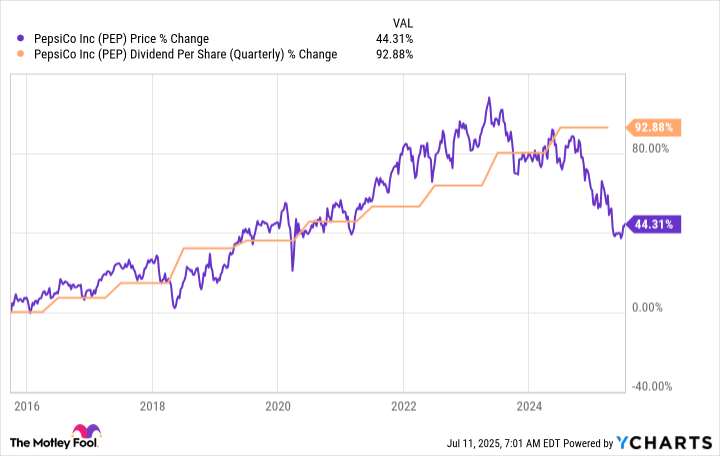

It’s evident that PepsiCo’s status as a “Dividend King” – a title given to companies that have increased their dividends for over 50 consecutive years – is proof of a robust and effectively implemented business strategy, capable of thriving in diverse market conditions.

It’s a bad time for PepsiCo

Regrettably, PepsiCo finds itself in a challenging period as growth rates have significantly decreased and are trailing behind major competitors. The firm has acknowledged that adverse circumstances might persist in the upcoming months. However, the acquisitions of Poppi and Siete demonstrate their efforts to instigate necessary changes for financial improvement. Given PepsiCo’s immense scale, it is evident that transforming its course won’t happen overnight; instead, it requires time.

Investing long-term presents a significant chance, given that PepsiCo’s price-to-sales, price-to-earnings, and price-to-book ratios are currently lower than their average over the past five years. Additionally, the dividend yield, which stands at approximately 4.3%, is nearing record highs for the company. If you favor value or income investments, PepsiCo seems attractively priced at this moment.

If you enjoy going against the mainstream, you might find it intriguing that investors are showing such a cold shoulder towards PepsiCo. It seems as if the financial world is expecting PepsiCo to consistently trail behind companies like Coca-Cola, despite history demonstrating that these two beverage titans frequently swap positions in terms of performance. Therefore, investing in PepsiCo while it’s falling behind Coca-Cola could mean you’re backing the underdog, even though there’s no concrete evidence to suggest they won’t change positions again down the line.

The long-standing high dividend yield and continuous growth of this dividend over time are likely to draw investors who favor both dividends and those focusing on growth and income stocks. It’s worth mentioning that PepsiCo’s dividend increased at a 7% annual rate for the past ten years, effectively doubling during that period – something few would find fault with. Although the near-term dividend growth might decelerate slightly, if PepsiCo manages to return to its growth trajectory as it has in the past, we can expect the dividend growth to rebound.

Slow and steady leads to millionaire-sized wins

Investing a substantial amount of money in PepsiCo’s stock today may not make you a millionaire by itself. However, this company can be an essential component of a broader, diversified investment portfolio, offering consistent growth over the long term, both through capital appreciation and dividend payouts. Interestingly, the stock appears to be currently discounted, experiencing a downturn that resembles a personal bear market for PepsiCo. This could make it an especially appealing time to purchase the stock.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 12:04