Is there much to appreciate in the shares of defense behemoth Lockheed Martin (LMT)? However, the question remains: does its appeal warrant making it a confident investment, one that promises substantial long-term benefits and potentially transformative returns for investors?

The bulls’ case for Lockheed Martin

In simpler terms, the argument for buying this stock is straightforward. It’s built on the constant demand for defense equipment and services due to their essential role in times of geopolitical tension. Not only has President Donald Trump proposed a substantial increase in the defense budget to an unprecedented $1.01 trillion, but NATO has also expanded, and its members have recently committed to investing 5% of their national income (GDP) on defense and security-related expenditure by 2035.

To elaborate, a significant portion of the military spending in the U.S., particularly, goes towards missile defense and tactical missiles – areas where Lockheed Martin excels. During an earnings call in April, CEO Jim Taiclet emphasized that their 21st-century security strategy, which combines traditional systems like satellites, aircraft, ships, launchers, and command centers with upgradable digital technologies, is perfectly suited for the missile defense system known as Golden Dome.

To elaborate, Lockheed Martin’s existing order book amounts to $173 billion, which is equivalent to approximately two and a half years of projected sales by their own forecast for annual revenue in 2025. Moreover, it’s important to mention that the U.S. government, being their main client, has an impressive track record of prompt payments.

Glancing at the financial projections, the midpoint of management’s forecast suggests an earnings per share of $23.15 and a free cash flow (FCF) of $6.7 billion. At the current stock price, this equates to a multiple of 17.2 for earnings and 16.3 for FCF.

It appears the company’s valuation looks promising given its strong potential for growth. However, as we know, investing is not typically cut and dry; it often requires more careful consideration.

The bears’ case for Lockheed Martin

The negative case for the stock can be seen in three interrelated arguments:

- Lockheed Martin’s execution challenges in recent years, notably with its most important single program, the F-35 Lightning II Joint Strike Fighter, have damaged confidence in its ability to produce “long-run franchise” programs.

- Lockheed Martin, like many other defense contractors, including Boeing and RTX, has struggled to achieve margin expansion in recent years, as the U.S. government has become more adept at negotiating contracts, particularly through the use of fixed-price contracts.

- The current environment is highly conducive to defense spending, but that doesn’t guarantee that it will be the case in the future.

Lockheed Martin’s execution and margin challenges

This year, two key incidents shed light on the company’s difficulties in executing its plans. Initially, there was a mention by the Department of Defense regarding their proposed defense budget for 2026, which suggested a decrease in the acquisition of F-35 aircraft.

It’s clear that the reason for a decrease in procurement is due to a shift in focus by the DOD towards making operational the existing F-35 aircraft instead of acquiring new ones. In 2024, only about half (51.5%) of the F-35 fleet was mission-capable according to airandspaceforces.com, with high-profile delays and problems associated with Technology Refresh 3 (TR3) on the F-35 contributing to this low number. Moreover, the substantial cost overruns related to the F-35 have led the military to contemplate flying it less as a way to cut expenses.

These problems undermine trust in Lockheed Martin, particularly since it bears initial expenses for projects with the aim of eventually transforming them into profitable long-term ventures. This raises doubts about its capacity to expand profit margins in the years ahead.

Another way to phrase this could be: The second problem at hand involves Boeing being awarded the Next-Generation Air Dominance (NGAD) contract, an award that may have been impacted by complications surrounding the F-35 program.

Long-term defense spending

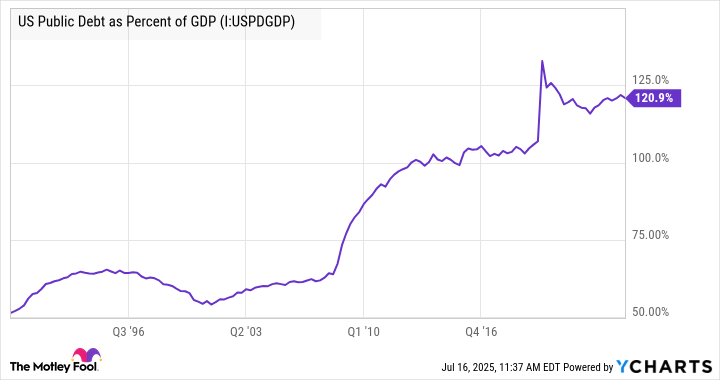

As a devoted investor, I find it essential to clarify that this platform isn’t designed for an in-depth discussion about the sustainability of government expenditure. However, if your portfolio includes defense stocks due to the anticipated longevity of increased spending from the U.S. government (which constitutes approximately two-thirds of NATO spending), then you might find comfort in the ensuing graph depicting the trajectory of U.S. public debt relative to its GDP. This visualization serves as a testament to the notion that escalating debt levels may not hinder future allocations for defense and other significant matters.

Furthermore, foreseeing the specific regions where worldwide defense focus will shift in the coming years can prove challenging, and even more so trying to determine this over an entire lifetime.

Is Lockheed Martin stock a buy?

All things considered, defense stocks seem slightly underpriced, but the challenges Lockheed Martin faces with the F-35 might not make it an ideal choice for maximizing profits from a favorable medium-term outlook on defense expenditure. Consequently, Lockheed Martin may not be a stock that offers significant investment opportunities for life-changing returns.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

2025-07-20 08:12