As a seasoned crypto investor with over a decade of market analysis under my belt, I have weathered numerous bull and bear markets, learning valuable lessons along the way. The latest prediction by Aksel Kibar of a potential pullback in Bitcoin‘s price to $80K has piqued my interest, but it’s not enough for me to make a hasty decision.

The renewed interest from large investors, or “whales,” moving stablecoins to exchanges is a positive sign that could bolster Bitcoin’s recovery. However, I’ve seen similar trends before, and they haven’t always resulted in immediate price surges. As the saying goes, “don’t count your Bitcoins before they hatch.”

The resistance at key levels like the 21-day simple moving average is concerning, but it’s not uncommon for Bitcoin to face snap rejections at critical points. I remember the time when many analysts predicted a swift rise to $200,000 only to see the price plummet shortly after.

Despite the uncertainty, I find hope in the resilience of the broader crypto market and the recovery of Bitcoin ETFs in the U.S. In my experience, these are often indicators of a potential rebound. But as always, I’ll approach this with caution, balancing short-term risks with long-term optimism.

To lighten the mood, let me share a joke that fellow investors can appreciate: Why did Bitcoin cross the road? To get to the other blockchain! It’s been a long and winding road in the world of crypto, but it never fails to keep things interesting.

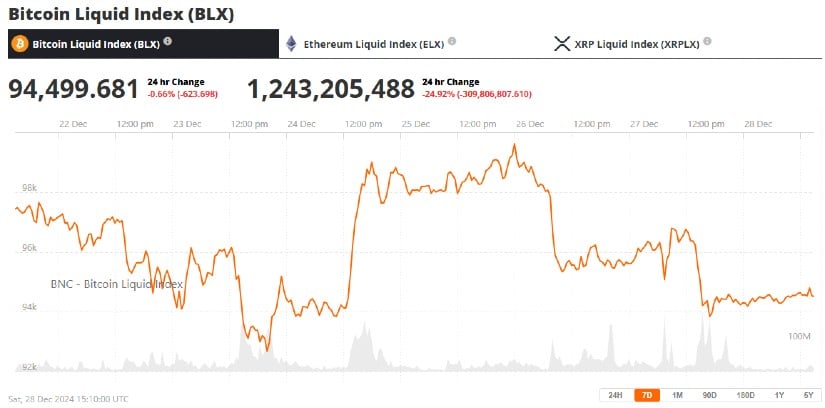

On December 26, Aksel Kibar, who is a certified market technician, discussed his insights, pointing out a potential “head and shoulders” formation which might indicate a substantial drop in the price of Bitcoin.

In simpler terms, Kibar posted on platform X (formerly Twitter) that Bitcoin ($BTCUSD) has broken out from a widening chart pattern which has now been completed. This breakout could be followed by a short-term Head and Shoulders (H&S) top formation, indicating a potential pullback. If the H&S top holds true, the price target could reach 80K. This pullback might lead us back to the broadening pattern, which was completed with a breakout above 73.7K.

As a researcher, I’m suggesting that based on Kibar’s findings, Bitcoin might encounter lower price levels before it settles into a stable phase, especially considering the development of the pattern on the daily chart.

Whales and Market Trends Signal Optimism

Regardless of the cautions about an impending adjustment, market information presents a hint of optimism for Bitcoin supporters. According to data from analytics company Santiment, there seems to be a revived curiosity among big investors, often referred to as “whales,” as they transfer stablecoins to trading platforms.

Following the post-Christmas downturn across various markets, cryptocurrency markets are exhibiting a hopeful pattern where large investors (often referred to as ‘whales’) are transferring stablecoins into exchanges, according to Santiment’s analysis on December 27th. While these actions don’t necessarily mean instant purchases, they do indicate optimism among investors as the year winds down.

Santiment noted that the activity on cryptocurrency exchanges was being dominated by stablecoins, suggesting this trend might indicate a positive outlook for Bitcoin’s resurgence.

Resistance at Key Levels

Bitcoin has found difficulty in staying above the $100,000 level, encountering swift rejections at vital resistance levels such as the 21-day simple moving average, which is presently around $99,425. This technical resistance has resulted in Bitcoin fluctuating between possible highs and pessimistic goals.

1) Investors are keeping a watchful eye and showing caution towards immediate market fluctuations. The misleading data shown on TradingView for a short while, where it indicated Bitcoin’s market control was zero percent, only served to increase the uncertainty during the post-Christmas stock market drop.

Broader Market Context and ETF Developments

Overall, the crypto market has demonstrated a degree of robustness. U.S.-based Bitcoin Exchange-Traded Funds (ETFs) have experienced a surge in investments, with over $1.5 billion flowing in following periods of outflows. This influx, though relatively small, suggests continued investor enthusiasm amidst the ongoing market turmoil.

By the year 2024, the future price movement of Bitcoin remains unpredictable, with experts keeping a keen eye on both technical indicators and global economic shifts. Whether it returns to $80,000 or experiences a robust recovery is largely contingent upon factors such as on-chain transactions, the actions of major investors (whales), and overall market mood.

Looking Ahead

Despite some forecasts suggesting a drop in Bitcoin price down to $80,000 causing apprehension, signs of increased stablecoin usage and ETF investments indicate a possible rebound over the next few months. Investors are urged to exercise caution, striking a balance between assessing short-term risks and maintaining long-term optimism as Bitcoin maneuvers through a fluctuating yet favorable market terrain.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-29 14:49