Costco Wholesale (COST)-the behemoth of bulk buying, the titan of warehouse fever dreams. It started its public life in 1985 at a jaw-droppingly humble $1.67 a share-split-adjusted, of course-and now, decades later, it’s worth more than 575 times that original pittance. Let’s not mince words: Costco has been a retail stock dynamo. In the last five years, the thing has rocketed up 205%, leaving even the S&P 500 choking on its dust. And if you’re a betting man, you’d think this beast can do it again in the next five, right? WRONG. Oh, we can *wish* that’ll happen, but history-and numbers-don’t work that way.

We’ve all heard the song of stocks soaring, only to come crashing down in a pile of confetti and regret. But don’t just throw all your chips into the Costco basket without taking a long, hard look under the hood. Let’s dive in and peer into the belly of the beast.

The State of Costco

Ah, Costco. The temple of bulk. The land where toilet paper is sold in quantities that could sustain a small army. But this is no joke. The Costco business model is a masterpiece of retail engineering. For just $65 a year (and let’s face it, that’s the price of two bad dinners out), you get to access high-quality goods at prices that are only marginally above what it costs them to make the stuff. They aren’t here to gouge you. They’re here to sell you in quantities that make your pantry look like a Costco warehouse.

And this isn’t just a fleeting phenomenon. As of fiscal 2025’s third quarter (May 11), Costco was operating 629 of its 914 stores across 47 U.S. states. It’s a juggernaut on a near-inevitable course to spread globally. Sure, the U.S. market is practically *done*-but fear not! There are more countries, more consumers, more headaches-and Costco is waiting to suck them into its gravitational pull. All those countries ripe for the taking. Except for maybe Target and Home Depot, who floundered when they tried to expand. Costco has cracked the expansion code. If this isn’t the perfect business model, I don’t know what is.

Why Some Investors Might Hesitate

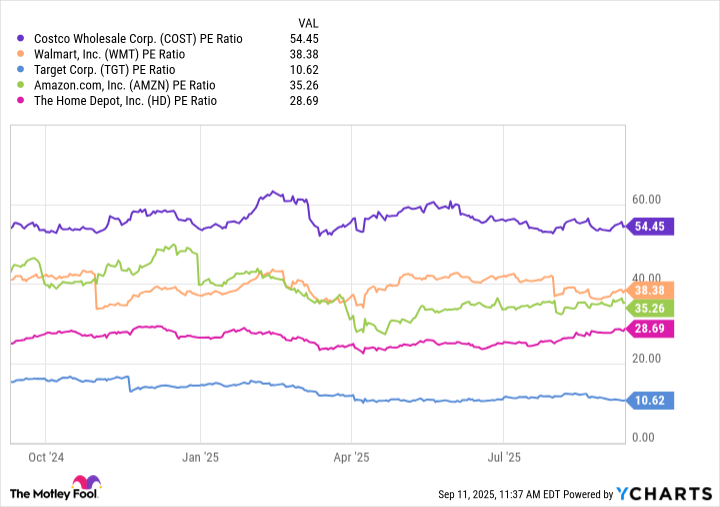

Now let’s talk about something truly sinister lurking in the Costco paradise: the price-to-earnings (P/E) ratio. At a mind-bending 54, this stock is MORE popular than the latest TikTok dance craze. Every investor worth their salt knows about Costco, and the price is *reflecting* that. The thing is, a P/E ratio this high? Well, it’s a sign of *hysteria*, and the kind that doesn’t end well.

To make matters worse, in 2025, Costco’s P/E ratio exceeded 60-something that hasn’t been seen since the dot-com bubble exploded in a fiery ball of irrational exuberance. So what does that mean for investors? It means you’re riding on a razor’s edge. You’re betting that Costco can somehow *defy reality* and keep these astronomical growth numbers churning, year after year. But guess what? Nothing lasts forever.

Sure, the company is planning to expand by 24 warehouses in fiscal 2025-but that’s less than a 3% increase. And if you’re expecting the kind of exponential growth that could justify such a high valuation? Well, that’s a pipe dream. Hell, even their net sales-$189 billion in the first three quarters of 2025-only saw an 8% rise. *Only* 8%. That’s good, but let’s not start printing t-shirts about it yet. There’s only so much more you can squeeze out of the core business without getting stuck in the “mature market” phase.

Let’s not even get into interest income. That’s dropped. And their tax burden? Up. The result: a net income rise of 9%, which is fine-*barely*. At this point, Costco is a *classic* case of slow but steady growth, but the price? *It’s out of control.* A forward P/E ratio of 43 isn’t promising when the market is going to expect growth just to keep the lights on. Good luck with that.

Where Will Costco Be in Five Years?

So, where does that leave us? Well, it’s clear that Costco isn’t going to go *down*. That would be the fantasy. This company is too well-oiled, too entrenched, and too loved by its consumers. But will it blow the roof off the stock market in the next five years? Nah. It’s unlikely. The best we can hope for is a decent return that *just* outperforms the S&P 500. But let’s be real: if you’re dreaming of some kind of gangbusters, moonshot performance, that’s probably not happening.

Sure, five years is a long time. Anything could happen. But unless a miracle (or a global disaster) happens, Costco’s stock is likely going to cool down. Investors should brace for a gradual devaluation of that lofty P/E ratio. It’s time to face facts: Costco is probably a hold for the long term. But if you’re looking for the next big thing, the *next big thrill*, well, maybe this isn’t your ticket. Take your cash elsewhere, kid.

And remember, the stock market is a strange beast. It always promises more than it delivers. Don’t get too attached to those *wild dreams* of big returns. 🍾

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-17 17:19