Costco. The name itself doesn’t sing, doesn’t promise sunshine. Just a warehouse. But warehouses, I’ve found, can hold more than just goods. They can hold value. The stock took a hit last year, a six percent dip. Not a disaster, just a reminder that even the sturdiest ships list in a storm. But over the long haul, Costco doesn’t just float, it moves. Reliable growth, decent profits. A simple model, and that’s the beauty of it. If you’d put a grand into this stock twenty years ago… well, let’s just say you wouldn’t be counting pennies.

The Costco Equation

The trick isn’t rocket science. Low prices. That’s the hook. It appeals to everyone, especially when wallets are feeling thin. People tighten their belts, and suddenly bulk buying doesn’t seem so extravagant. Costco understands this. They thrive when others stumble. It’s a basic equation, really. Need plus value equals… well, equals a healthy bottom line.

They’re still reporting solid numbers. Eight point two percent sales growth in the last quarter. Not flashy, but consistent. And they’re adding members, upgrading them to executive status. Loyalty. A rare commodity these days. It’s a slow burn, this Costco thing. Not a wildfire, but a steady, reliable heat.

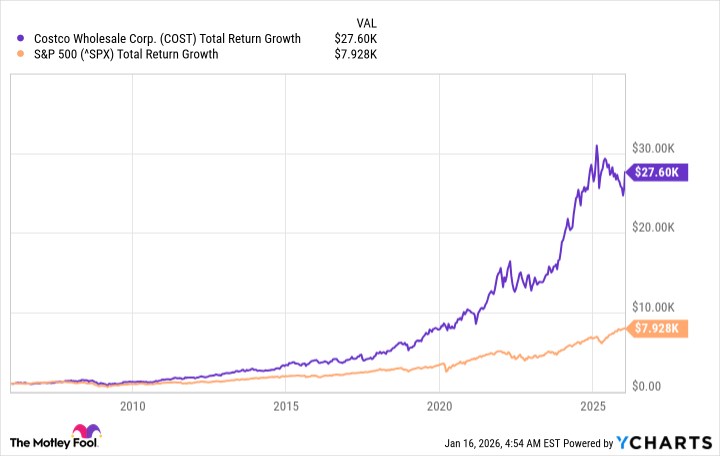

The core idea hasn’t changed in decades. A warehouse, a membership, a promise of savings. Recognize that, back then, and a thousand dollars would be twenty-seven thousand six hundred today. Not bad for a gamble on bulk toilet paper and rotisserie chickens. Compare that to the S&P 500, which would have given you a measly seven thousand nine hundred. The difference isn’t just numbers, it’s about understanding where value hides.

Can it last? The model is solid, if uninspired. They’re embracing technology, where it makes sense. Not chasing every shiny object, just using it to streamline things. They’re still expanding, still finding opportunities. Past performance isn’t a guarantee, of course. But in a world full of illusions, Costco feels… real. It’s not a glamorous investment, but it’s a smart one. And in this business, smart usually wins.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 13:22