Costco Wholesale (COST +1.16%) exhibits a peculiar resilience, a slow, upward drift against the prevailing currents. To observe a 15% increase in valuation over the past year, while the broader market seems perpetually poised on the brink of… something, is to invite a certain disquiet. It is not a surge born of demonstrable innovation, nor a response to any discernible external stimulus, but rather a quiet, almost bureaucratic accumulation.

The parallel advances in the valuations of Walmart and Target offer no solace, merely reinforcing the impression of a systemic anomaly. The forthcoming earnings report for the second quarter of fiscal 2026, scheduled for March 5th, feels less like a potential catalyst and more like a procedural formality, a document destined to confirm what is already, inexplicably, known.

The question, then, is not whether Costco is a sound investment, but whether the very act of seeking a rationale for its current valuation is itself a futile exercise, a descent into a labyrinth of self-justification. One finds oneself, not analyzing a stock, but attempting to decipher a code, a set of unspoken rules governing its ascent.

The Ritual of Renewal

Costco’s enduring popularity, evidenced by its approximately 92% membership renewal rate, is not a testament to superior merchandise or exceptional service, but rather a demonstration of habit, a collective adherence to a pre-ordained pattern of consumption. It is a comforting predictability in a world increasingly defined by chaos, a monthly pilgrimage to the warehouse, a reaffirmation of belonging.

Its former inclusion in Berkshire Hathaway’s portfolio, and the subsequent presence of Charlie Munger on Costco’s board, feels less like a strategic endorsement and more like a historical footnote, a relic of a bygone era when logic and reason still held sway. Munger’s passing in 2023 serves as a grim reminder of the impermanence of all things, even seemingly immutable corporate structures.

The reported 6% revenue increase in the first quarter of fiscal 2026, and the corresponding 11% surge in net income, are not indicators of robust growth, but rather the predictable outcome of a meticulously calibrated system, a machine designed to generate incremental gains, regardless of external conditions. The previous fiscal year’s performance – an 8% revenue increase and a 10% profit surge – merely confirms the cyclical nature of this process, a perpetual motion machine fueled by consumer habit.

Costco’s success in international expansion, particularly in markets where Walmart faltered, is not a triumph of strategic foresight, but rather a demonstration of the universality of human desire for bulk discounts and predictable shopping experiences. It is a system that transcends cultural boundaries, a relentless pursuit of efficiency and standardization.

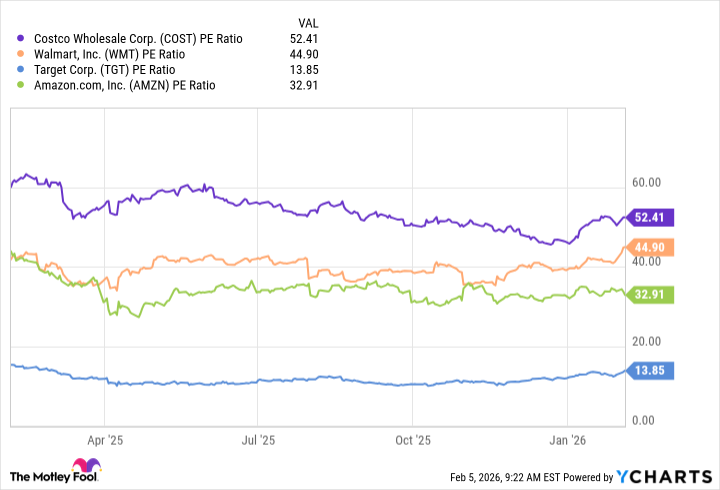

The inherent paradox lies in Costco’s very success. The escalating P/E ratio, now exceeding that of its peers – Walmart, Target, even Amazon – suggests a disconnect between valuation and underlying fundamentals. The growth, while consistent, does not seem to justify the premium. One begins to suspect that the stock is not being valued on its merits, but rather on the collective belief in its continued ascent, a self-fulfilling prophecy fueled by investor enthusiasm.

Berkshire Hathaway’s decision to divest its Costco holdings in 2020, while later acknowledged by Buffett as “probably a mistake,” remains a troubling sign. It suggests that even the most astute investors occasionally succumb to the allure of inflated valuations, mistaking momentum for genuine growth. The subsequent rise in valuation only serves to reinforce the precariousness of the situation, a house of cards built on a foundation of investor optimism.

A Stasis of Ownership

Long-term investors may find solace in Costco’s consistent performance, but new entrants should proceed with caution. The company is undoubtedly well-managed, and its ability to generate revenue and profits is unlikely to diminish. However, the current valuation appears unsustainable, a reflection of irrational exuberance rather than fundamental value.

Until the earnings multiple aligns with that of its peers, this stock remains, not a compelling buy, but a testament to the inscrutable logic of the market, a reminder that even in the realm of finance, meaning is often elusive, and certainty a dangerous illusion. The warehouse stands, immutable, a monument to the enduring power of habit, and the unsettling ambiguity of value.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 14:12