In the grand, gilded halls of Wall Street, the stalwart titans of consumer staples—Walmart, Coca-Cola, Procter & Gamble, and PepsiCo—loom like ancient toads, their wares nestled in every nook of our homes. Yet, amidst these venerable giants, a sprightly newcomer emerges: Costco (COST), whose influence and cunning have stirred both admiration and suspicion.

Is it a treasure trove for the discerning value investor, or merely a sly trap cloaked in the glitter of growth? Let us peel back its veneer.

Unveiling Costco’s Secrets

Before succumbing to temptation, we must answer two pressing questions: What does Costco do, and how colossal is it?

Costco is nothing short of a retail titan. With over 900 warehouse stores spanning 14 countries—most of which grace the American landscape—it boasts a market cap of roughly $400 billion. In the realm of consumer staples, it stands as the second-largest stock, a veritable giant among giants.

The linchpin of Costco’s crafty strategy is its membership model. By restricting access to its hallowed halls to paying members only, the company reaps a bountiful stream of revenue from membership fees. In 2024, this clever ruse yielded a staggering $4.8 billion—a mere 2% of total revenue, yet the very lifeblood of its profitability. Indeed, a lion’s share of Costco’s $1.9 billion net income springs from these high-margin fees, enabling the company to offer prices as low as a sly fox’s promise.

The Boon and Bane of Costco’s Dominion

There are several beguiling reasons to champion Costco stock. Firstly, its business model is a stroke of mischievous genius—a scheme that relies less on the fickle whims of transient shoppers and more on the steady goldmine of membership fees. Unlike the typical retailer, whose survival teeters on the backs of ever-roaming consumers, Costco thrives on the loyalty of its members, whether they wander its aisles or not.

Secondly, Costco is not merely a retailer; it wields its own private-label brand, Kirkland, like a secret weapon. Nearly one-third of its sales are attributed to these products, which, much like a concealed trapdoor, yield higher margins than the offerings of its rivals.

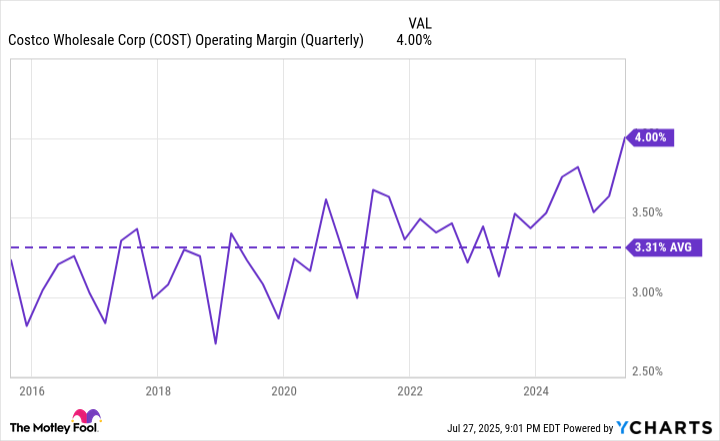

Lastly, the enigmatic realm of artificial intelligence looms on the horizon. For years, Costco’s operating margins have hovered around a modest 3%, but recent quarters have seen a nudge upward to around 4%. Should the company harness the arcane arts of AI—deploying humanoid robots and AI-driven inventory management—it might transform its operations into a veritable cauldron of efficiency, further widening its margins.

Yet, dark clouds gather over Costco’s empire. Trade and tariff worries cast long shadows, for many of its products journey from distant lands, leaving it vulnerable to the caprices of international policy. Moreover, the fickleness of consumer spending—easily chilled by a weakening labor market or a sudden spike in inflation—poses a real threat to this retail titan and its shareholders.

Furthermore, the competitive arena is rife with ferocious adversaries. Deep-pocketed rivals such as Walmart and Amazon lurk in the shadows, ever ready to pounce on any misstep, eager to snatch away customers and market share with a rapacious hunger.

Is Costco Stock a Treasure Trove for the Value Investor?

For the discerning value investor, the decision to invest in Costco is a conundrum wrapped in a riddle. Its price-to-earnings multiple of 53 looms like a foreboding specter, far loftier than most of its consumer staples counterparts. Yet, beneath this veneer of expense lies a cleverly engineered revenue stream—the membership fees—which offers a form of stability that few retailers can boast.

The promise of AI-driven efficiencies is like a siren’s song, whispering of margins that could widen further and profits that could soar. However, the risks—macroeconomic uncertainties, the specter of trade tariffs, and the ever-looming shadow of cutthroat competition—serve as a grim reminder that the path ahead is fraught with danger.

Thus, while growth-oriented investors might be seduced by the allure of technological miracles, value investors—those who favor the subtle art of uncovering hidden gems—should approach Costco with a wary eye. Its high valuation, despite the brilliance of its membership model, casts a shadow of doubt over its long-term value proposition.

In the final analysis, Costco stands as a paradox—a cunning, almost Machiavellian enterprise that offers a steady income stream through its membership model, yet is burdened by an exorbitant P/E ratio and the lurking threats of market volatility. For those of us in the value investing guild, the verdict is cautious: if you’re enchanted by the sly promise of AI-fueled efficiency and the clever design of its membership strategy, then perhaps a closer look is warranted. But for the prudent investor, the allure of growth may be a treacherous mirage. 🤔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-29 04:26