In a world where the chimera of public equity dances tantalizingly before investors, CoreWeave (CRWV), having graced the public markets for merely six months, presents a striking tableau-its stock price has more than tripled amidst a tempest of volatility. This dizzying ascent is buoyed by a burgeoning revenue stream, yet beneath this jubilation lingers a faint undertone of apprehension.

Indeed, the very fabric of CoreWeave’s narrative is woven with threads of rising debt and stock dilution, particularly in light of its hefty $9 billion engagement with Core Scientific. The romanticized nature of its recent highs has receded somewhat in the wake of this reality check, yet the company’s nascent partnership with Nvidia (NASDAQ: NVDA) could serve as a salve for anxious investors, providing them with a glimpse of potential prosperity.

Nvidia’s Pact: A Ray of Hope for the CoreWeave Investors

CoreWeave has crafted a business model reminiscent of a delicate ballet, prancing gracefully upon the foundation of artificial intelligence (AI) data centers, buoyed by Nvidia’s formidable graphics processing units (GPUs). It rents its cloud computing capabilities to illustrious clients such as Meta Platforms and Microsoft, which dominate its revenue streams, with the recent addition of a titan, OpenAI.

“Nvidia is obligated to purchase the residual unsold capacity” of CoreWeave, a promissory note that reflects an acute awareness of the intricate ballet performed by supply and demand-a choreography that, in CoreWeave’s case, is being overshadowed by insatiable desire for computing resources.

CFO Nitin Agrawal, during the August earnings confab, lamented that the company’s “growth continues to be capacity-constrained,” a sentiment that resonates with the burden of unrealized potential. Their backlog swelled by nearly $14 billion year-over-year in Q2, nudged along by the grand contracts of conglomerates, a hint at the turmoil lurking beneath splendid success.

For the record, CoreWeave’s revenue for Q2 blossomed to $1.2 billion, a lovely leap from the meager $395 million it could muster in the prior year. Yet, in the shadow of its considerable revenue backlog, worth a staggering $30 billion, the company is like a gardener waiting for bloom, all the while tending 33 dedicated AI data centers across the U.S. and Europe, generating an active power capacity of 470 megawatts (MW).

In contemporary times, the company has ramped up its power capacity with an impressive acceleration-600 MW added just last quarter, bringing its total to a respectable 2.2 gigawatts (GW). Yet, this addition might merely skim the surface of impending demand. An analysis by McKinsey indicates that data center capacity demand could quadruple by 2030, creating a significant chasm between aspiration and availability.

In a midrange scenario, the firm forecasts that global capacity needs will soar to 220 GW by 2030, a staggering rise from 55 GW in 2023. This looming demand hints that CoreWeave may find itself perpetually ensnared in a web of insufficient capacity, largely due to the AI data center boom. Therein lies a bitter irony: while the promise of AI technology burgeons, the infrastructure lags behind, and a deficit of 15 GW is anticipated within the U.S. alone by 2030.

Therefore, the specter of CoreWeave’s future remains uncertain. Nvidia’s contract, while a welcome cushion, cannot obliterate the realities of an industry encased in an ever-tightening grip of demand and supply. For those who wander into the realm of investment pondering the trajectory of AI computing, the road ahead is fraught with opportunities wrapped in complexities.

What Investors Might Ponder

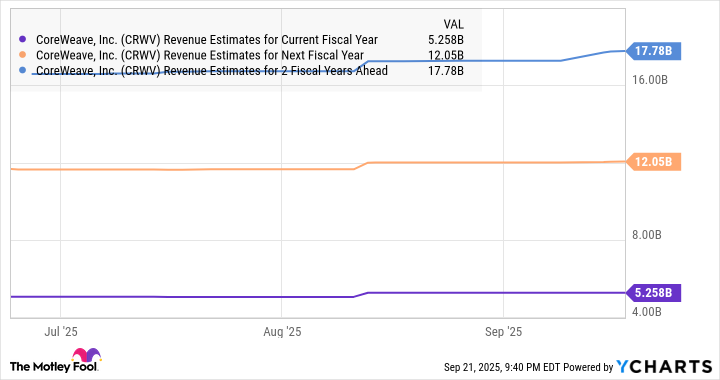

In light of Nvidia’s solemn guarantee, one might deduce that the demand for AI computing will maintain its enduring zest, potentially translating into a burgeoning backlog and elevated growth through 2028. Analysts anticipate as much-and perhaps therein lies the cruelest jest of all.

The vast expanse of opportunity within the cloud AI infrastructure sphere suggests that CoreWeave could sustain noteworthy growth beyond 2028. One can almost indulge in daydreams of a 20% annual revenue swell in 2029 and 2030, leading to a tantalizing $25.6 billion in revenue. If CoreWeave trades at a modest five times sales then, a market capitalization hovering around $130 billion would ascend-doubling its present standing.

Yet the present offers a striking contrast. CoreWeave stands at 16 times sales, not an exorbitant figure when viewed through the lens of its remarkable growth. Thus, for those astute enough to navigate the convoluted currents of AI cloud infrastructure, this stock may beckon enticingly. However, consider this: the Nvidia contract is a nod-a fragile yet confident step towards the possibilities that lie ahead in both CoreWeave and the broader AI data center market. And amidst the uncertainties, we are left to ponder: is there enough light to render the future less ambiguous? 🤔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-27 01:10