Recent market performance has demonstrated investor enthusiasm for companies positioned to benefit from the proliferation of artificial intelligence. While the long-term implications remain subject to considerable uncertainty, the current valuation of select AI-adjacent equities warrants careful examination. This analysis focuses on CoreWeave, a provider of computational infrastructure, and attempts to reconcile its rapid growth with inherent financial risks.

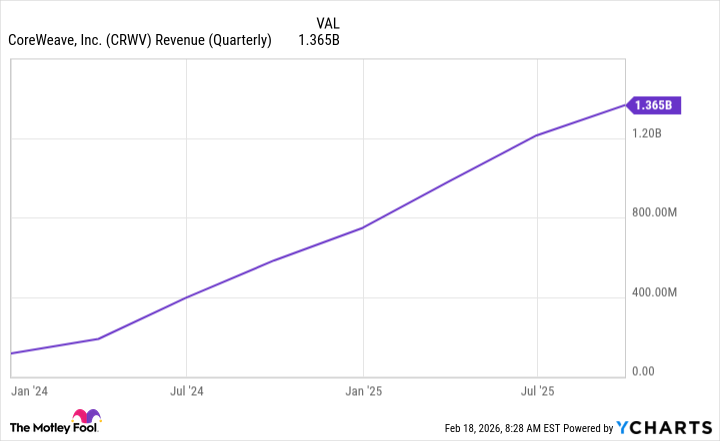

CoreWeave: A Revenue Trajectory

CoreWeave has experienced substantial revenue growth, attributable to increasing demand for GPU-accelerated computing resources. The company’s business model – providing on-demand access to Nvidia’s high-end GPUs – offers a compelling alternative to the capital-intensive process of building and maintaining in-house data centers. This has resonated with a client base seeking both flexibility and cost efficiency.

The company’s reliance on Nvidia’s technology, while currently advantageous, introduces a degree of dependency. CoreWeave’s ability to maintain competitive pricing and service levels is contingent upon continued access to Nvidia’s GPUs and favorable terms. The potential for supply chain disruptions or shifts in Nvidia’s pricing strategy presents a clear risk.

Financial Leverage and Infrastructure Expansion

The primary challenge facing CoreWeave is not customer acquisition, but rather the scaling of infrastructure to meet accelerating demand. This necessitates significant capital expenditure, which the company is currently funding through debt. While debt financing can amplify returns during periods of rapid growth, it also introduces a substantial degree of financial risk. The company’s existing leverage warrants close monitoring, particularly in the context of potentially rising interest rates.

The following points summarize the key considerations:

- Revenue Growth: Current revenue trajectory is encouraging, but sustainability remains to be seen.

- Capital Expenditure: Significant ongoing investment in infrastructure is required to maintain growth.

- Debt Burden: High leverage introduces vulnerability to adverse economic conditions.

- Nvidia Dependency: Reliance on a single supplier creates potential supply chain risks.

Valuation and Risk Assessment

The current market valuation of CoreWeave appears optimistic, reflecting expectations of continued rapid growth. However, investors should carefully consider the inherent risks associated with the company’s financial leverage and reliance on a single supplier. A conservative assessment of future growth prospects, coupled with a realistic assessment of potential downside risks, is warranted.

Nvidia’s investment in CoreWeave is a noteworthy development, suggesting confidence in the company’s potential. However, it does not eliminate the aforementioned risks. The market’s enthusiasm for AI-related equities should not overshadow the importance of fundamental analysis and prudent risk management.

In conclusion, while CoreWeave presents an intriguing growth opportunity, investors should proceed with caution. A thorough understanding of the company’s financial profile, coupled with a realistic assessment of potential risks, is essential before making an investment decision.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-02-20 12:12