Now, CoreWeave, you see, has been causing a bit of a stir in the artificial intelligence racket. A dashedly clever little company, really. Launched into the market with a vim and vigour that would make a rocket scientist blush, the stock price did a rather spectacular jig, soaring upwards like a startled pheasant. It’s settled down a bit since, of course – one can’t expect fireworks all the time – but remains, shall we say, perkily positioned. A rise of nearly 140% since its debut is nothing to sneeze at, what!

There’s a good deal to commend it, this CoreWeave. They’ve cornered a rather lucrative niche – renting out the computational muscle needed for all this AI tomfoolery. And not just any muscle, mind you, but the top-of-the-line stuff from Nvidia – a firm with a reputation as solid as a bank vault. A most promising arrangement, wouldn’t you agree? They seem to have the knack for providing exactly what the market craves, which, in this instance, is computing power by the hour. A bit like hiring a particularly strong fellow to move some furniture, only with silicon chips instead of brawn.

So, if one is inclined towards investments with a bit of pep, CoreWeave might well be worth a look. But the question, as always, is when to jump in. Should one rush to acquire shares before the firm announces its earnings on February 26th? Let’s unravel this little conundrum, shall we?

Capacity for AI Workloads

Now, CoreWeave’s success isn’t a matter of mere luck, you understand. They’ve been remarkably astute in identifying a genuine need. These AI chaps, you see, require an awful lot of computing capacity, and often find themselves in a bit of a pickle when it comes to securing it. CoreWeave, with its fleet of Nvidia’s finest graphics processing units, has stepped in to fill the void. Customers can rent these powerful tools by the hour, allowing them to dabble in AI without the expense and bother of investing in their own hardware. It’s a tremendously convenient arrangement, and explains the rather impressive revenue growth they’ve been experiencing – climbing in the triple digits for the last three quarters, a positively dizzying ascent!

What’s more, CoreWeave has a knack for being first in line when Nvidia releases its latest and greatest systems. Demand for these Nvidia GPUs is, shall we say, rather brisk, often exceeding supply. So, gaining early access is a considerable advantage. And with the close relationship they’ve cultivated with the chip giant, one anticipates this trend continuing. A most satisfactory state of affairs, wouldn’t you say?

Nvidia and CoreWeave

As one might expect, Nvidia has taken a bit of a shine to CoreWeave, holding a stake in the company and even pledging to purchase any unused cloud capacity through 2032. A rather substantial vote of confidence, wouldn’t you agree? And considering Nvidia’s vantage point in the AI market, they’re well-positioned to spot a winner when they see one. It’s a bit like having a particularly discerning butler – you can trust him to select the finest vintage.

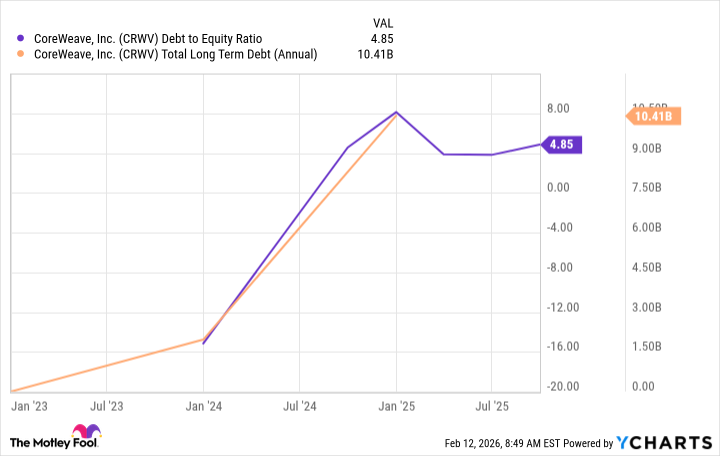

Of course, there’s always a snag, isn’t there? CoreWeave, in its eagerness to meet demand, is investing heavily in infrastructure, which means taking on a considerable amount of debt. A bit of a risky business, perhaps, especially given that they’re already rather leveraged. Still, one shouldn’t be overly alarmed. A dash of risk is often necessary when pursuing a potentially lucrative investment.

This isn’t an investment for the faint of heart, naturally. But for growth investors who are willing to accept a bit of a gamble, CoreWeave could prove to be a rather rewarding proposition as the AI boom continues apace.

What happens on Feb. 26

Now, let’s turn our attention to the timing of a potential investment. CoreWeave is due to report its earnings on February 26th, after the market closes. This comes after the reports of several other AI heavyweights, including Advanced Micro Devices and Amazon. And these players have all spoken of soaring demand for AI capacity. Amazon, in fact, plans to spend a staggering $200 billion on capital expenditures this year, with a focus on its cloud computing arm. A rather ambitious undertaking, wouldn’t you say?

So, there’s reason to be optimistic about CoreWeave’s upcoming report. However, a positive earnings report doesn’t necessarily guarantee a jump in the stock price. Investors have become a bit more cautious about AI valuations lately, and may be hesitant to pile in. AMD and Amazon both saw their stock prices dip following their reports, a cautionary tale, perhaps.

What’s an investor to do? Avoid trying to time the market, and instead buy a stock when it appears reasonably priced, and when you have confidence in the company’s prospects. This strategy, I find, eliminates the need to worry about short-term price fluctuations. After all, when one considers a stock’s performance over five or ten years, a few weeks of volatility are hardly likely to make a significant difference. Therefore, for growth investors, CoreWeave is a solid stock to acquire – now, or after February 26th. A most agreeable outcome, wouldn’t you say?

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-14 13:22