The demand for the sort of processing power that fuels artificial intelligence – those clever algorithms that seem determined to take over the world, or at least suggest what you might want to buy next – has been, to put it mildly, enthusiastic. This has, naturally, sent valuations of companies involved in the field into the stratosphere. Now, chasing the already-skyrocketing valuations of the established players, like Nvidia (a company that, incidentally, makes more chips than a particularly industrious beaver), felt a bit… late to the party. So investors began to cast their eyes around, searching for the next promising prospect.

Enter CoreWeave. It’s a name that doesn’t immediately conjure images of silicon and supercomputers, but that’s precisely the business they’re in: renting out computing muscle to those who need it, providing access to the latest chips from the aforementioned Nvidia. When the company went public, it surged, becoming one of those AI stocks that everyone was talking about. It seemed a sure thing, a guaranteed path to riches. Or, at least, a decent return.

But, as often happens, the story took a turn. Over the past six months, CoreWeave’s stock has lost around 30% of its value. A rather significant drop, and enough to give even the most seasoned investor pause. It’s down more than 50% from its peak, which, if you think about it, is like climbing a very tall ladder and then… well, you get the idea. The question now is: is this a temporary wobble, a chance to buy in at a discount, or a sign of more trouble ahead?

CoreWeave’s Business: Still Red Hot, But…

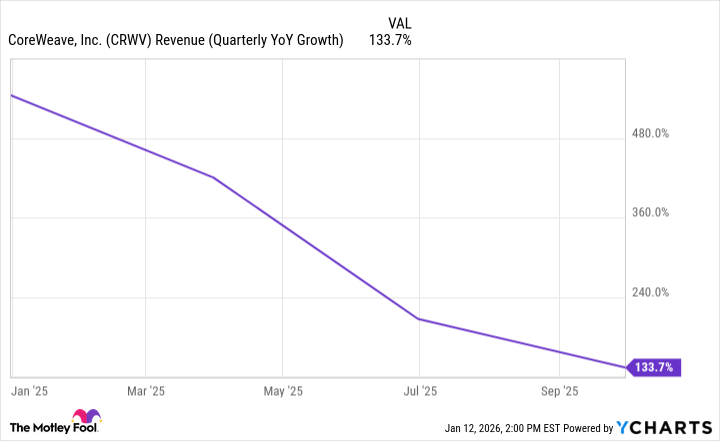

CoreWeave has experienced a slight cooling in its growth rate recently, which, given the absolutely phenomenal growth it experienced last year, was perhaps inevitable. It’s a bit like trying to maintain a sprint for an entire marathon – eventually, you have to slow down. Still, the latest results are impressive. Revenue more than doubled. That’s not bad, even if it’s not quite the exponential growth some were expecting.

Back in November, the company announced a revenue backlog of over $55 billion. That’s a lot of computing power, and a clear indication of strong demand. They’ve also landed a major deal with Meta Platforms – a multi-year agreement worth over $14 billion to help manage its AI workloads. It’s a tidy sum, and a testament to CoreWeave’s capabilities.

The demand is certainly there, fueled by the insatiable appetite for AI. But investors, it seems, have started to take a closer look at the numbers, and what they’ve found isn’t entirely reassuring.

The Price of Enthusiasm

CoreWeave has been an exciting growth stock, no doubt. But it’s also been… expensive. At one point, its market capitalization reached $88 billion. That’s a hefty price tag, and one that requires a lot of optimism about future earnings.

And therein lies the rub. While the company has achieved impressive top-line growth, its bottom line remains firmly in the red. During the first nine months of the year, it incurred net losses totaling $715.3 million. That’s an improvement over the previous year, but it’s still a substantial loss.

The company also reported a net interest expense of $841.4 million during the same period – more than 19 times its operating profit of just $43.6 million. It’s a capital-intensive business, requiring significant investment in hardware. This makes it difficult to demonstrate a clear path to profitability. Investors, understandably, have started to think twice, and some have opted to sell, cashing out some gains along the way. It’s a perfectly rational response, really.

Is CoreWeave a Buy Today?

CoreWeave’s stock is certainly cheaper than it was at its peak. But investors shouldn’t ignore its lack of profitability. It’s a significant red flag, especially in a market where so many companies are vying for attention. The company could fare even worse if market conditions deteriorate.

With so many AI stocks to choose from, investors don’t necessarily need to take on the risk that comes with CoreWeave. While its market capitalization of $45 billion is just a fraction of Nvidia’s, it’s arguably safer to stick with the established players. After all, sometimes the most exciting investments are the least sensible.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2026-01-15 17:52