Dear Reader, permit me to present a curious spectacle: investors prancing through the ballrooms of Wall Street like debutantes at their first cotillion. With mere days till 2025 bows out, the Dow (^DJI 0.04%), S&P 500 (^GSPC 0.03%), and Nasdaq (^IXIC 0.09%) have pirouted upward 14%, 16%, and 20% respectively. One might mistake the trading floor for a carnival, complete with ringmasters touting “Artificial Intelligence” and “Quantum Computing” as the next Midas. Even the Federal Reserve’s rate-cut whispers sound suspiciously like a magician’s patter.

Yet history teaches us that when champagne flows freely on Wall Street, the hangover arrives with remarkable punctuality. Two venerable soothsayers-the Shiller P/E Ratio and the Buffett Indicator-now point their bony fingers at 2026 with the grim certainty of tax collectors.

A Pair of Crystal Balls With Uncomfortable Visions

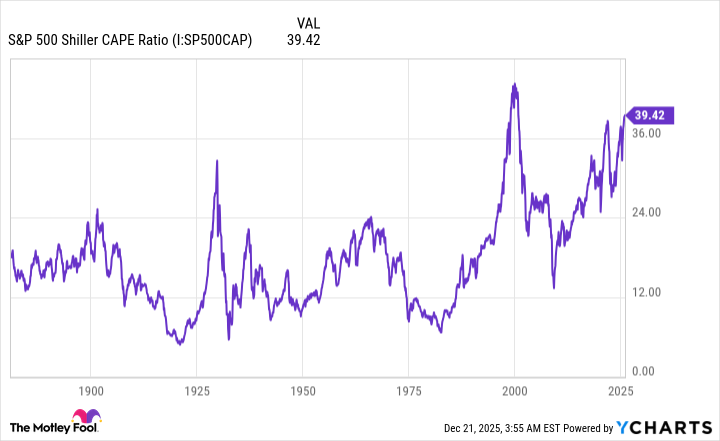

The Shiller P/E, that decadal wine-taster of market valuations, currently pours a vintage of 40.15-a figure so intoxicating it ranks second only to the dot-com era’s bubblicious peak. Let us not forget: when this ratio last breached 30 (excluding present company), the ensuing declines ranged from a polite 20% correction to a full-throated 89% massacre. True, it cannot tell when the music shall stop-but it guarantees the band is tuning their instruments.

Meanwhile, the Buffett Indicator-America’s collective stock market cap divided by GDP-recently celebrated its 226th birthday, trading at more than double its historical average. One imagines Warren Buffett himself, having sold $184 billion in stock “chocolates” over twelve quarters, now sipping mint juleps on the sidelines. When this metric goes on a bender, Wall Street’s chandeliers tend to crash within months.

Buffett Indicator hits 223%-most expensive stock market valuation ever 🚨🚨 pic.twitter.com/p14CI3VXGu

Barchart (@Barchart) October 26, 2025

The Pendulum Swings, But Not Without Drama

Let us now consult the history books with which our colleagues at Bespoke Investment Group so helpfully provided. Since the Great Depression, bear markets have averaged 286 days of gloom (though eight managed to stretch past year-long soirées). Bulls, however, gallop on for 1,011 days-long enough to sire three generations of investment bankers.

New bull market confirmed.

S&P 500 up 20% from 2022 lows. Read more at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonpBespoke (@bespokeinvest) June 8, 2023

Thus we arrive at our paradox: while these indicators scream “abandon ship!” like deckhands on the Titanic, history whispers that every crash sews the seeds for tomorrow’s tulip mania. The contrarian’s dilemma? To dance in the rain of falling shares or don a sou’wester and wait for sunshine.

Consider this: the same crowd now buying “AI-driven” ETFs on margin will soon enough be auctioning their Teslas to cover margin calls. But as Ostap Bender knew when hawking dubious bonds in 1920s Odessa, fortunes favor those who dance when others trip. Keep your pockets lined with silver, your wit sharper than a short seller’s tongue, and remember-the market’s greatest trick is convincing you it’s different this time. 🚨

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-27 12:43