FUCKING listen up, you legions of mindless sheep! I’m a contrarian investor and I don’t buy into the herd’s hysteria. They’ll tell you that Costco (COST) has been boosting its dividend every damn year for over two decades – a record that makes the mainstream salivate. But beneath that façade of “steady growth” lies a riddle wrapped in a mystery inside an enigma. Yes, the club-store model is as bulletproof as a tank – with a nearly 90% renewal rate – and lower prices keep the masses happy. Yet, the numbers are screaming: P/S, P/E, and P/B ratios are way, WAY above their five-year averages, and that paltry dividend yield of 0.6% is about as appetizing as a stale cracker. Investors are gorging on the “growth” story, but if you’re not buying the hype, maybe you’re onto something. In the madhouse that is the market, sometimes the best contrarian move is to bet on what everyone else is freaking out about.

The Problem with Costco

In the retail jungle, Costco stands apart. Its customers pay a membership fee – a guaranteed revenue stream that lets it operate on tight margins. Lower prices keep them coming back, renewing nearly every time. But here’s the kicker: the business is rock-solid, yet the stock is like a carnival ride cranked to 11. Everyone is pricing a mountain of good news into Costco, but if you’re a contrarian, maybe that’s exactly where the REAL opportunity lies. Because when the herd is stampeding, that’s when you smell the stink of irrational exuberance. Embrace the chaos!

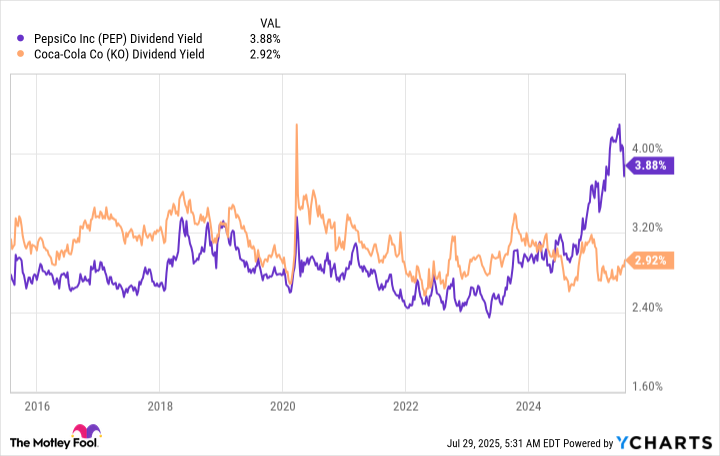

Meanwhile, the masses are drooling over the Dividend Kings – Coca-Cola (KO) and PepsiCo (PEP). Investors fixated on income and valuation see Costco’s meager yield as a deal-breaker. And sure, these titans have long histories of dividend increases, but they’re the darlings of the herd. If the masses are piling in, that’s usually the moment to bet against them.

If You Care About Valuation, Consider Coca-Cola and PepsiCo

Take Coca-Cola, for instance. In Q2, this beverage behemoth grew its organic revenues by a solid 5% – a beacon of hope in these inflation-fueled times. It sells an affordable luxury, a vice that people can’t seem to live without. And yes, it’s a Dividend King with over six decades of increases, but even Dividend Kings have their limits. Its ratios hover around or just below the five-year averages – but if you’re buying a “reasonably priced” stock, you’re buying what everyone else is. That might be exactly the trap.

On the flip side, PepsiCo might seem like the contrarian’s dream with its 4% dividend yield and valuation metrics that are soundly below the five-year averages. But don’t be fooled – its organic sales growth is a paltry 2.1%, a sign that even these so-called safe havens have their demons. It’s a diversified beast, dabbling in beverages, snacks, and packaged foods – more levers to pull when the market’s in turmoil. But if it’s underperforming relative to Coca-Cola, the market has already priced that in.

Yet here’s the catch for the contrarian: if you’re willing to bet on the underdog, PepsiCo might just be your ticket to ride. It’s weathered storms before and is retooling with recent acquisitions – a probiotic beverage maker and a Mexican-American food producer – gearing up for a comeback.

Costco Is Too Expensive – Or Is It?

The conventional wisdom screams that Costco’s stock is overpriced – with valuation metrics that leave no room for error. But remember, as a contrarian investor you don’t follow the herd. While Coca-Cola and PepsiCo may offer the allure of dividends and seemingly attractive valuations, they are the darlings of the market. Sometimes, the real opportunity lies in the misunderstood and overhyped. Costco’s business is as solid as they come; those inflated multiples might just be a reflection of the irrational exuberance infecting the masses. So if you’re gutsy enough to bet against the crowd, maybe it’s time to consider buying into the madness. Because in this financial circus, nothing is as it seems…🔥

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-03 10:41