Nuclear power. It’s back, they say. As if it ever truly left. More accurately, people are remembering they need it. It makes electricity. Constantly. Unlike those sun and wind things, which are… fickle. And now, with all these computers demanding power – artificial intelligence, they call it – well, something reliable is useful. So it goes.

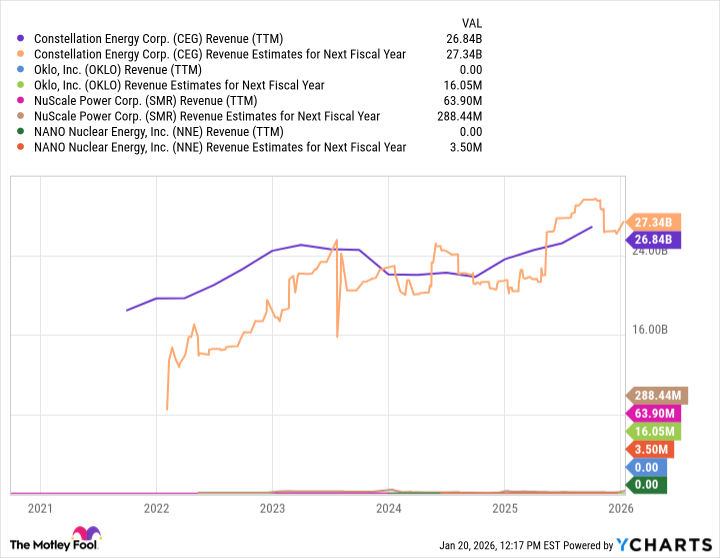

There’s a lot of chatter about startups. NuScale, Oklo, Nano Nuclear. Tiny reactors, portable reactors. Ambitious. Bless their hearts. They’re building dreams out of atoms. But dreams don’t pay the bills. Not yet, anyway.

Constellation Energy, though. That’s a different story. They already have the reactors. A whole fleet of them. The biggest in the United States, in fact. It’s not glamorous, but it’s solid. They’re not promising the future; they’re delivering the present. And in the power business, that counts for something.

Not a Startup, Just…Big

Those other companies? They’re sketching blueprints. Constellation is sending out invoices. NuScale has a design approved by the regulators, which is a start. But approval doesn’t generate kilowatt-hours. Oklo and Nano are still in the licensing maze. A maze, mind you, designed by people who remember things like safety and responsibility. So it goes.

Constellation has deals. Big deals. Meta Platforms wants all the power from one of their plants for twenty years. Microsoft is trying to resurrect Three Mile Island. Yes, that Three Mile Island. Humans are strange creatures. They learn, sometimes. Or they just build bigger containment structures. Either way, power will flow.

They’re profitable. They made money last year. A lot of money, actually. More than those startups, combined. The numbers are… reassuring. Not exciting, perhaps. Just…reassuring. Future projections show more of the same. Which, in a world obsessed with exponential growth, is almost revolutionary.

Their business model is… unusual. Most utilities are regional monopolies, regulated by governments. Constellation sells power on the open market. They can charge what the traffic will bear. It’s risky, of course. Prices fluctuate. But it also means they can capture more of the upside when things are good. It’s a gamble, really. A calculated gamble. Like most things. So it goes.

There’s a political wrinkle, too. In the Mid-Atlantic region, some people are talking about price caps. The former President seems to be on board. Local governors, too. It could limit Constellation’s profits. It’s always something. There’s always a politician somewhere, trying to make things…complicated. It’s a universal constant.

The stock isn’t cheap. It trades at a high multiple of earnings and book value. The market is expecting a lot. A lot of growth, a lot of innovation, a lot of…well, a lot. It’s a premium price for a relatively stable business. A bit like buying a slightly used lifeboat. Expensive, but potentially life-saving.

There’s still opportunity, though. Especially if this AI thing really takes off. If all these computers keep demanding power, Constellation is well-positioned to benefit. It’s not a sure thing, of course. Nothing is. But it’s a reasonably good bet. For those who like that sort of thing. Or, if you prefer, you could just buy a nuclear energy ETF. Spread the risk around. It’s a sensible approach. A very sensible approach. So it goes.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- Games That Faced Bans in Countries Over Political Themes

- USD KRW PREDICTION

2026-01-24 18:53