It’s the madhouse of earnings season, and the corporate titans of the soda apocalypse are already circling like vultures over a blood-soaked buffet. Coca-Cola and PepsiCo—those decaying empires of sugary excess—have reported their Q2 results, and the numbers are a twisted carnival of red ink, phantom profits, and the ghost of high-fructose corn syrup haunting boardrooms like a bad hangover. The world is changing, baby, and these corporations are flailing in the mud like drunkards trying to dance the tango.

Both stocks have become holy relics for dividend investors, clinging to their 50-year payout streaks like addicts to a dwindling stash. But let’s be clear: this is not about growth. This is about survival in a world where people are finally realizing that soda is a slow-motion poison. One of these stocks might still be salvageable, but the other? Well, let’s just say it’s a house of cards built on a sugar-fueled acid trip.

Comparing the two businesses

These aren’t just cola factories anymore—they’re sprawling, delusional empires of hydration and destruction. Coca-Cola’s Topo Chico hard seltzers and PepsiCo’s Hard Mountain Dew are not innovations; they’re desperate Hail Mary passes. Both companies have branched into snacks, alcohol, and every other liquid or packaged lie they can cram into a can or a bag. It’s a corporate buffet of shame, and the menu is written in blood.

PepsiCo’s snack division, with its Frito-Lay and Quaker monstrosities, is drowning in a sea of health-conscious consumers. People want kale, not Cheetos. The nutrition apocalypse is here, and these companies are still selling you the same sugary nightmares they’ve been pushing since the Eisenhower administration. Meanwhile, the Trump administration’s “sugar switch” initiative is just another bureaucratic punchline in a world where even the government can’t keep up with its own contradictions.

How the numbers compare

The Q2 results? A circus of accounting tricks and one-time charges. Coca-Cola’s $3.8 billion net income isn’t a victory—it’s a miracle wrought by slashing $1.4 billion in “other operating charges.” That’s not growth, that’s a corporate lobotomy. PepsiCo, on the other hand, is bleeding $1.9 billion from intangible impairments, which sounds like a fancy way of saying “we’re all going to die.”

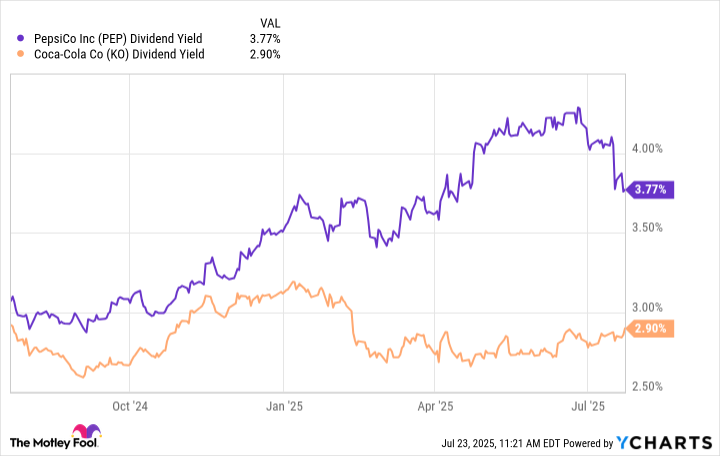

And let’s not forget the forward P/E ratios: Coca-Cola’s 23 is a carnival barker’s lie, while PepsiCo’s 18 is the ghost of Warren Buffett’s cigar. But here’s the kicker—PepsiCo’s dividend yield of 3.8% is a siren song for income investors. It’s not about growth, it’s about survival. These are not stocks; they’re retirement homes for the financially desperate.

Coca-Cola or PepsiCo?

If you’re buying today, PepsiCo is the lesser evil in this apocalyptic soup. It’s got the snack division to fall back on, a lower forward P/E, and a dividend yield that screams “I’m still alive!” But don’t be fooled—this isn’t a buy recommendation. This is a warning. These companies are relics in a world that’s moving toward kale smoothies and electric cars. They’re the last gasps of a dying empire, and you’re being asked to fund the funeral.

So, what’s the answer? There isn’t one. These stocks are the corporate equivalent of a sinking ship, and you’re the one buying a ticket. But if you must choose, PepsiCo’s diversification and lower valuation make it the slightly less insane option. Just don’t expect to sleep at night. The financial apocalypse is coming, and these companies are just the opening act. 🍹

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-27 10:34