Last year, in a fit of what I can only describe as optimistic delusion, I pitted two titans of consumerism against each other: Coca-Cola (KO +1.88%), a beverage so ubiquitous it practically defines the concept of ‘stuff’, and Domino’s Pizza (DPZ +0.80%), a purveyor of circular comestibles delivered with unsettling speed. The former, a long-term holding of a certain well-known investor (whose name, for reasons of not wanting to be audited, we shall not mention), versus the latter, a relatively recent addition to the portfolio. Both, undeniably, shift a lot of product. And that, in the grand scheme of things, is… something.

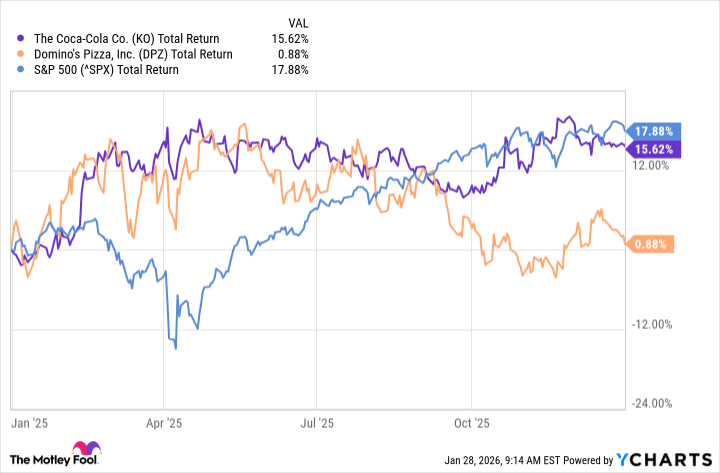

I suggested Coca-Cola would outperform in 2025. It did. Not by a margin to set the financial world alight, mind you – more of a gentle, almost apologetic, victory – but a victory nonetheless. The question now, as we stand on the precipice of 2026, is whether this mild trend will continue. Or if, like a rogue asteroid suddenly changing course, Domino’s will somehow manage to defy all reasonable expectations.

Why Coca-Cola Won Last Year (Or, The Relativity of Success)

Neither Coca-Cola nor Domino’s exactly set the market ablaze last year. The market, as it often does, remained largely indifferent. However, Coca-Cola edged closer to the theoretical concept of ‘positive return’ while Domino’s… didn’t. It wasn’t a dramatic fall, just a sort of… plateau. A flat, pizza-shaped plateau. (It’s important to remember that plateaus, while geographically stable, are rarely exciting in financial terms.)

My reasoning last year, if memory serves (and it usually does, although the memories are often filed alphabetically by the color of the filing cabinet), was that Coca-Cola possessed a longer track record of… existing. And a higher dividend yield. These, I posited, would be important. It turns out I was… not entirely wrong. The market, in a fit of unexpected rationality, seemed to appreciate stability. Especially after two years of what can only be described as ‘optimistic exuberance’ (a phrase best left undefined).

The market, of course, then promptly delivered a third consecutive year of double-digit gains, proving that my entire thesis was, in retrospect, utterly pointless. But Coca-Cola still managed to look reasonably solid, partly due to its localized production, which apparently impressed people. (One wonders if the market is easily impressed. It’s a thought.)

Matchup 2026: A Forecast of Mild Uncertainty

Now, as we enter a new year after three years of double-digit gains (a statistical anomaly that should probably be investigated by someone), does my previous reasoning still hold water? Or has the entire financial universe decided to play a prank on me?

Coca-Cola continues to perform… adequately. Its localized production remains a point of mild interest. In the most recent quarter (the third quarter of 2025, earnings for which will be released on February 10th, should you be interested in marking it on your calendar), sales increased by 5%. A respectable, if not earth-shattering, figure. Comparable operating margin rose from 30.7% to 31.9%. They’re also managing to raise prices, change packaging sizes, and launch new products. A relentless pursuit of incremental gains, really. (It’s the engine of modern capitalism, you know. Tiny improvements, endlessly repeated.)

And then there’s the dividend. Coca-Cola is a ‘Dividend King’, apparently. They’ve been raising their dividend for 63 years, rain or shine. A remarkable feat of financial consistency. It typically yields around 3%, but currently it’s 2.9% because the stock has done… something. (The precise details are, frankly, exhausting.)

Domino’s, meanwhile, has been reporting similar mid-single-digit sales growth. But the market… hasn’t noticed. Global retail sales increased by 6.3% in the third fiscal quarter of 2025. Comparable sales were up 5.2%. Restaurants, in general, are under pressure in this inflationary environment. (Apparently, people still need to eat, even when everything is expensive. A curious phenomenon.) The market may simply be seeing limited upside for Domino’s. (Or it may be distracted by something shiny. The market is easily distracted.)

One point in Domino’s favor is that it didn’t move much last year, giving it a nice springboard for 2026. (A slightly wobbly springboard, perhaps, but a springboard nonetheless.) However, Coca-Cola is slightly cheaper, trading at 24 times trailing-12-month earnings versus Coke’s 23. (A difference of approximately 4.17%, if you’re keeping track. Which, frankly, you shouldn’t be.)

This is a tough call for 2026. Very tough. I’m going to, with a degree of trepidation, suggest that Domino’s might just edge ahead. It continues to grow, and the market, in a moment of unexpected generosity, might recognize its resilience. But honestly, it could go either way. It’s the stock market. It’s fundamentally unpredictable. And that, in the grand scheme of things, is probably for the best.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-02-01 19:23