As a seasoned researcher with over two decades of experience in the financial markets, I’ve witnessed countless trends come and go. However, the meteoric rise of Bitcoin has left me genuinely astonished. The CoinGecko report underscores what many of us have been observing: Bitcoin is not just a passing fad but a game-changer in the investment world.

According to a recent analysis from CoinGecko, Bitcoin has surpassed conventional investment assets in performance over the last ten years, making it a highly promising investment opportunity.

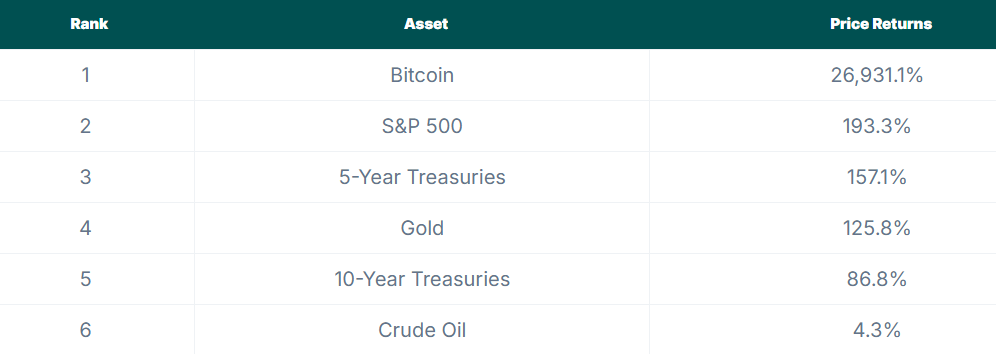

The report reveals Bitcoin’s unmatched returns compared to gold, stocks, and US Treasury bonds.

Bitcoin is Changing the Investment Market

2014 saw an investment of $100 in Bitcoin grow to around $26,931 today. That’s equivalent to a staggering 27,000% increase!

Instead of this investment, you’d get a much higher return if you put your money in the S&P 500 index, which could potentially bring you an impressive 193.3%. On the other hand, gold might offer a profit of 125.8%, and investing in 10-year US Treasuries would likely yield 86.8%.

In 2024, Bitcoin’s performance has been remarkable compared to other assets. So far this year, it has yielded a return of 129%, outperforming gold (32.2%) and the S&P 500 (28.3%). Many analysts believe that the surge in Bitcoin is due to increased institutional interest and positive macroeconomic factors.

In this timeframe of ten years, Bitcoin stands out as an exceptional high-growth investment compared to gold, bonds, and stocks which offer safer but lower returns for cautious investors. However, it’s important to note that Bitcoin is a relatively recent addition to the financial market, possessing a significantly smaller market value than more established assets. This smaller size allowed it to expand at an incredibly fast rate. (Report statement paraphrased)

On the other hand, the report underscores that bonds have thrived across medium-term timeframes. For instance, over the past three years, five-year US Treasuries yielded a substantial 267.8% return. Similarly, ten-year Treasuries managed a strong 218.0% increase. These numbers suggest that bonds are a reliable investment during periods of economic stability.

While Bitcoin offers unmatched growth potential, its volatility poses risks. These findings highlight the importance of portfolio diversification. Traditional investments, such as bonds and stocks, can provide stability for risk-averse investors. Even investment management giant BlackRock suggests allocating up to 2% of portfolios to Bitcoin.

The report stated that while Bitcoin’s returns are exceptional, it carries substantial risks. Maintaining a diverse investment portfolio, spanning multiple asset types, is crucial for achieving lasting prosperity.

Instead of putting all your eggs in one basket by solely investing in Bitcoin due to its potential for both significant gains and losses, consider balancing it with other, more stable investment options. By doing so, you may be able to minimize potential losses while still benefiting from any growth in the value of Bitcoin.

With Bitcoin becoming more ingrained in international financial structures, its function continues to transform. It’s essential for investors to thoughtfully evaluate the amount of risk they are comfortable with, in pursuit of potentially outstanding gains. One point that cannot be denied: this report clearly demonstrates Bitcoin’s pivotal role in contemporary investment strategies.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-13 20:17