As a seasoned observer of the ever-evolving landscape of cryptocurrencies, I must say that the insights shared by this article truly resonate with my own experiences. The way these projects are harnessing the power of decentralization and blockchain technology to revolutionize various sectors is nothing short of remarkable.

As a dedicated research analyst at CoinGecko, I’ve been closely observing and reporting on the remarkable achievements of AI-integrated cryptocurrency ventures. Additionally, I can’t help but notice the extraordinary surge in popularity among certain meme coins, an uncharted territory in the crypto market.

During an interview with BeInCrypto, Lee emphasized several exciting trends that could shape the crypto landscape in 2025, including farming cryptocurrency points for airdrops, continuous trading on decentralized exchanges, and projects involving real-world assets (RWA) as noteworthy developments to keep an eye on.

The Surge of AI-Enabled Projects

As an analyst, I’ve observed since ChatGPT’s debut that the crypto community has been fascinated with developing projects aimed at integrating the potential of blockchain technology and artificial intelligence. By 2024, numerous initiatives have demonstrated promising outcomes in providing a decentralized platform for AI access.

As a researcher, I’ve spotlighted the Virtuals Protocol – an impressive, decentralized venture that empowers creators to develop, possess, and profit from artificial intelligence entities within digital realms, as one of the standout success stories in this domain.

Over the past month, Virtuals generated over 21,000 AI Agent tokens, as revealed by Dune analytics. Interestingly, some tokens such as AIXBT and LUNA experienced a significant increase of over 300%, just a few days following their debut in the market.

Moreover, Lee referred to the recently established venture firm AI16z, focused on artificial intelligence (AI), which debuted in October and boasts a market value of approximately $600 million. It’s worth noting that as of this month, the Eliza Framework, serving as the technical backbone for AI16z, has gained significant popularity and is now among the most frequently used open-source frameworks for creating AI agents.

On this open-source stage, developers at every skill level can construct and release AI-infused projects. The AI16z structure was tailor-made to link centralized and decentralized environments, thus catering to the needs of both Web3 and traditional Web2 developers.

A Successful Year for Meme Coins

In addition to advancements in AI integration, there’s also been an increased effort in creating fresh meme cryptocurrencies. This trend has resulted in increased trading activity and a significant rise in total profits.

As a crypto investor, I’ve noticed an exciting surge in the popularity of Solana, which has given rise to platforms like Pump.fun. This development has sparked a wave of meme coin creation, making them more accessible than ever before. Now, with just a few clicks, anyone can create their own meme coins, following the trend that emerged in 2023, as I learned from Lee’s conversation with BeInCrypto.

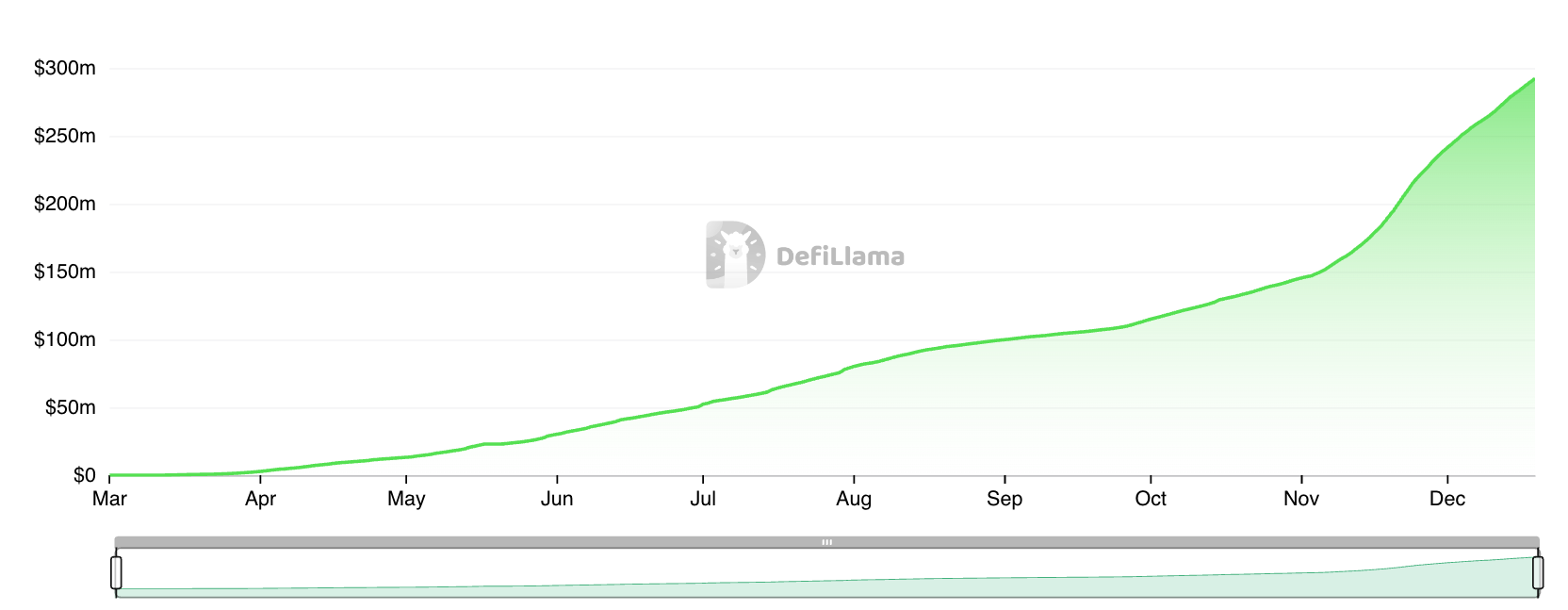

As a crypto investor, I’ve found myself drawn to Pump.fun, a game-changer that’s made a significant impact since its debut this year within the Solana meme token landscape. Data from DeFi Llama indicates that in 2024 alone, its meme coin launchpad raked in an impressive nearly $300 million.

Promising Airdrop Narratives

According to Lee, one of the standout achievements in the DeFi space this year has been the popularity of airdrops associated with successful projects.

In my analysis, after a lull over the past few years, Decentralized Finance (DeFi) has regained traction. The surge can be attributed to the allure of ‘points farming’ for airdrops, which significantly boosted the adoption of Pendle. On the other hand, Ethena’s innovative stablecoin model and its seamless integration with various popular DeFi platforms have contributed to its growing popularity among users.

Pendle’s protocol on Ethereum converts the returns from cryptocurrencies into tradable tokens, empowering users to trade and handle income-generating digital assets. This system facilitates approaches such as fixed-income investment, speculation on yield, and yield farming – essentially introducing financial concepts typically found in traditional finance to the realm of Decentralized Finance (DeFi).

As a researcher delving into the realm of decentralized finance, I’ve come across an intriguing platform called Pendle. Despite its long-standing concept, what sets it apart is its unique framework that empowers users to engage in token trading, all while potentially generating yields as high as 47% on their underlying assets. This surpasses the performance of many comparable projects currently in existence.

2021 marked the debut of Pendle, which has experienced significant growth in 2022, largely attributed to heightened Ethereum liquid staking and airdrops from decentralized finance platforms such as Ether.Fi. In April, the expansion of Ethena’s USDe pool cap to $400 million sparked additional activity, leading to an astounding $4.88 billion in total value locked (TVL) for Pendle.

Crypto Points Farming Practices

Notably, Pendle’s strategy for earning crypto points stands out. These points serve as a reward system in Web3 projects, designed to encourage user participation. By accomplishing certain tasks, users can accumulate these points, which may result in airdrops or could be utilized for other motivational benefits.

Lee noted that ‘points farming’ was an unexpected trend emerging during the bear market. This development saw numerous new projects like Eigen and staking protocols utilizing idle capital. They did this by providing points (in expectation of future airdrops) as rewards for investors, in exchange for locking up their total value.

In conversation about achievements in Decentralized Finance (DeFi), CoinGecko’s research analyst highlighted the Aave Protocol’s token, as it has seen an increase in activity due to substantial buying by large investors, or “whales.” This activity has led to a fresh influx of liquidity into the market.

Just like traditional decentralized exchanges, perpetual trading has seen a rise in demand lately. As evidence, Lee pointed to Hyperliquid’s latest airdrop as a case that demonstrates how such initiatives can dramatically increase trading activity.

At the tail end of November, Hyperliquid, an advanced, self-operating cryptocurrency exchange running on its proprietary Layer 1 blockchain, generated buzz by distributing its HYPE tokens to more than 90,000 account holders through an airdrop.

This generous distribution of tokens made crypto history as the largest airdrop ever done, while the token’s pricer surge has been ongoing, reaching an all-time high this week. The crypto community greeted the move with surprise, setting a new standard for future crypto airdrops.

A Bright Future for Real-World Assets

As stated by Lee, tangible or financial assets from the real world (often referred to as Real-World Assets or RWAs) continue to be relevant. These assets, which exist beyond the digital realm, are symbolized on the blockchain using tokens.

Previously, the RWA concept didn’t gain much traction, but it seems to have found stability this time. Notably, major financial entities are becoming more active in the RWA sector. BlackRock, for instance, has established its BUIDL fund, which allows qualified investors to generate US dollar returns. This was shared during a conversation with BeInCrypto.

As reported by RWA.xyz, the value of tokenized treasuries has now exceeded $3 billion, marking a significant increase from its initial value of around $700 million at the beginning of the year.

As I delved into the realm of RWA (Risk-Weighted Assets) in my analysis, the introduction of BUIDL, a tokenized US treasury by BlackRock, marked a significant milestone in July. This entry sparked a notable market upswing for BUIDL, which in turn led to an overall expansion in the total market capitalization of assets associated with RWA.

As a seasoned investor with years of experience in both traditional and cryptocurrency markets, I have witnessed the evolution of decentralized finance (DeFi) projects that are redefining the financial landscape. Among these groundbreaking initiatives, RWA crypto projects have particularly caught my attention this year.

With smart contracts and automated credit evaluations, Maple enables institutional investors to extend loans to reliable businesses by tokenizing real-world assets. This innovative approach opens up new financial tools and strategies.

In simpler terms, Ondo Finance is another well-known project in the world of cryptocurrency focused on RWA (Real World Assets). They specialize in turning fixed-income assets into digital tokens. Their strategies involve various vaults designed to enhance yield and manage risk. The ONDO token gives investors access to a wide range of assets, making it an attractive option for those looking for unique investment opportunities.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-20 15:14