Today, in a spectacular act of fiscal tightrope walking over a chasm of wild anticipation, Coinbase unleashed its Q1 2025 earnings report. The result: an unforgiving thud that reverberated through the cathedral of bullish hopes and left analysts clutching their pearls—yet curiously, a parade of users persisted, marching obliviously onward, as Coinbase’s USDC hoard swelled a portly 49% quarter-over-quarter. Bravo, blind enthusiasm! 🥳

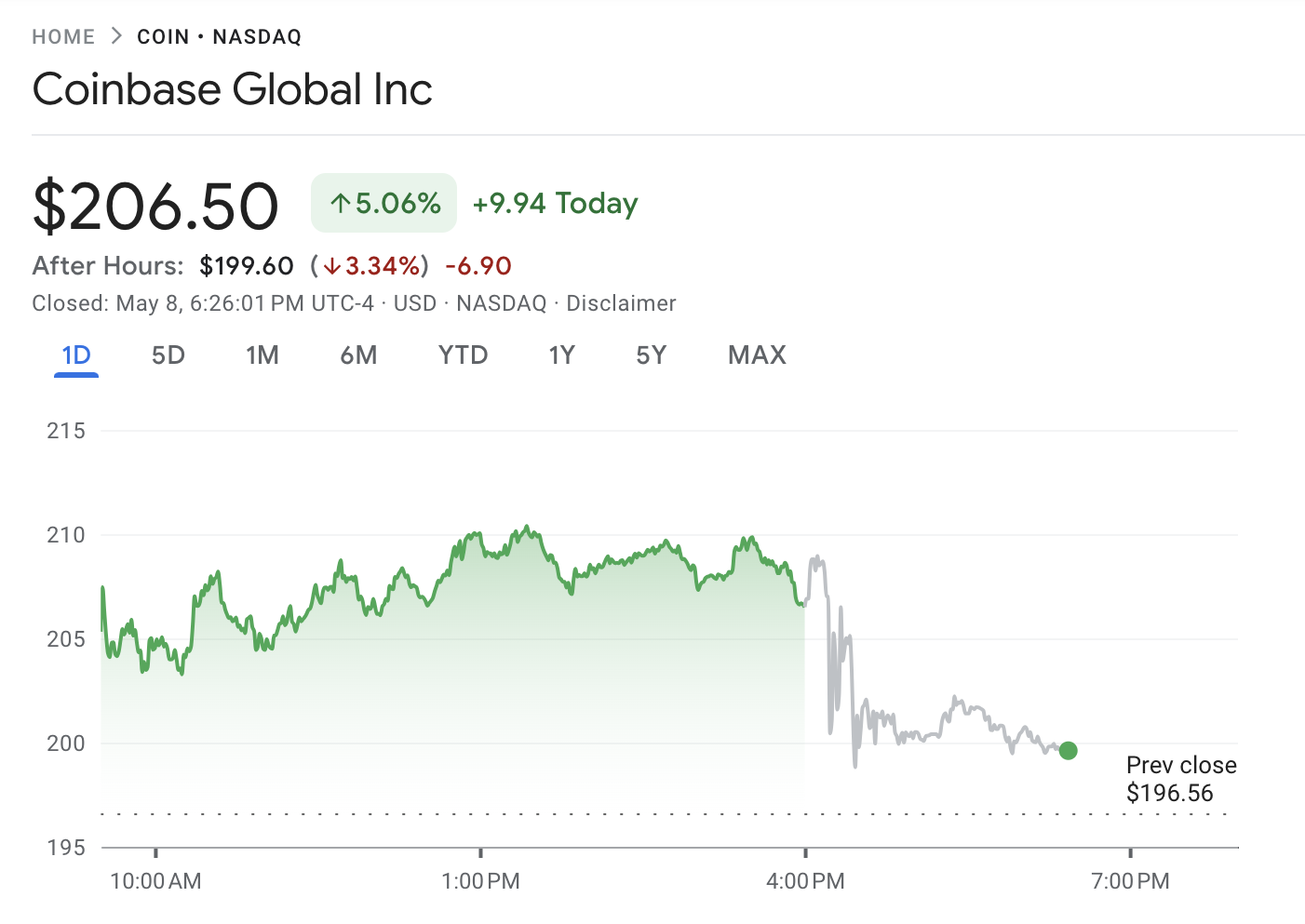

One might have expected champagne to rain and fireworks to dazzle after a fortuitous Monday preamble, but alas—the gods of after-hours trading were unamused, swatting Coinbase’s valuation down by over 3%. Sic transit gloria crypto.

Coinbase’s Bearish Earnings Report

Behold Coinbase, the shimmering leviathan of global crypto exchanges, who now waves a bouquet of tepid good news for the faint of heart. The SEC has retreated, perhaps in a rare fit of good sense, and Coinbase has gobbled up the globe’s vastest crypto derivatives exchange (Deribit, the name leaves Nabokov chuckling into his butterfly net).

The congregation of digital soothsayers had uttered bullish incantations, yet the Q1 2025 report heralded only disappointment: cue the world’s tiniest violin and a candle for shattered dreams.

The grand reveal: revenues nearly $200 million adrift of the $2.2 billion mirage, transaction revenue limping in $70 million below expectations, and a limp, apologetic Earnings per Share—just $0.24 where $2.09 was dreamt. Subscription and services revenue? Down by $4.5 million, lost like last season’s NFTs.

The Fates had whispered bearish warnings before the curtains even rose: the unwashed masses were beset by scams, lootings worthy of a Dickensian underbelly. Coinbase’s own stock fell off a cliff, dropping 30%—a stunt not seen since the FTX pantomime. For a fleeting hour, there was optimism. Then, cold reality and after-hours trading, and down it tumbled once more.

Still, not all is wilted and woebegone: trading volume outfoxed predictions by a hair, hitting $393 billion compared to the anticipated $392.7 billion—a rounding error, perhaps, but in cryptoland, we count every Satoshi. Meanwhile, a well-tended stake in Circle blossomed handsomely: Coinbase’s covetous grip on gross USDC balances soared to a plump $12.3 billion—up a theatrical 49% quarter-over-quarter. Brava, spreadsheet magicians! 🤹♂️

Between these minor mercies and grander exploits—a regulatory peace here, a Deribit gobble there—Coinbase serenades us thusly:

“Looking ahead, we’re focused on expanding real-world crypto utility, fortifying our trading dominion, and scaling the machinery that will twiddle the levers of finance yet to come. Regulators smile upon us, and our vision for economic freedom races ever swifter—onward!” Or so they croon, undaunted by the symphony of missed targets.

To divine Coinbase’s fate is to gaze at clouds and spy Rorschach butterflies—perhaps a bull, perhaps a bear, perhaps merely an anxious squirrel. The Q1 report staggered under expectations, and yet the treasure chest overflows. The mists of optimism are thick: new regulatory licenses in Argentina and India suggest a grand comedy of expansion playing out in distant lands. Will Coinbase vault back, flop, or simply meme its way onward? Gentle investor, unclench your jaw and pass the popcorn. 🍿

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-09 03:28