Ah, Coinbase! The grand titan of the American crypto exchange realm, now finds itself in a quagmire of its own making, as it contemplates a revision of its token listing strategy. A strategy, mind you, that must now contend with the relentless tide of new cryptocurrencies flooding the market like a deluge of uninvited guests at a dinner party.

Indeed, the crypto ecosystem is experiencing a veritable explosion, a veritable cornucopia of tokens, each clamoring for attention, each more desperate than the last.

Coinbase’s Dilemma: A Million Tokens a Week? What Are We, Token Gods? 😅

On that fateful day of January 26, the illustrious CEO of Coinbase, Brian Armstrong, stood before the masses, proclaiming the urgent need to reassess their token listing procedures. He lamented the impossibility of manually evaluating each token, as a staggering one million tokens are birthed into existence each week. One million! It’s as if the universe itself has conspired to overwhelm us with an avalanche of digital currency.

But lo! This predicament is not confined to the exchange alone. Our dear Armstrong pointed out that even the regulators, those guardians of financial propriety, would find themselves gasping for breath in the face of such a torrent.

“We must rethink our listing process at Coinbase, given that we are now witnessing the birth of ~1m tokens weekly, and the numbers are only set to grow. A high-quality problem, indeed! Yet, evaluating each one individually is akin to counting grains of sand on a beach. And regulators, bless their hearts, cannot possibly approve each one at this pace (they can’t do 1m a week),” he lamented.

In a stroke of genius—or perhaps desperation—Armstrong proposed a radical shift from the traditional “allow-list” model to a “block-list” approach. This newfangled system would employ automated on-chain data scans and the wisdom of the community to sift through the rubble and identify the nefarious tokens that threaten our very existence. A noble endeavor, indeed, allowing regulators to focus on the truly harmful assets without succumbing to the madness of the masses.

Meanwhile, in a bid to simplify the trading experience for the beleaguered user, Coinbase plans to deepen its integration with decentralized exchanges (DEXs). Armstrong, with a twinkle in his eye, assured us that customers should not be burdened with the knowledge of whether their trades occur on a centralized exchange (CEX) or a DEX. After all, who needs to know such trivialities? 🤷♂️

“We shall continue to integrate native DEX support more deeply. Customers shouldn’t need to know or care whether the trade is happening on a DEX or CEX,” Armstrong concluded, as if he were a modern-day oracle.

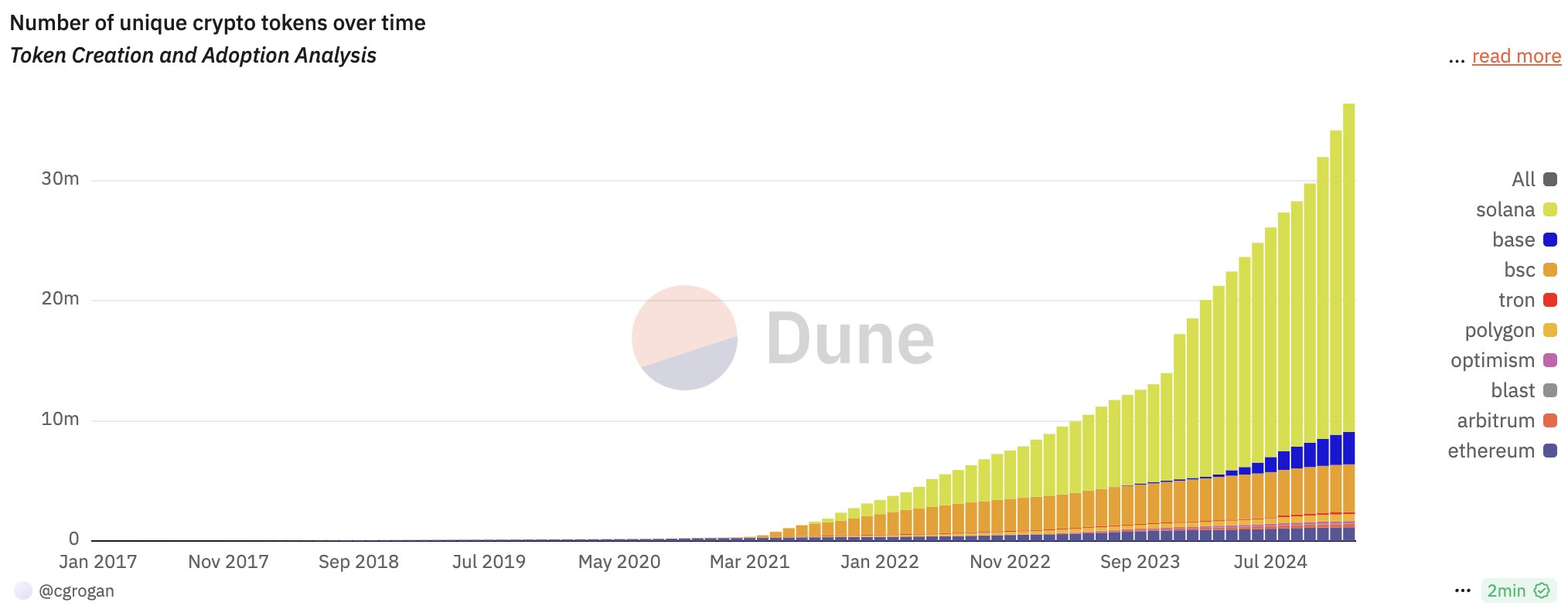

The staggering rise in token creation underscores the urgent necessity for such transformative changes. Conor Grogan, a sage among Coinbase executives, recently revealed that the crypto market now boasts over 36 million tokens, with projections soaring to a dizzying 100 million by 2025. To put this in perspective, during the altcoin boom of 2017-2018, we were but a humble collection of fewer than 3,000 tokens.

Indeed, the rise of meme coins has played a significant role in this explosive growth. Platforms like Solana-based Pump.fun and Tron-based SunPump have democratized the token launch process, making it as easy as pie for crypto enthusiasts. According to the wise sages at Dune Analytics, Pump.fun alone has facilitated the creation of over 6 million tokens since its inception last year. Truly, we live in a time of wonders and absurdities! 🎉

Read More

2025-01-26 18:23