Coinbase, the behemoth of American crypto exchanges, has hinted at the inclusion of Ether.fi (ETHFI) and Bittensor (TAO) in its listing roadmap.

ETHFI, a decentralized protocol token, offers liquid staking and restaking solutions for Ethereum. Meanwhile, Bittensor’s TAO serves multiple roles within its ecosystem, functioning as both a utility token and a reward mechanism. 🎭

Traders Go Wild Over Coinbase’s Listing News

Coinbase, in its infinite wisdom, only supports two types of assets: native network assets and tokens that comply with a supported token standard. Lo and behold, ETHFI and TAO have made the cut. 🎉

The exchange took to X (formerly Twitter) to announce that ETHFI and TAO have met its listing criteria. They even shared the contract addresses for the two tokens, because why not? 🤷♂️

“Assets added to the roadmap today: Ether.fi (ETHFI), and Bittensor (TAO),” the post declared.

This decision follows what Coinbase describes as a “thorough evaluation of legal, compliance, and technical security standards.” Market cap and popularity? Irrelevant. 🚫

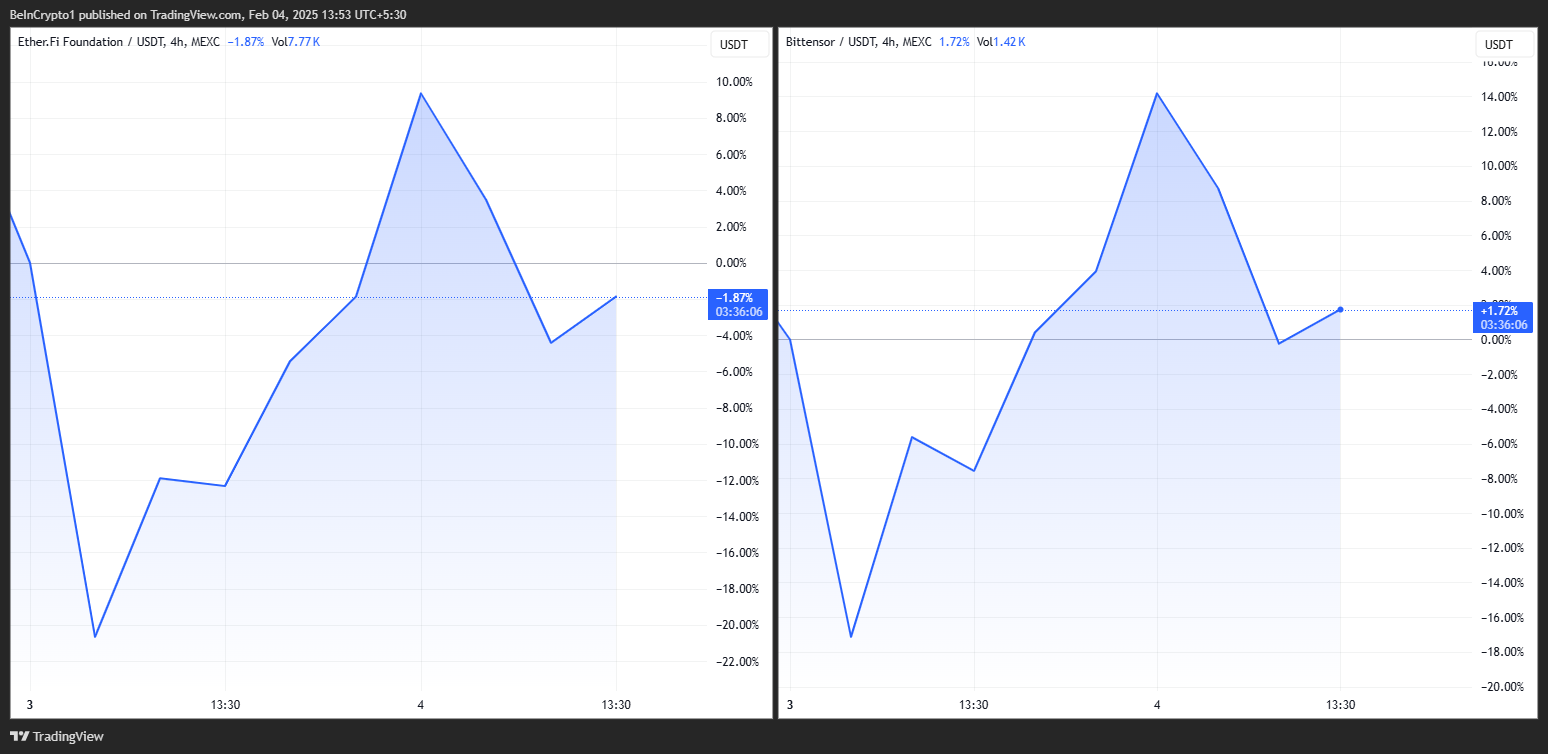

Post-announcement, ETHFI and TAO prices surged by over 30% each before the inevitable profit-taking began. 📈

This surge was hardly surprising, as tokens typically react positively to listing announcements on major exchanges. Remember Base token TOSHI? It shot up 70% when Coinbase added it to its roadmap. Binance listings have a similar effect. 🚀

This phenomenon is part of the “buy-the-rumor, sell-the-event” strategy, coupled with expectations of increased liquidity. Binance leads in trading volume, while Coinbase reigns supreme in the US. High liquidity often leads to price appreciation, reduced volatility, and easier trading. Other factors include increased accessibility, demand, and trust. 🏦

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

- 30 Best Couple/Wife Swap Movies You Need to See

2025-02-04 12:48