As a seasoned analyst who has witnessed the crypto market’s meteoric rise and fall, I find the predictions outlined by Coinbase for 2025 highly promising. The focus on regulatory developments and the potential growth of stablecoins, ETFs, DeFi, and tokenization is not only strategic but also in line with the evolving landscape of the digital asset market.

Coinbase has just shared their forecasts regarding the future of the cryptocurrency industry up to 2025. Their analysis primarily covers significant aspects like stablecoins, tokenization, ETFs, DeFi, and legal updates in these areas.

Reports from other industry players also suggest a positive outlook for the crypto market in 2025.

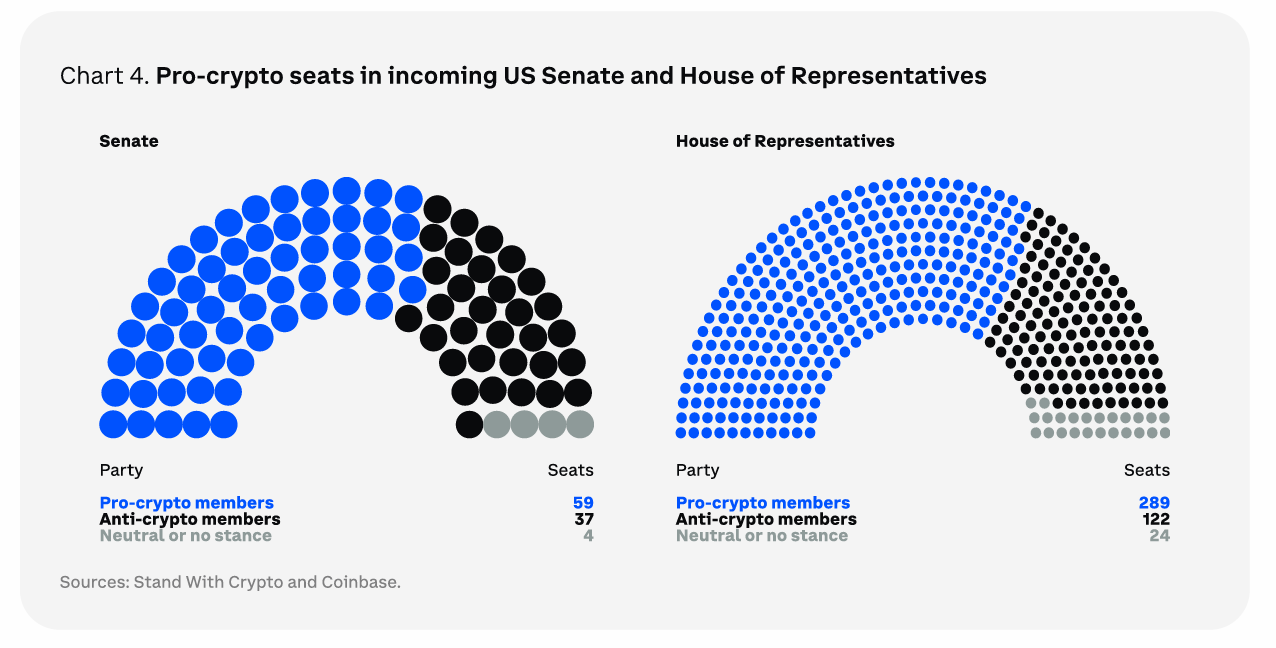

A Favorable Regulatory Environment Will Drive Market Growth

One way to rephrase the given statement in a more natural and easy-to-read manner is:

It’s worth mentioning that the push for cryptocurrencies isn’t just happening in the United States. In fact, countries like Europe, members of the G20, the UK, the UAE, Hong Kong, and Singapore are all working on creating regulations to foster the growth of digital assets.

As an analyst, I foresee myself anticipating that regulatory adjustments within the U.S. in 2025 could serve as a significant driver for growth, much like Richard Teng, the CEO of Binance, proposes. It’s plausible that other nations may follow this lead, mirroring similar trends in the global financial landscape.

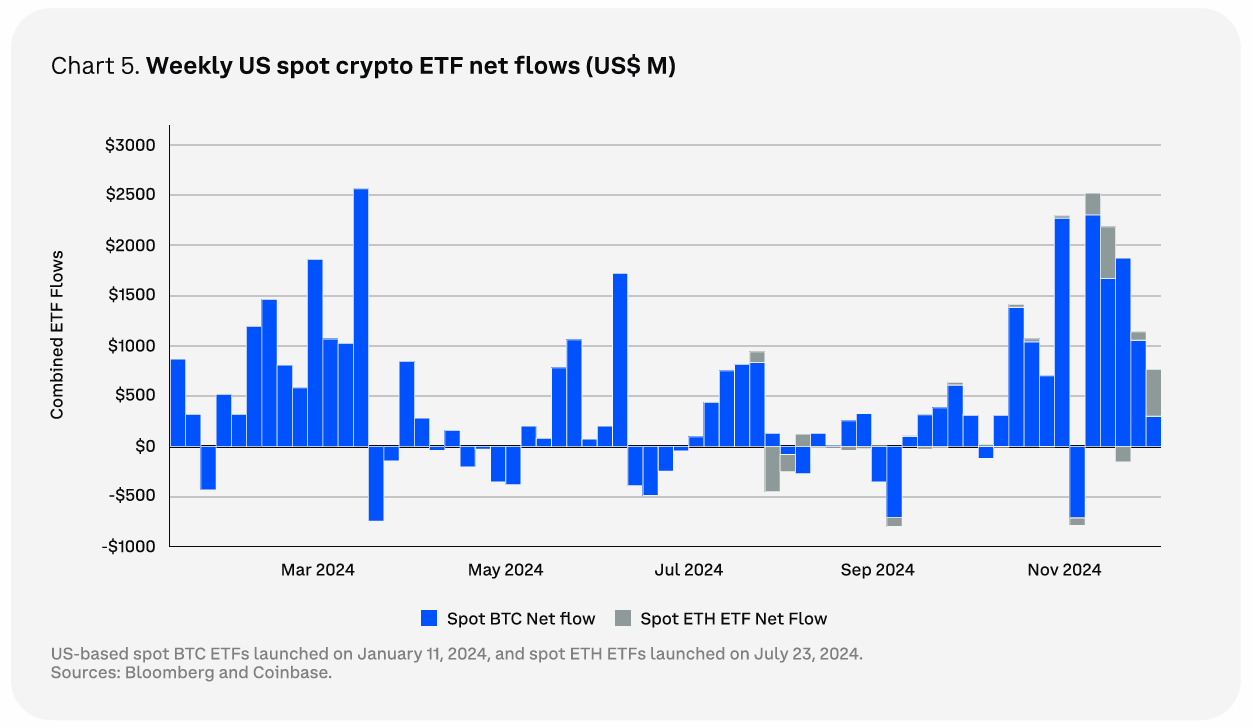

Positive Developments for Crypto ETFs

Coinbase emphasizes the importance of Bitcoin and Ethereum Exchange-Traded Funds (ETFs) in drawing fresh investment capital. The figures show that a total of $30.7 billion has been flowing in since they were launched.

Additionally, the report proposes a possibility for Exchange-Traded Funds (ETFs) associated with digital assets such as XRP, Solana (SOL), Litecoin (LTC), and Hedera Hashgraph (HBAR) to receive authorization. However, it’s important to note that the potential advantages could be temporary in nature.

Significantly, Coinbase anticipates that the Securities and Exchange Commission (SEC) might approve staking within ETFs or eliminate the necessity for exchanging ETF shares in cash. This change could significantly expand the ETF market, according to Coinbase’s speculation. Moreover, SEC Commissioner Hester Peirce has suggested that such developments may take place “relatively soon.

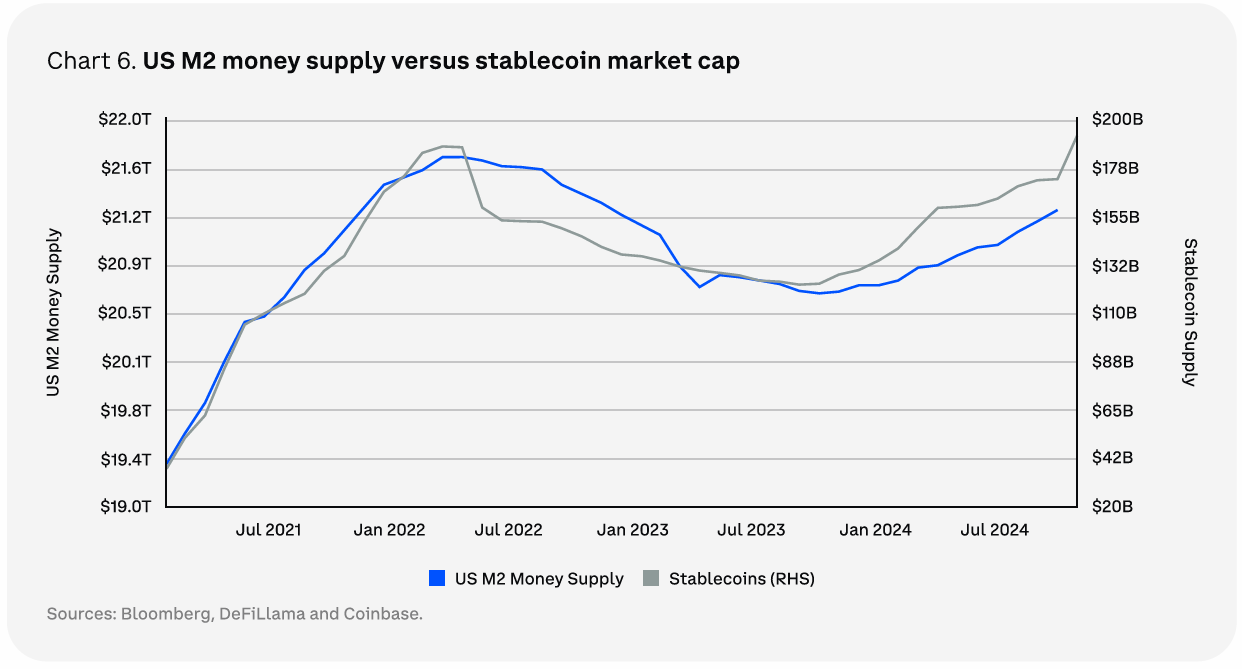

Global Adoption of Stablecoins

In simpler terms, Coinbase anticipates a significant increase in the use of stablecoins. At present, the combined value of all stablecoins is over $190 billion, which equates to approximately 0.9% of the total U.S. M2 money supply.

According to the report, it’s expected that stablecoins might make up around 14% of the $21 trillion in U.S. M2 money supply, primarily due to their advantage in speed and cost-effectiveness over conventional approaches.

It appears that the time could soon arrive when the main purposes of using stablecoins will shift from trading to facilitating international money transfers and commerce, as suggested by Coinbase.

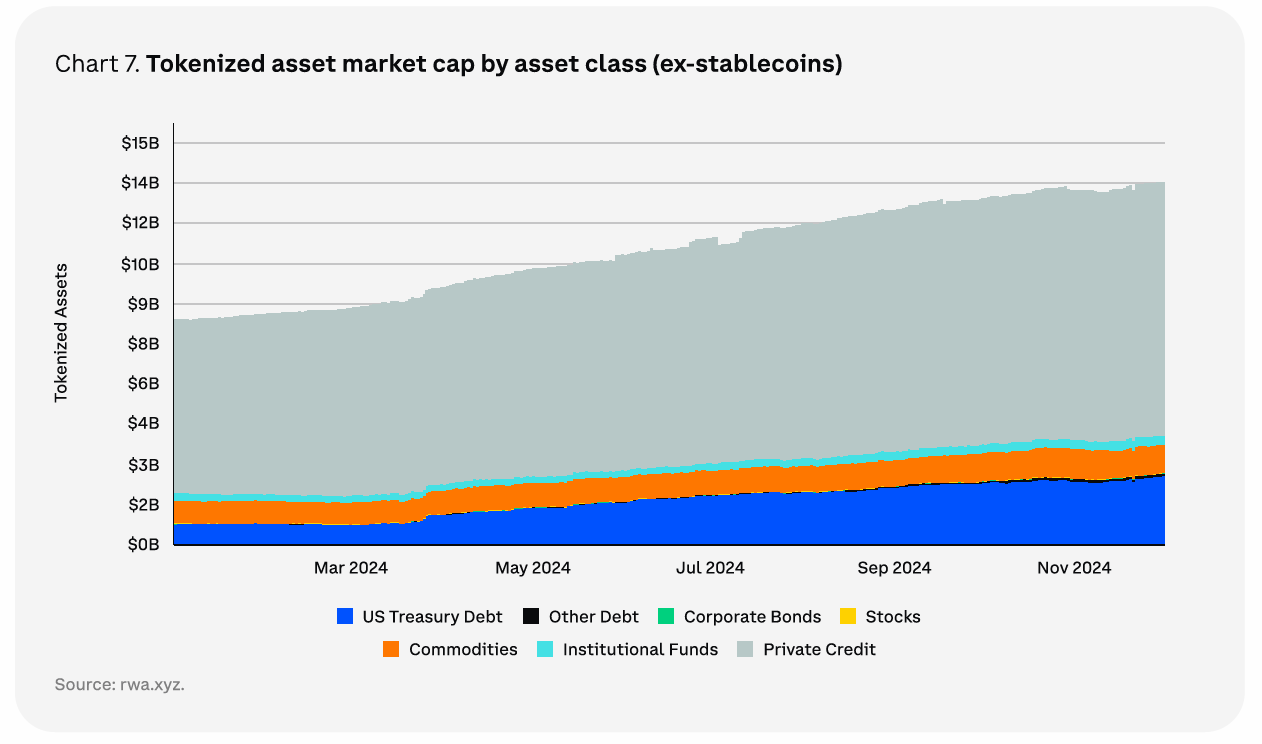

Tokenization to Thrive Amid Regulatory Challenges

It is projected that tokenized assets will witness ongoing expansion in 2025, according to Coinbase. The value of tokenized representations of real-world assets surpassed 60% growth within the last year, amounting to nearly $14 billion.

It’s projected that the total value of Real Asset (RWA) investments could potentially grow by a minimum of $2 trillion within the next five years, with established financial heavyweights such as BlackRock and Franklin Templeton contributing significantly to this increase.

The practice of breaking down financial instruments into smaller units, or tokenization, is no longer limited to conventional assets like U.S. Treasury bonds and money market funds. Instead, it’s being applied in diverse sectors such as private credit, commodities, corporate bonds, real estate, and insurance.

In due time, Coinbase anticipates that tokenization could simplify the entire portfolio construction and investment process by moving it onto the blockchain, though this might be several years off. However, such endeavors encounter their own distinctive obstacles, such as liquidity fragmentation across various blockchains and ongoing regulatory barriers.

According to a Messari report, it’s predicted that conversations about Bitcoin and tokenized Real World Assets (RWAs) will be at the forefront in 2025.

DeFi to Rebound in 2025

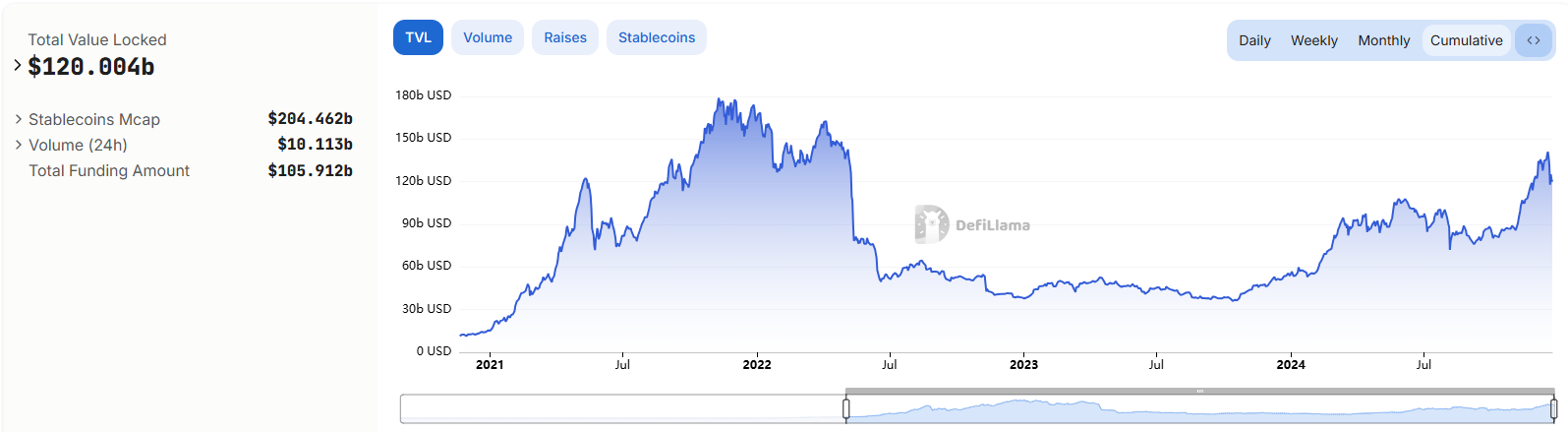

Even though the market’s total capitalization surpassed an impressive $3.7 trillion, the Total Value Locked (TVL) in DeFi hasn’t reached its peak of $200 billion again; right now, it’s sitting at about $120 billion.

Coinbase argues that DeFi faced significant challenges in the last cycle, as many protocols offered unsustainable yields. However, regulatory changes in the US could allow DeFi protocols to share revenue with token holders, fostering a revival.

As a crypto investor, I found it intriguing when the report mentioned remarks by Federal Reserve Governor Christopher Waller suggesting that Decentralized Finance (DeFi) could work hand-in-hand with traditional Centralized Finance (CeFi), leveraging Distributed Ledger Technology (DLT). This collaboration could potentially boost data storage efficiency, making it a promising development for our digital economy.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-23 14:05