In the dusty corners of the digital frontier, Coinbase has unveiled its inaugural Ethereum Validator Performance Report, a tome of numbers and dreams, revealing that it now commands a legion of 120,000 validators, shepherding a staggering 3.84 million staked Ethereum (ETH) tokens.

With this hefty sum accounting for 11.42% of the total staked Ethereum, Coinbase stands tall as the largest individual node operator on the Ethereum network, like a giant among mere mortals.

What Ethereum Stakers on Coinbase Should Know

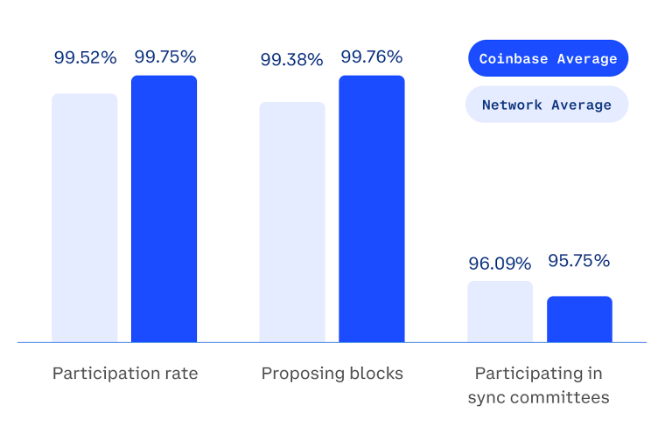

The report, a beacon of hope for the weary staker, highlights a participation rate of 99.75% and uptime that would make even the most diligent farmer proud, ensuring that staked assets continue to churn out rewards like a well-oiled machine. Coinbase, in its wisdom, reported no instances of slashing or double signing, which means users’ funds have remained as secure as a squirrel’s winter stash. These findings could have significant implications for users who stake ETH through the platform.

Yet, lurking in the shadows of this success is the specter of security. Coinbase has made it clear that it prioritizes avoiding slashing penalties over the siren call of maximizing uptime. This means users might find their returns slightly lower than those platforms that chase the elusive 100% uptime like a dog chasing its tail.

Moreover, the company has spread its validators across the globe, like seeds in a vast field, utilizing multiple cloud providers (AWS and GCP) to reduce the likelihood of service disruptions. Another crucial factor for users is client diversity. Coinbase’s ambition for multiple execution and consensus clients is to prevent single points of failure, much like a farmer diversifying crops to avoid a blight.

However, as the largest individual operator, Coinbase’s influence over the Ethereum network is swelling like a summer river. Some stakeholders may be wringing their hands over centralization risks as Coinbase’s share of the Ethereum network grows, raising eyebrows and questions about the very fabric of decentralization.

Indeed, Coinbase’s growing share has sparked a firestorm of debate about Ethereum’s decentralization, as large operators tighten their grip on network governance.

“11.42% stake concentration in a single entity raises red flags for network security. Transparency is good, but decentralization is better. We need more distributed validation,” a user lamented in a post on X (Twitter), echoing the concerns of many.

Users may find themselves at a crossroads, weighing the convenience of staking with the Coinbase exchange against the broader implications of network centralization, like a traveler pondering which path to take in a dense forest.

Ethereum educator Sassal acknowledged that Coinbase’s 11.42% share makes it the largest Ethereum node operator. However, Lido, another ETH staking protocol, remains the largest staking entity when considering its collective stake across multiple operators, like a collective of farmers banding together for strength.

“We now know how much ETH Coinbase has staked (11.42% of the total stake). This, of course, makes Coinbase the single largest node operator on the network (Lido is bigger as a collective, but each node operator has a much smaller % share) Kudos to Coinbase for the transparency!,” Sassal remarked, tipping his hat to the giants of the industry.

Meanwhile, the report follows a period of mixed developments for the company. Recent findings indicate that traffic to centralized exchanges, including Coinbase and Binance, has plummeted by nearly 30%, reflecting the harsh winds of a declining crypto market.

Notwithstanding, Coinbase has expanded its offerings with the launch of Verified Liquidity Pools, aimed at both institutional and retail traders, like a farmer diversifying his crops to weather the storm.

Additionally, Coinbase recently saw a legal development as the SEC dropped a high-profile lawsuit against the company. The lawsuit had been a dark cloud over Coinbase and the broader crypto industry, making its dismissal a notable event, like the sun breaking through after a long storm.

“Are they releasing these things now because SEC is off their back,” one user quipped, adding a dash of humor to the serious business of crypto.

With its increasing share of staked Ethereum, Coinbase’s role in the network will likely continue to be debated, like a town

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-03-20 11:05