As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the ebb and flow of market trends and the dynamic nature of technological advancements. The recent announcement by Coinbase to suspend trading for Wrapped Bitcoin (WBTC) has piqued my interest, not just as an observer, but as someone who sees the potential implications for the broader crypto landscape.

On December 19, 2024, around 12 p.m. Eastern Time, Coinbase – the largest cryptocurrency exchange based in the United States – has made known its intention to halt trading for Wrapped Bitcoin (WBTC).

The announcement, made in a recent post from X (previously known as Twitter), explains that the move was due to a regular examination of their listed properties to maintain conformity with listing regulations.

Coinbase Sidesteps WBTC Amid cbBTC Boom

The suspension affects both Coinbase Exchange and Coinbase Prime. Despite the halt in trading activities, holders of WBTC can continue to manage their funds freely and withdraw them whenever they want. In anticipation of the changeover, Coinbase has switched WBTC trading to a limit-only system, allowing users to set and cancel orders, but matches may still happen.

Coinbase is planning to pause WBTC (Wrapped Bitcoin) trading on December 19, 2024, approximately at noon Eastern Time. Rest assured, your WBTC funds will still be accessible and you can withdraw them whenever you want. We’ve switched our WBTC order books to a limit-only mode, meaning you can place or cancel limit orders, but matches may only occur.” (Coinbase explained.)

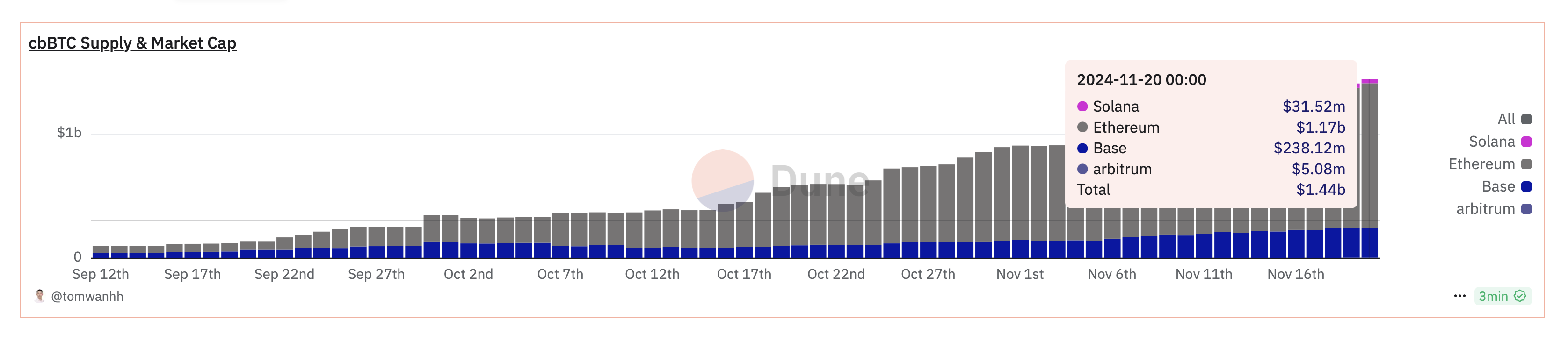

Coinbase’s move to suspend WBTC comes amid the rapid success of its wrapped Bitcoin token, cbBTC. Recently, cbBTC surpassed a $1 billion market capitalization, reflecting growing adoption and trust within the crypto community. This milestone has further cemented cbBTC’s position as a strong competitor to WBTC in the decentralized finance (DeFi) space.

Currently, it’s been observed that the total value of Dune’s cbBTC market stands at a staggering $1.44 billion. The wide availability of CBTC on networks such as Solana, Ethereum, and Base has made it easier for more people to get their hands on this cryptocurrency. Notably, Arbitrum is the most recent platform where cbBTC can be found.

CbBTC has been activated on Arbitrum. This ERC-20 token, which is equivalent in value to Bitcoin (BTC) held by Coinbase, is now readily available on Arbitrum and can be securely accessed by more users within the Ethereum network as announced by Coinbase on Tuesday.

As a crypto investor, I’m excited about the strategic move by DeFi giant Aave towards integrating cbBTC into their Version 3 (V3) platform. This development not only expands its utility within the ecosystem but also fuels the growing momentum in the DeFi space. Perhaps, this could be a significant factor in Coinbase’s decision to phase out WBTC trading, hinting at a potential shift towards cbBTC.

WBTC Core Team Urge Coinbase to Reconsider

The creators of Wrapped Bitcoin have shown disappointment and astonishment over Coinbase’s decision. In a public announcement on X, the main team of WBTC highlighted their dedication towards adhering to regulations, maintaining transparency, and upholding the principles of decentralization.

The team expressed disappointment and bewilderment over Coinbase’s choice to remove Wrapped Bitcoin (WBTC) from their platform…They kindly request that Coinbase reevaluate this decision and maintain WBTC trading support,” is a more natural and easy-to-read paraphrase of the original statement.

The statement outlined WBTC’s longstanding reputation for novel mechanisms, regulatory compliance, and decentralized governance. Highlighting its seamless integration with DeFi protocols, WBTC described itself as an essential liquidity solution for Bitcoin users. Urging Coinbase to reconsider, WBTC reaffirmed its readiness to address any concerns or provide additional information to support its case.

Simultaneously, Coinbase’s announcement has led to a variety of responses within the cryptocurrency world. Some users have voiced their disapproval towards the platform, implying that the move indicates a struggle with managing competition.

“Coinbase can’t handle fair competition?? WBTC superior to cbBTC” said Gally Sama in a post.

Nevertheless, others support the move, citing concerns over WBTC’s custody model, with one user referencing BitGo’s recent adoption of a multi-jurisdictional custody system.

“You put custody in the hands of a fraud. What did you think was gonna happen?” the user expressed.

This critique aligns with growing fears about Justin Sun’s involvement in WBTC’s custody processes, as BeInCrypto reported recently. Some users have acted preemptively to avoid potential risks, with one commenter sharing their reservations.

After the Sun moved the multisignature for Wrapped Bitcoin (WBTC) into their account, they transferred all their WBTC to Coinbase and traded it for actual Bitcoin, which they withdrew to their hardware wallet. They just confirmed that I had provided them with accurate advice regarding this move.

The decision to suspend WBTC trading could mark a pivotal moment in the competition between wrapped Bitcoin solutions. While cbBTC’s integration across multiple blockchain networks has gained momentum, skepticism surrounding WBTC’s custody model and leadership has intensified.

Justin Sun has voiced criticism of Coinbase’s cbBTC strategy, labeling it a setback for Bitcoin’s broader adoption. As the debate continues, the industry watches closely to see whether Coinbase’s cbBTC will solidify its dominance or if WBTC can regain its position as a leading wrapped Bitcoin solution. Regardless, the shifting dynamics reflect the importance of transparency, governance, and community trust in shaping the future of DeFi.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-20 17:25