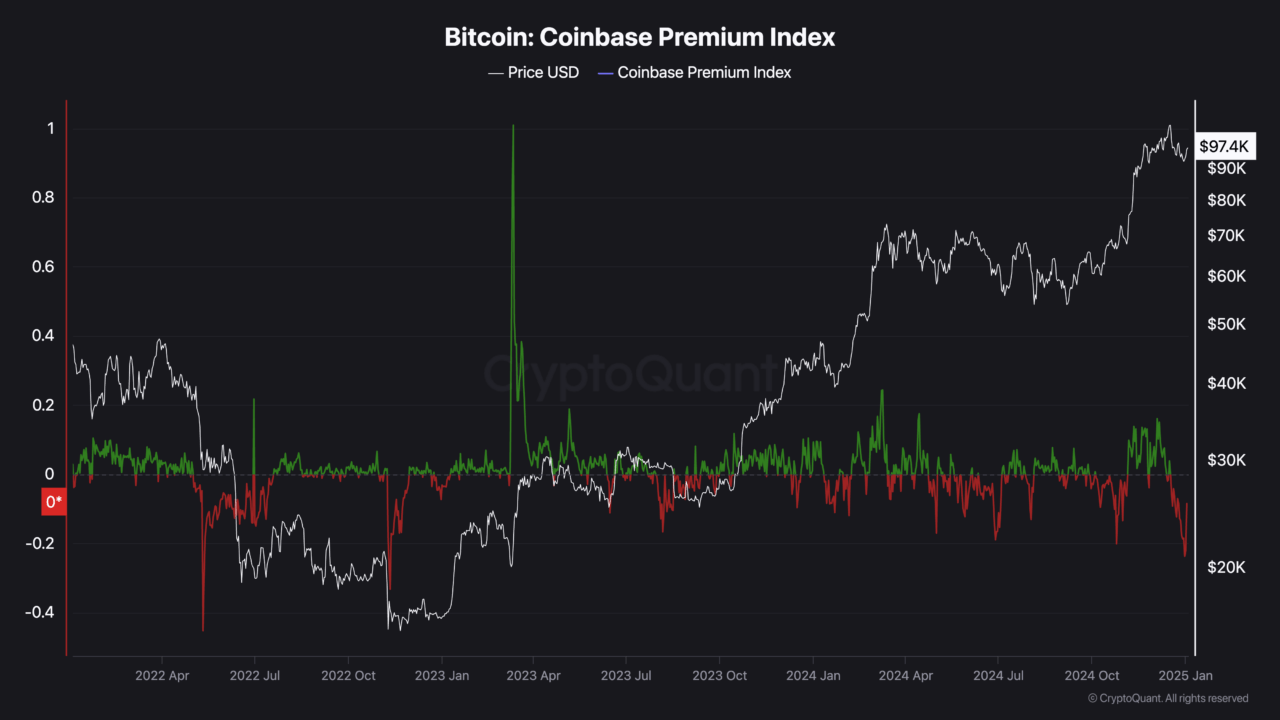

As a seasoned analyst with over a decade of experience in the financial markets, I find myself constantly monitoring key indicators and trends to gain insights into market sentiment and investment behavior. The recent drop in the Coinbase Premium Index to a 12-month low has raised some red flags for me, as this metric is often a reliable gauge of U.S. investor demand for Bitcoin.

In my early days as an analyst, I learned the hard way that market sentiment can be fickle and unpredictable. However, the consistent trend of this index over time provides us with valuable insights into the collective mindset of investors in the world’s largest economy. The drop to -0.237 suggests a lack of institutional demand and cautious sentiment among U.S. investors, which could have near-term implications for Bitcoin’s price.

On the other hand, I find it intriguing that Tether, a leading stablecoin issuer, has recently added 7,629 bitcoins to its balance sheet. This move comes after a nine-month hiatus from accumulating Bitcoin and brings its total holdings to over $7.68 billion. As someone who has witnessed many market cycles, I’ve learned that whales like Tether can have a significant impact on the overall market dynamics.

In closing, while U.S. investors may be taking a cautious approach towards Bitcoin, it seems that Tether is betting big on the flagship cryptocurrency. As always in the world of finance, I’ll keep a close eye on these developments and adjust my strategies accordingly. And as a final note, remember: “The market can stay irrational longer than you can remain solvent.” – John Maynard Keynes.

As an analyst, I’ve noticed a significant drop in U.S.-based interest in the cryptocurrency market over the past year, reaching its lowest point in that period. This trend has sparked worries among us about the potential short-term price fluctuations of the leading cryptocurrencies.

As per a post by analyst Burak Kesmeci from CryptoQuant, the Coinbase Bitcoin Price Difference Indicator (which compares the bitcoin price on Coinbase with other significant cryptocurrency trading platforms like Binance) has dropped to its lowest point in the last twelve months.

The index serves as an indicator of the overall attitude towards the market by American investors, where a high value indicates strong investor interest within the country, suggesting they find Bitcoin more expensive on Coinbase due to increased buying pressure or high demand. Conversely, a low value suggests that Bitcoin may be cheaper on Coinbase compared to Binance, possibly due to selling pressure or reduced interest among investors.

As reported in the post, prior to the U.S. elections, the index reached an all-time low of -0.2 due to increased uncertainty. However, this value has since decreased even more to -0.237, marking a 12-month low. Kesmeci explains that this decline doesn’t just reflect a lack of institutional demand but also demonstrates the cautious attitude among U.S. investors.

As a researcher, I’ve noticed a cautious stance among U.S. investors regarding their investments. However, Tether, a significant player in the stablecoin market, has recently resumed its acquisition of Bitcoin after a nine-month pause. This latest move adds 7,629 Bitcoins to their existing holdings, bringing their total to 82,983 BTC, which is currently worth approximately $7.68 billion.

Based on information from Arkham Intelligence, it appears that the dominant issuer of stablecoins has been consistently accumulating Bitcoin. The value of their Bitcoin holdings has grown so significantly that it currently surpasses $6 billion, making it their largest asset in terms of the leading stablecoin.

The wallet contains approximately $210.5 million in value of gold-backed Tether’s cryptocurrency XAUT, along with $25.6 million of their previously issued euro-backed stablecoin EURT.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-03 20:14