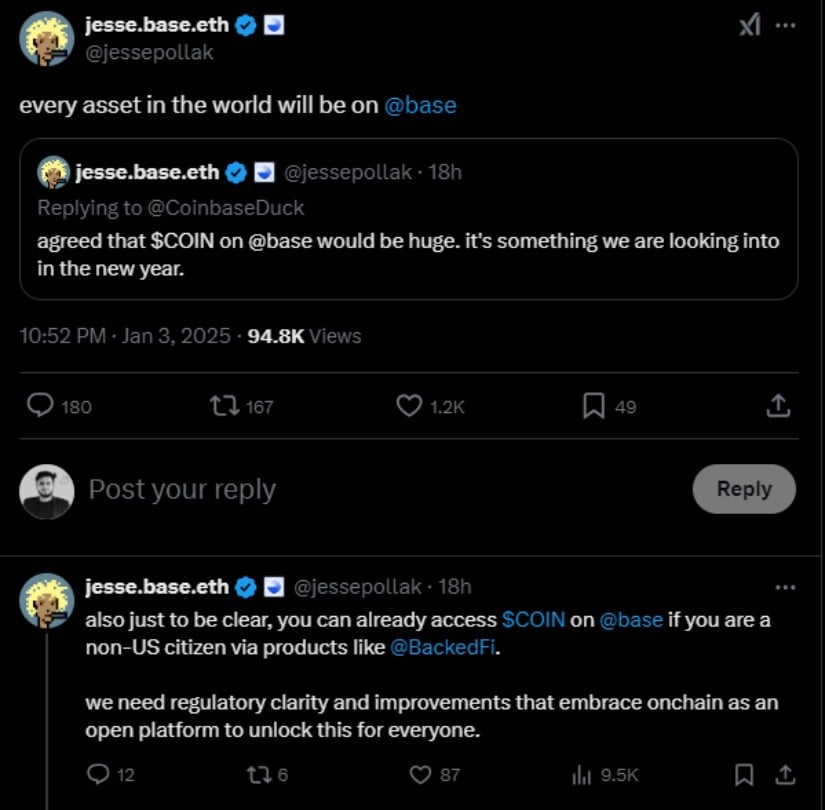

Jesse Pollak, who works as a developer at Base, shared a plan in a post on social media on January 3rd, suggesting a significant change that could reshape the crypto sector. Pollak expressed his ambition, “Every asset will be available on Base,” emphasizing an ambitious goal for future digital financial systems.

As an analyst, I’m observing that while international users can already invest in tokenized COIN shares through platforms such as Backed, U.S. investors may need to exercise patience. The company, in its proactive stance, is diligently pursuing regulatory clarity within the United States. To reiterate, they are taking an exploratory approach, emphasizing their quest for a clear path forward in terms of U.S. regulations.

It’s crucial we achieve regulatory certainty and advancements that view blockchain as an open environment, so its potential can be accessible to all.

As an analyst, I must acknowledge that the road ahead is filled with substantial hurdles. Under the leadership of President Joe Biden, the U.S. Securities and Exchange Commission (SEC) has taken over 100 enforcement actions against crypto firms, thus creating a climate of intense examination within the digital currency sector.

COIN Soars Over 20%—Thanks to Trump

Over the past few days, I’ve been on quite a ride with COIN – it’s been like cruising on a wild rollercoaster! On November 11, this crypto gem shot up an astounding 20% and breached the $300 mark for the first time since early 2021. This sudden spike can be attributed to the optimism surrounding Donald Trump’s presidential victory, with many of us hoping that his administration would adopt a more lenient stance towards crypto regulation.

According to Michael Miller, an analyst at Morningstar specializing in equities, he pointed out in November that the outcome of the election could potentially be advantageous for Coinbase. This digital currency exchange platform has encountered substantial regulatory hurdles from the Securities and Exchange Commission (SEC) and is currently embroiled in a legal dispute with the agency.

According to Miller, we expect Coinbase to gain advantage following the election outcomes. The company has faced tough regulatory scrutiny from the SEC and is currently engaged in legal battles against the agency.

Nevertheless, achieving consistent regulations continues to be a rough journey. While progress has been made towards shifting from rule-enforcement to lawmaking, Citigroup pointed out in a December analysis that the U.S. is still trailing behind many other regions in establishing well-rounded crypto legislation.

2025 forecasts indicate a bullish outlook on the price trends of COIN, along with other digital assets like Ripple‘s XRP and meme coins such as Dogecoin. For discerning investors seeking promising crypto investments, numerous choices present valuable opportunities to bolster their portfolios.

RWA — The $30 Trillion Opportunity

As a crypto investor, I’m truly excited about the immense potential of investing in tokenized assets. According to Colin Butler, the global head of institutional capital at Polygon, we’re looking at a $30 trillion market opportunity for tokenized real-world assets (RWAs). These tokenized securities are a crucial part of this rapidly expanding sector, and I can’t wait to see how they shape the future of our investment landscape.

It’s widely expected that there will be significant expansion in this area. Citigroup believes that digital tokens representing securities could potentially be worth between 4 and 5 trillion dollars by 2030. Moreover, the Global Financial Markets Association (GFMA) together with Boston Consulting Group, envision tokenized illiquid assets reaching a staggering 16 trillion dollars within the same timeframe.

As an analyst, I’d like to underscore Butler’s point about the transformative effect of tokenization on wealthy individuals. Specifically, I’m referring to those with net worths ranging from $1 million to $30 million who collectively hold $100 trillion in assets. Tokenization offers a unique opportunity to unlock liquidity in previously inaccessible asset classes for many investors.

Approximately 300 trillion dollars in total global assets exist. Of this sum, an impressive half, or 100 trillion dollars, is held by individuals whose net worth falls within the range of one to thirty million dollars, as stated by Butler.

Goldman Sachs Pushes Tokenization

Major financial powerhouses like Goldman Sachs aren’t just idling by. They intend to launch three digital tokenization services by the end of the year, indicating a robust institutional involvement in this area. The desire is evident, as clients are increasingly showing an interest in these digitally-backed investment options.

Platforms such as Propy for real estate and KlimaDAO in the digital carbon market sector are driving progress in their respective fields. With increasing popularity, these systems have witnessed an uptick in user engagement due to the growing acceptance of tokenized assets on various public and private blockchain networks.

Tokenization’s far-reaching effects could lead to significant transformations. It offers liquidity and access to previously illiquid asset classes, which could fundamentally change the way portfolios are structured. Experts like Butler foresee a future where private bankers may suggest up to 20% of a client’s portfolio be invested in tokenized assets, marking a significant shift from the negligible percentages currently allocated.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-05 11:48