As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find Brian Armstrong’s words at the Goldman Sachs Communacopia & Technology Conference particularly resonant. The need for clear regulation has long been a pressing issue for the crypto industry, and it’s refreshing to hear such a prominent figure in the space emphasizing its importance.

According to a report from Seeking Alpha dated 10th September 2024, Brian Armstrong, Co-Founder and CEO of Coinbase Global (NASDAQ: CEO), emphasized the importance of clear regulations for the advancement of the cryptocurrency industry. Armstrong pointed out that regulatory clarity is one of the main challenges in the crypto sector, and resolving this issue would create a fair environment for all participants. He is convinced that clear laws would attract substantial investment into the cryptocurrency market.

At the Goldman Sachs Communacopia & Technology Conference, Armstrong suggested that the United States could experience significant advantages by enacting laws similar to those already established in Europe and other regions. He expressed confidence that such legislation would facilitate an enormous investment in the cryptocurrency industry. He emphasized that “if we manage to pass legislation in the U.S., a substantial amount of capital will flow in.

The report noted Armstrong’s assertion that America cannot afford to delay regulatory developments much longer, as most G20 nations have already moved forward with their own crypto legislation. Armstrong is confident that the U.S. will eventually follow suit, ensuring the country remains competitive in the global crypto landscape.

Beyond Armstrong’s perspective on regulating cryptocurrencies, the report noted that crypto is increasingly a hot topic among political figures in the United States, particularly during this election season. Notably, some candidates have emphasized crypto regulation as a key component of their campaigns, demonstrating its growing significance.

According to Armstrong, any legislative approval is viewed as a favorable sign for the industry. He used the increasing number of Bitcoin ETFs as evidence that clear regulations can stimulate expansion and security within the market.

Alesia Haas, Coinbase’s Chief Financial Officer, added her thoughts, pointing out that for the cost of cryptocurrencies to decrease, it must first be fully standardized or commoditized. Haas suggested that broad acceptance by banks and financial institutions is essential for this to happen, leading eventually to reduced transaction fees. As per Haas, the crypto market hasn’t reached full commoditization yet, and a significant reduction in fees won’t occur until the ecosystem matures further.

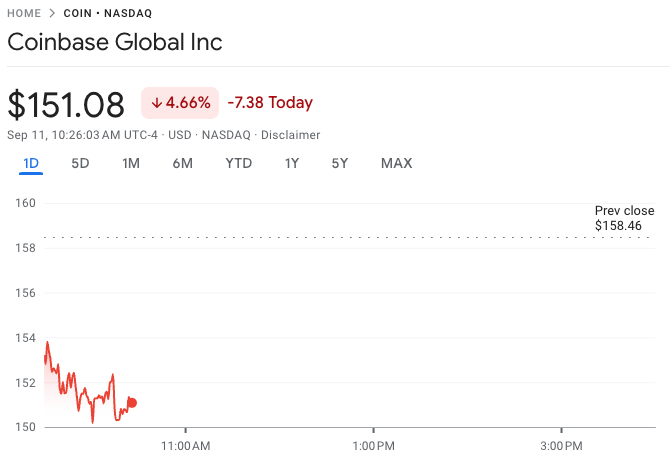

As I type this (at precisely 2:26 PM UTC on the 10th of September), Coinbase stocks are being exchanged for approximately $151.08 each, marking a decrease of 4.66% compared to today’s opening price.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-09-11 18:08