The machinery of governance ground to a halt, as predictable as the turning of winter’s leaves. Lawmakers, entrenched in their opposing groves, allowed the clock’s hands to bleed past midnight. Investors, ever the weathered sailors, had already reefed their sails against the coming squall.

The great market barometers-the S&P 500, the Dow, the Nasdaq-trembled like birch trees in a storm before steadying themselves. Yet beneath this surface agitation, a quieter current stirred. Gold, that ancient refuge, whispered promises of constancy. Bitcoin, the digital émigré, surged 3%-a sly wink from the future.

In times of fiscal tempest, traditional finance often creaks under the strain, its clients clutching at lifelines to meet earthly obligations. Yet here, a paradox emerges: Coinbase Global (COIN) stands not as a casualty, but a beneficiary.

The Alchemist of Bits and Bytes

Coinbase, that grand bazaar of cryptographic wealth, now hosts $425 billion in assets-a vault of digital dreams spanning 100 nations. Its corridors echo with the footsteps of traders converting fiat into Ethereum, Litecoin into Bitcoin, each transaction a small revolution against the old order.

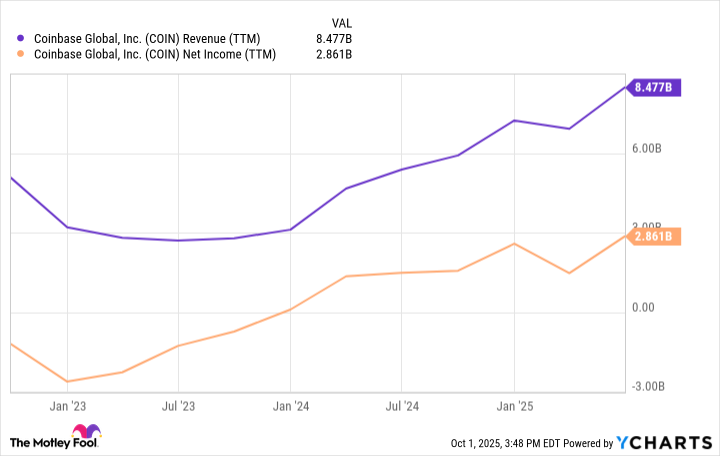

Quarterly revenues swell like a river in spring: $1.42 billion recently, surpassing last year’s $1.38 billion. Profits, once a mere trickle at $36 million annually, now roar at $1.43 billion-a cascade of progress.

Three years have seen revenue multiply thirtyfold, net income triple. These numbers do not merely climb-they ascend with the urgency of a generation rewriting its inheritance.

Analysts, those modern-day augurs, gaze into their screens with cautious optimism. Half of 34 seers recommend purchase, their collective gaze fixed on a $371 target-7% higher. One visionary prophesies $510, a 43% ascent. The chorus is divided, yet unmistakably rising.

Epilogue in a Time of Uncertainty

Coinbase’s subscription model-a $5 monthly passage to zero-fee trading-echoes Robinhood’s siren song. That competitor’s stock has ballooned 271% this year, proof that investors crave new alchemies.

I offer no prophecy of similar gains. Yet in the present disquiet, as governments falter and currencies tremble, Coinbase emerges as both refuge and rebellion. To hold its shares is to keep a lantern lit against the fog of old certainties. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-10-02 01:10