Coca-Cola (KO) is the corporate equivalent of a nicotine-stained ashtray in a Las Vegas casino bathroom – STALE, TIMELESS, and dripping with a syrupy residue that refuses to die. Its stock has slouched through a century of market convulsions like a zombie clutching a coupon for 10% off its own funeral, making it the patron saint of dividend chasers and retirees with a taste for predictable misery.

But then there’s Warren Buffett. That Oracle of Omaha, that fiscal warlock whose shadow looms over Berkshire Hathaway like a vulture on a tombstone, began hoarding KO shares in the late ’80s. By 1994, he’d amassed 400 MILLION shares – a stake so grotesque it could drown Wall Street in a diabetic coma. And yet here’s the kicker: Berkshire hasn’t TOUCHED those shares since Bill Clinton was still pretending he didn’t inhale. The silence is deafening. The inaction? A RORSCHACH TEST for investors.

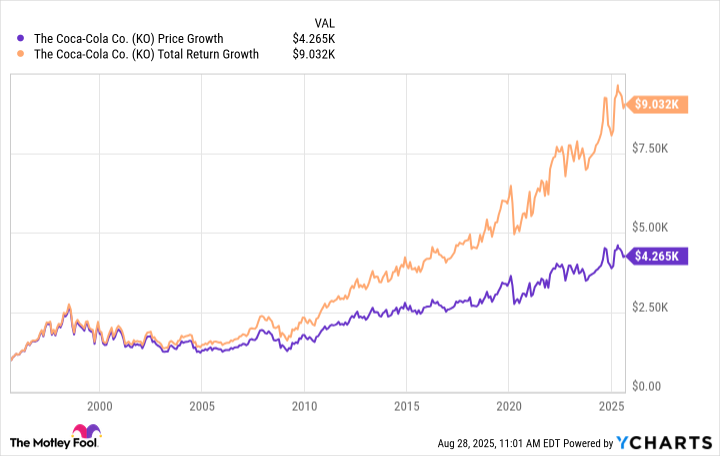

Coca-Cola Since 1995: A Case Study in Corporate Narcolepsy

Imagine plunking down a grand on KO in 1995. Today you’d be staring at $9,030 – a return so anemic it makes a Treasury bill look like a meth binge. $4,270 from the stock itself? That’s just the market’s version of a participation trophy. The real “magic”? $4,760 in dividends from 63 straight years of payout hikes. A DIVIDEND KING, sure – but isn’t that like being crowned monarch of a kingdom built on a sinking island?

Here’s where it gets weird: The S&P 500 would’ve turned that same $1k into $20,000. DOUBLE. Buffett’s KO stake? Probably outpaced it – the man bought during the Reagan administration when stocks were cheaper than a meth-head’s lunch. But since ’94, Berkshire’s dividend reinvestment strategy has been… non-existent. The current P/E ratio of 24 looms like a gaunt specter whispering “value trap” into Buffett’s ear. Is KO just a golden goose with a leaky beak? Or is the Oracle playing a longer game?

For income junkies, KO still drips allure. That 2.9% yield? It’s a siren song screaming over the S&P’s 1.2% whisper. But let’s not kid ourselves – this is the stock market’s equivalent of settling for a consolation prize. Thirty years of underperformance? That’s not investing. That’s masochism with quarterly payouts.

The truth? Coca-Cola’s a relic swimming in a sea of algorithmic sharks and crypto vampires. Unless you’re building a portfolio for your grandmother’s nursing home trust, this “safe haven” might just be a life preserver filled with concrete. 🥤

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Where to Change Hair Color in Where Winds Meet

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2025-09-01 18:03