In a move that could only be described as audacious, Circle, the issuer of the ubiquitous USDC stablecoin, has swallowed Hashnote, the mastermind behind the USYC token, in a deal that reeks of ambition and a dash of hubris.

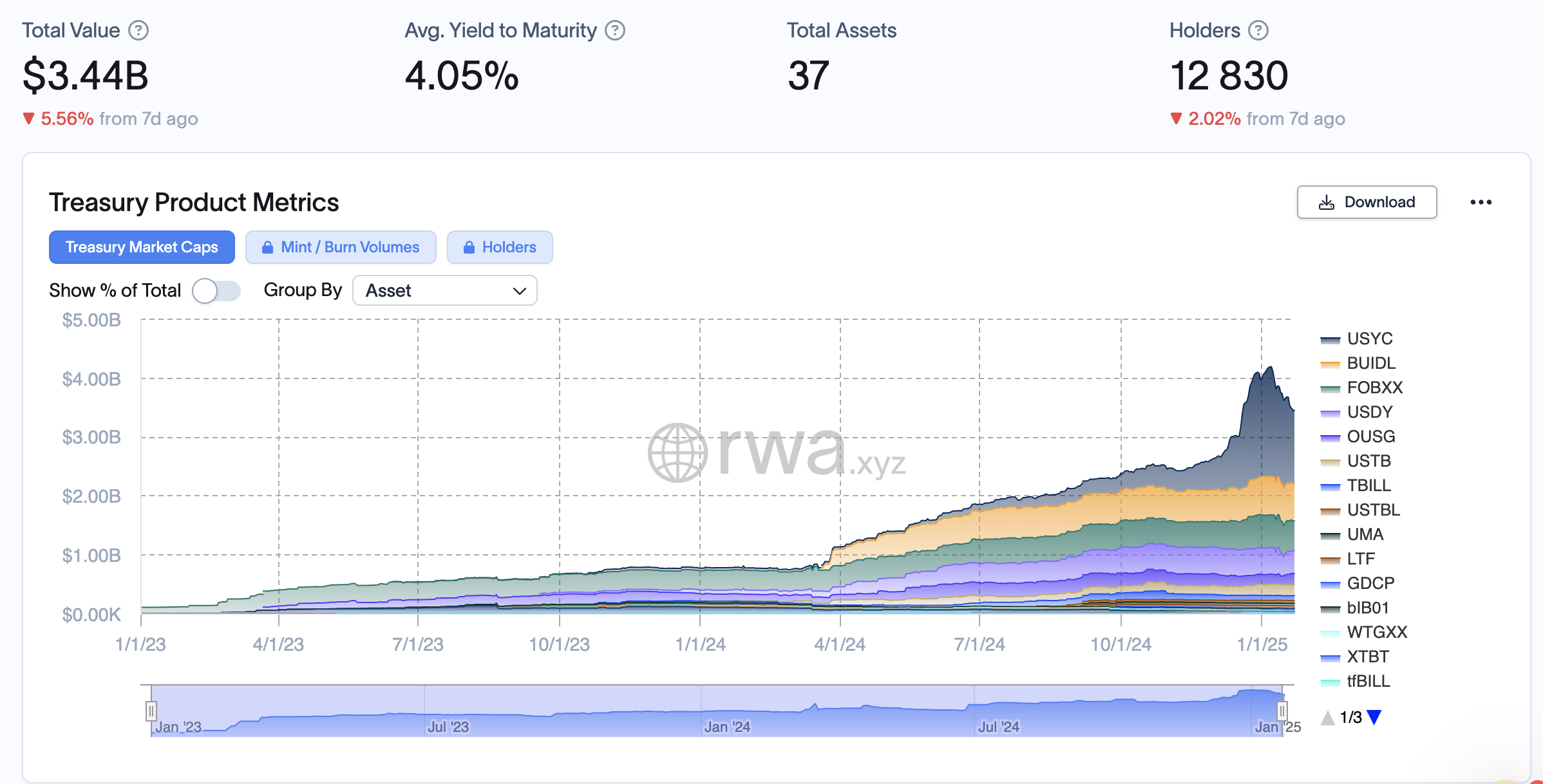

According to RWA.xyz, USYC, the world’s largest tokenized treasury and money market fund, manages a staggering $1.52 billion in assets. One might wonder if this is a financial revolution or just another chapter in the never-ending saga of crypto theatrics. 🤔

USYC and USDC: A Marriage of Convenience or Destiny?

Circle’s grand plan is to merge USYC with USDC, creating a seamless bridge between tokenized money market assets and the ever-liquid USDC. This union will allow USYC to strut its stuff as yield-bearing collateral on crypto exchanges, custodians, and prime brokers. A match made in blockchain heaven? Or just another crypto power play? 💍

Jeremy Allaire, Circle’s CEO, waxed poetic about the integration, calling it a “pivotal step” for the stablecoin market. One can almost hear the violins playing in the background as he declared:

“We helped invent tokenized cash, and are now leading the way in tokenized money markets. Both will become essential to the future of the global financial system. Circle’s acquisition of Hashnote and our strategic partnership with DRW-affiliate Cumberland are crucial to delivering these products at scale.”

USYC, a tokenized money market fund, promises high yield and security, offering investors a slice of short-term treasury obligations. Backed by major trading firms and derivatives exchanges, it’s positioning itself as the Swiss Army knife of collateral management. But will it live up to the hype? Or is it just another shiny object in the crypto carnival? 🎪

“Joining Circle increases our ability to rapidly scale adoption by pairing USDC, a widely-used, liquid payment and trading stablecoin, with USYC, a safe, Tokenized Money Market Fund for yield-bearing collateral,” said Leo Mizuhara, Hashnote’s founder and CEO, with the enthusiasm of a man who just won the crypto lottery.

Adding to the drama, Circle has partnered with Cumberland, a DRW affiliate and one of the largest institutional cryptocurrency traders. Cumberland will work its magic to expand liquidity and streamline settlement processes for USDC and USYC. Because, of course, what’s a crypto deal without a little institutional muscle flexing? 💪

In a move that screams “we’re not done yet,” Circle also announced the deployment of native USDC on Canton, a public network for confidential and secure financial applications. Canton, which supports over $3.6 trillion in tokenized assets and $1.5 trillion in monthly repo operations, is the playground of top banks, asset managers, and exchanges. The integration of USYC and USDC with Canton promises 24/7 asset availability and instant conversion between collateral and cash. Because who doesn’

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2025-01-23 14:06