As someone who has spent years observing and participating in the ever-evolving world of finance, I can confidently say that the rise of stablecoins like USDC is nothing short of revolutionary for emerging markets. Having grown up in regions where access to traditional banking was limited and financial literacy was scarce, I have always been drawn to solutions that democratize access to financial services.

Stablecoins, with their promise of security, global access, and peer-to-peer transactions, are a beacon of hope for underserved communities worldwide. They offer a lifeline to those who have been excluded from the formal financial system, enabling them to participate in the global economy like never before. It’s like having a bank account in your pocket, accessible from even the most remote corners of the earth.

That being said, I believe that the journey towards widespread stablecoin adoption is not without its challenges. Financial literacy initiatives and educational resources are crucial for building trust and promoting awareness within communities with low financial literacy. Additionally, the lack of access to mobile devices and computers in some rural areas still poses a significant barrier. But, as technology continues to advance and policies become clearer, I am optimistic that these barriers will be overcome.

Now, let me share a little joke to lighten the mood: Why don’t we ever play hide-and-seek with a stablecoin? Because you can always find it in the same digital wallet!

In areas with frequent economic instability and currency depreciation, stablecoins serve as a vital resource. Their inherent stability makes them an attractive option for people and businesses in countries where wealth is threatened by inflation. Unlike traditional currencies that can rapidly fluctuate, stablecoins maintain their value through being tied to assets like the US dollar or commodities, thus fostering their growing popularity in regions such as Sub-Saharan Africa and Latin America.

The Role of Stablecoins in Local Economies

Various organizations such as banks, corporations, and private entities utilize stablecoins to simplify tasks like cross-border transactions and cash flow administration, and they employ these digital assets to minimize the negative effects of drastic exchange rate shifts.

As a researcher delving into the realm of digital currencies, I’ve come to understand that instances like Kash Razzaghi, Circle’s Chief Business Officer, mentioned in his BeInCrypto interview, significantly boost global stablecoin adoption. These instances enable swifter and more economical transactions compared to conventional financial systems, making them appealing alternatives for many users worldwide.

In rapidly developing economies, the rules governing cryptocurrencies and stablecoins are undergoing change, as stated.

In 2014, the emergence of stablecoins combined the robust features of blockchain technology with the monetary stability necessary for mass usage. While blockchain offers transparency and speed, stablecoins tackle the problem of fluctuating cryptocurrency values. This makes stablecoins appealing to more than just financial traders and speculators; they also catch the attention of retail and institutional sectors.

Looking ahead, the use of stablecoins is expected to expand even more, as mentioned by Razzaghi.

As a researcher, I anticipate that in the future, we will witness a strengthening of formal licensing systems, the enhancement of Know Your Customer/Anti-Money Laundering (KYC/AML) structures, and possibly the alignment with comprehensive Central Bank Digital Currency (CBDC) strategies. This is because policymakers aim to strike a balance between fostering innovation, maintaining financial stability, and ensuring compliance.

Razzaghi singled out countries in Sub-Saharan Africa as key influencers in the spread of stablecoins. In 2021, statistics from the World Bank showed that only about half of the region’s adult population owned a bank account. This lack of traditional banking infrastructure made cryptocurrencies an attractive alternative for countries such as Nigeria, Ethiopia, Kenya, and South Africa.

DeFi Adoption in Africa

In Nigerian markets and other African nations, local Decentralized Finance (DeFi) projects are experiencing notable growth, following the surge of stablecoins. Nigeria, which is a key player in global cryptocurrency adoption, has seen more than $30 billion worth of value transacted via DeFi services last year, as per a recent Chainanalysis report.

With the growth of the DeFi (Decentralized Finance) sector, options like stablecoin lending, savings products, and remittance solutions are becoming more reachable for users in developing markets. This is particularly beneficial for individuals who have been traditionally shut out of banking systems, as it promotes inclusivity and enables them to interact with the global economy, according to Razzaghi.

yellowCard is a Nigerian-born service that serves as an on/off ramp for stablecoins like USDT, USDC, and cryptocurrencies such as BTC and ETH. It offers a secure, liquid, and cost-effective way for customers across Africa to access these digital assets using their local currencies directly.

Similarly, countries in the region have developed mobile-friendly services for users without internet access. In 2020, Kenya’s major mobile network operator, Safaricom, along with communications company Vodacom Group, launched M-PESA Africa. This platform allows users to access stablecoin-fiat services such as Binance and has expanded its operations to countries like Tanzania, Mozambique, Ethiopia, Egypt, and Ghana.

Stablecoin solutions are modifying themselves to tackle issues like restricted internet access and inadequate infrastructure by creating mobile-friendly systems and other transaction options. For instance, certain initiatives are investigating SMS transactions and collaborations with local telecommunication companies to broaden their services to underprivileged communities, as Razzaghi explained to BeInCrypto.

The goal is to enhance the availability of reliable digital currency services in underprivileged rural communities, which will help promote financial equality.

Stablecoins in High-Inflation Countries

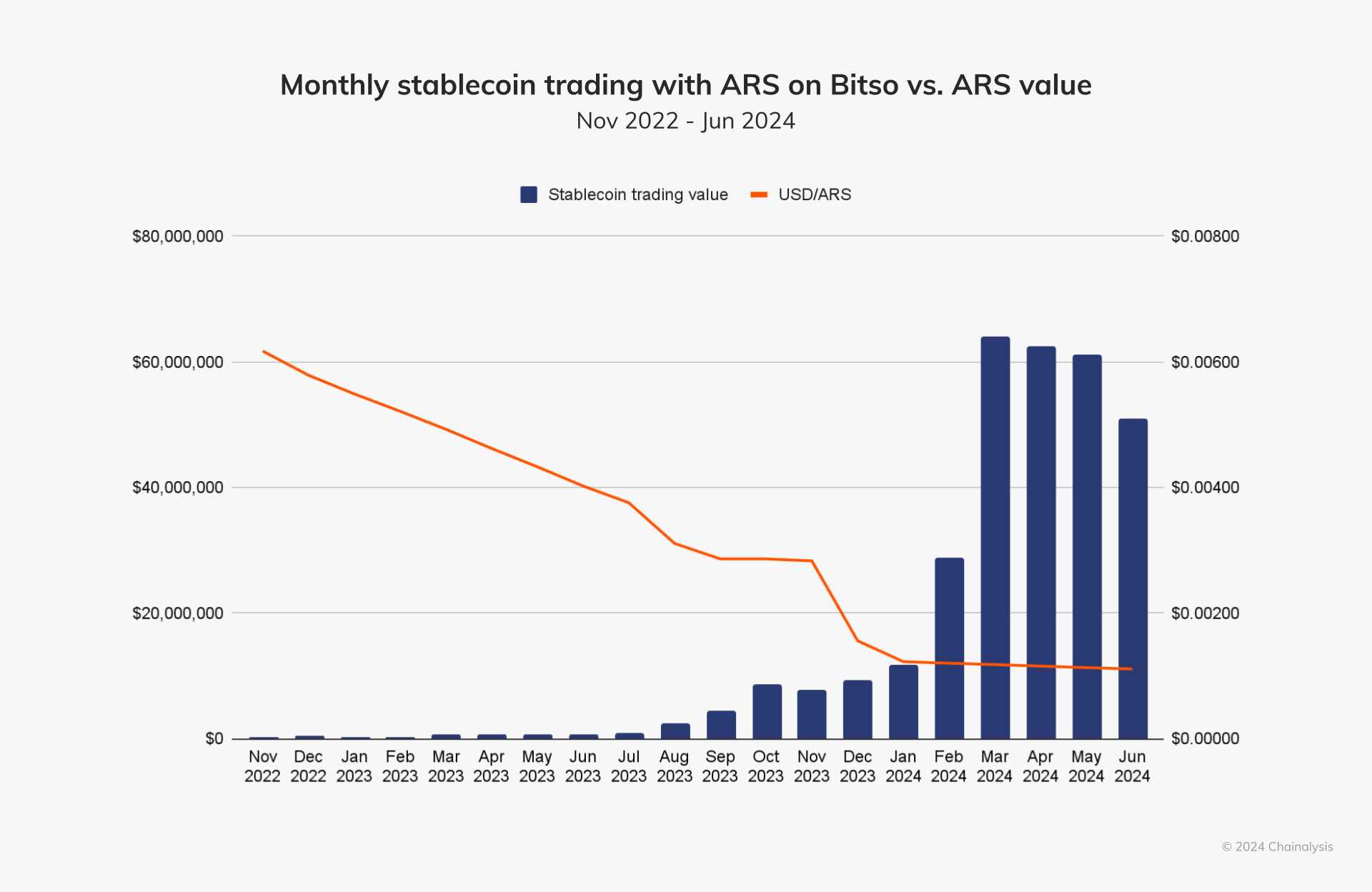

In Argentina, where inflation rates soar above 100%, residents often resort to using digital currencies like USDT and USDC, which are pegged to the US dollar, as a means to safeguard their savings from depreciation. Demand for these stablecoins spikes on local exchange platforms whenever the Argentine peso loses value or when the government imposes new regulations on currency transactions.

In July 2023, when Argentina’s peso fell to less than $0.004, the worth of stablecoin trades skyrocketed to over $1 million the following month, as suggested by a Chainalysis report from 2024. Similarly, in December 2023, after President Milei declared his intention to devalue the currency by 50% as part of an austerity plan, the peso plummeted below $0.002. Consequently, the value of stablecoin trades surpassed $10 million the following month.

In Venezuela, due to the high inflation of the Bolivar, stablecoins have taken over as a primary method of transaction. People frequently utilize peer-to-peer platforms for daily purchases and services, and they rely on stablecoins for their stability.

Razzaghi pointed out that due to the increased need for U.S. dollars, Latin America has evolved into a significant region where digital assets are utilized in various ways. People often rely on stablecoins such as USDC, which are tied to the value of the U.S. dollar, as a means to hold their wealth.

Almost one million developers play a crucial role in this expansion, many of whom are engaged in offshore assignments for U.S. corporations. This talented pool of workers fuels local creativity, leading to substantial advancements in fintechs and neobanks that enhance financial accessibility and lower costs for consumers across Latin America.

Razzaghi stated that a significant portion of this rapid growth can be attributed to the fact that about 75% of the region’s 30 million digital banking users are individuals and small to medium-sized businesses that were previously without access to traditional banking services or had limited access.

In simpler terms, Razzaghi pointed out Airtm – a financial technology company – as a prime instance of seamless stablecoin incorporation. Through these accounts, businesses can effortlessly carry out affordable, swift transactions. Furthermore, the account holders can conveniently exchange USDC into their native currency without hassle.

For businesses in this area facing expensive cross-border transaction fees and volatile local currencies, this could prove very beneficial. It also ensures swift and cost-effective payment of employees in U.S. dollars,” he noted.

Consequently, these regional cryptocurrency trading platforms empower people to keep their financial transactions going even under difficult local economic circumstances.

Challenges Facing Stablecoin Adoption

Although there are numerous advantages to using stablecoins, some complexities may hinder their widespread use, particularly in developing countries. While Decentralized Finance (DeFi) projects can help navigate regulatory uncertainties in certain nations, a comprehensive rollout remains challenging without an established framework.

Furthermore, people living in remote areas often have limited internet connectivity. Additionally, disparities in financial literacy across various regions make accessibility more of a challenge. Consequently, informative workshops and educational resources are essential for promoting stablecoin adoption.

According to Razzaghi, who spoke with BeInCrypto, teams behind stablecoin projects and local communities are diligently organizing educational activities like workshops, webinars, and outreach programs to educate people about safely using digital assets and maximizing their effectiveness. These learning opportunities play a significant role in fostering trust and encouraging the acceptance of stablecoins in areas with limited financial knowledge, he explained.

Some ongoing projects include Nigeria’s Yellow Card, which has established a digital academy offering complimentary courses on cryptocurrencies to people and businesses throughout Africa. On the other hand, services like M-Pesa facilitate smoother transactions for communities with limited resources. Nevertheless, hurdles such as inadequate access to mobile devices and computers limit the effectiveness of these initiatives.

As time goes by, it’s expected that more defined guidelines, increased network connections, and ongoing financial education initiatives will lead to a wider adoption of stablecoins, allowing us to fully utilize their built-in advantages such as enhanced security and global availability, according to Razzaghi.

Greater implementation of like-minded efforts is crucial for the widespread adoption of stablecoin.

Stablecoins vs. Central Bank Digital Currencies

A point causing hesitation in the acceptance of stablecoins is the emergence of Central Bank Digital Currencies (CBDCs). These are digital representations of a country’s money, controlled and supervised by central banks. Unlike physical cash, they aren’t intended to replace it but rather complement it.

The main difference between CBDCs and cryptocurrencies is in their issuance. Governments issue and support the value of CBDCs, while private entities manage and issue cryptocurrencies, leading to potential market volatility.

As reported by the Atlantic Council’s CBDC tracker, countries such as The Bahamas, Jamaica, and Nigeria have already launched CBDCs. In Nigeria and The Bahamas, there has been a noticeable increase in CBDC issuance. At present, these nations are focusing on boosting retail adoption of their CBDCs within their domestic markets.

Each member of the G20 group is delving into Central Bank Digital Currencies (CBDC), with 19 nations actively pursuing advanced stages of CBDC investigation. Out of these, a total of 13 countries have reached the pilot phase for their CBDC projects, among them are Brazil, Japan, India, Australia, Russia, and Turkey.

While CBDCs and stablecoins may potentially vie for supremacy in digital transactions, each system possesses distinct advantages.

As someone who has spent years working in the financial sector and observing the evolution of digital currencies, I firmly believe that there are significant opportunities for collaboration between compliant stablecoins like USDC and central bank digital currencies (CBDCs).

From my perspective, stablecoins could play a pivotal role in facilitating peer-to-peer cross-border transactions – a feature that has yet to be fully incorporated into the design of most CBDCs currently under development. This is particularly relevant for individuals and businesses who often face high fees and slow processing times when transferring money across borders.

Having experienced firsthand the challenges faced by people trying to send remittances or make international payments, I can attest to the potential benefits that stablecoins could bring in terms of speed, cost-effectiveness, and accessibility. By combining the best aspects of both stablecoins and CBDCs, we can create a more inclusive and efficient financial system for everyone.

Nonetheless, Razzaghi believes the two systems can co-exist rather than compete.

As an analyst, I’d rephrase it as follows: “I’ve observed that innovations within the private sector, particularly those based on blockchain technology like USDC, are already delivering many of the benefits traditionally associated with Central Bank Digital Currencies (CBDCs). In essence, these private-sector advancements are bridging the gap that a CBDC would aim to fill.

Analyzing these processes offers insights into how developing economies integrate stablecoins and central bank digital currencies. This reveals their ability to redefine the worldwide financial system, promoting a more inclusive approach.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2024-12-31 16:40