The current enthusiasm for artificial intelligence, one observes, has induced a sort of febrile state amongst investors. Every chip, every wire, every power station vaguely connected to the digital realm is now touted as a path to instant wealth. One is reminded of the South Sea Bubble, though, thankfully, without the accompanying highwaymen. Amidst this rather vulgar display, a certain company, Ciena, has managed to progress with a quiet competence that is, frankly, refreshing.

Palantir, Nvidia, Broadcom – these names resonate with the predictable clamour of the market. Perfectly respectable firms, no doubt, but already burdened with expectations that, one suspects, will prove rather difficult to satisfy. Ciena, on the other hand, has been operating beneath the radar, quietly constructing the infrastructure upon which this entire digital fantasy rests.

Let us be clear: Ciena manufactures the plumbing. Optical networking components, routers, switches – the unglamorous necessities that ensure data actually moves. It is a business predicated not on innovation, but on reliability. A rare quality in these times.

The Essential, if Unexciting, Infrastructure

The company’s products, admittedly, lack the seductive allure of a self-driving car or a particularly clever algorithm. They are, however, indispensable. The insatiable appetite of artificial intelligence for data transmission – the sheer volume of information required for training and operation – demands a capacity that existing networks struggle to provide. A powerful graphics processing unit, one might observe, is rather like a Rolls-Royce parked on a muddy track. The potential is there, but the execution is…limited.

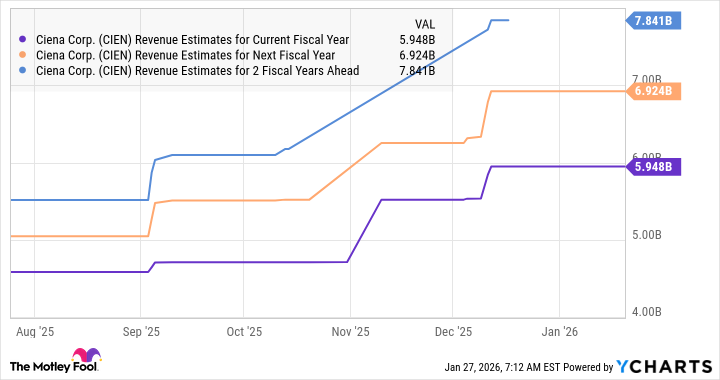

Meta Platforms, a company not entirely averse to extravagant expenditure, has apparently recognised this. Orders worth $7.8 billion in the last fiscal year suggest a degree of foresight, or perhaps simply a recognition of practical necessity. The backlog, it appears, is growing faster than the company can fulfil it – a most agreeable problem to have. Growth of 19% last year, while not precisely revolutionary, is certainly…steady.

Analysts, predictably, are beginning to take notice. The data center networking market, according to Grand View Research, is poised for a quadrupling by 2033. Ciena’s share of the optical networking market has increased by four percentage points to 22%, according to Bank of America. One suspects this is not a coincidence. A solid performance, one might say, in a rather turbulent sea.

A Modest Ascent

The stock has, admittedly, enjoyed a rather vigorous run, appreciating by 140% in the past year. However, it currently trades at 7 times sales, a discount to the U.S. technology sector’s average of 8.7. Assuming the company achieves $6 billion in revenue this year – a figure that appears entirely plausible – a market capitalization of $52 billion is not an unreasonable expectation. A potential increase of 57% from current levels. Not a fortune, perhaps, but a perfectly respectable return in these uncertain times.

One is not suggesting a reckless plunge into the market. Merely a cautious observation that, amidst the prevailing hysteria, Ciena represents a modicum of sense. A solid company, engaged in a necessary trade, with a reasonable valuation. A rare combination, indeed.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2026-01-30 23:15