Intel, you say? A fascinating specimen. A leviathan, once. Now… a convalescent, propped up by the well-meaning, and occasionally cynical, ministrations of Nvidia, SoftBank, and the American treasury. The stock, of course, danced a jig—a temporary reprieve, fueled by hope and the boundless capacity of markets to mistake a twitch for a resurrection. One hundred and thirty-seven percent, they boast. A most impressive illusion. I suspect even Behemoth would raise a skeptical eyebrow.

The latest quarterly report, naturally, provided the necessary deflation. The air, as it always does, escaped the balloon. It wasn’t unexpected, mind you. The machinery of recovery is a sluggish beast. And Intel, alas, is attempting to navigate a landscape littered with the wreckage of its own past ambitions. One senses a certain… inertia. A reluctance to truly embrace the inevitable. A tragic flaw, wouldn’t you agree?

Let us, then, turn our attention to a more… spirited contender. A company that appears to have grasped the nettle, or perhaps simply possesses a more cunning strategist at the helm. Advanced Micro Devices. AMD. The name lacks the gravitas of its elder rival, but then, gravitas is often a burden. A weight that slows the dance.

The Price of Time

Intel’s revenue, a rather subdued 4% decline year-over-year. The data center segment, their supposed sanctuary, offered only a modest 9% growth. They claim supply constraints. A convenient excuse, wouldn’t you say? As if the market will patiently await their convenience. The universe, my dear reader, does not negotiate.

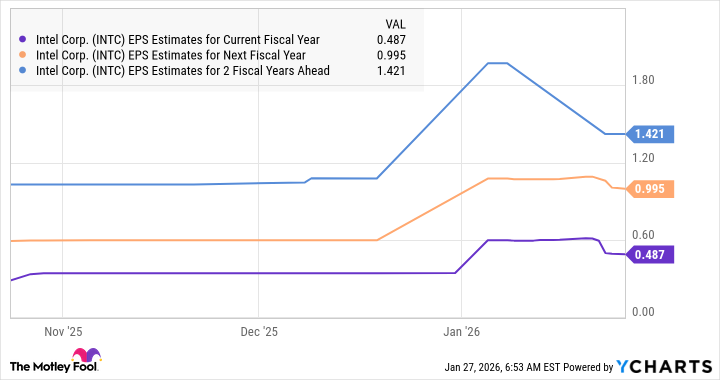

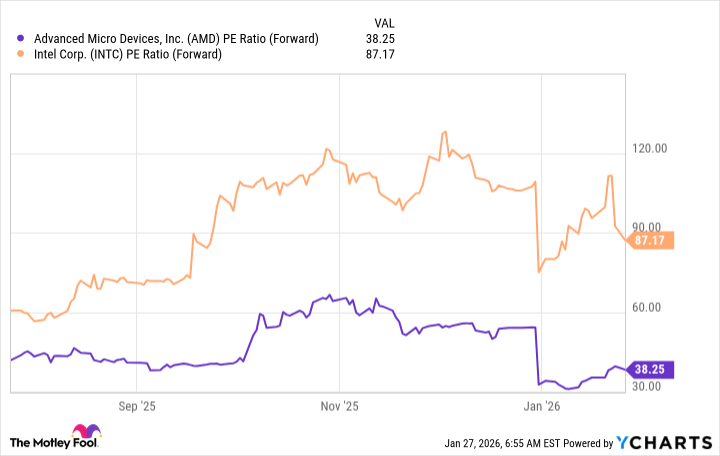

They assure us supply will improve. That 2026 will bring a resurgence. Perhaps. But hope, as any seasoned trader knows, is a treacherous currency. Especially when one is trading at eighty-eight times earnings. A valuation that suggests either profound faith or utter delusion. The earnings call, I imagine, was a spectacle. A carefully orchestrated pantomime of optimism. One almost expects Woland himself to offer a commentary.

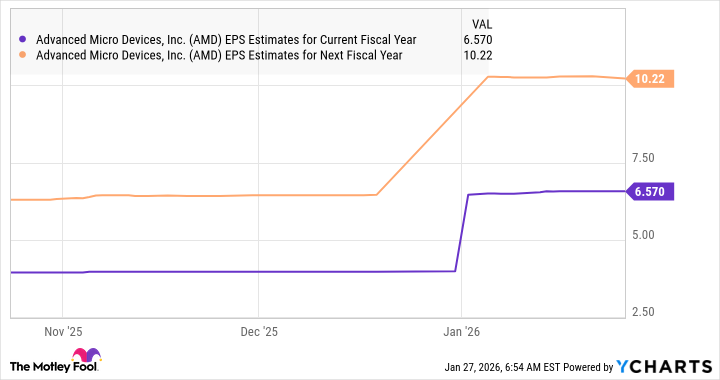

Meanwhile, AMD. A different tune altogether. Analysts, those fickle creatures, are actually raising their expectations. A most unusual occurrence. It seems AMD has understood the essential truth: that the future belongs to those who can harness the power of the silicon soul. They are poised, it appears, to capitalize on the insatiable hunger for both data center graphics and server-grade CPUs. A most promising development.

The Ascent of the Phoenix

Both Intel and AMD compete in the same arenas: personal computers and data centers. Both manufacture CPUs and GPUs. Yet, the financial results diverge dramatically. Intel struggles. AMD thrives. It’s as if they are playing different games entirely. One is a lumbering giant, desperately clinging to past glories. The other, a nimble predator, adapting to the changing landscape.

AMD anticipates a 32% revenue increase for 2025. Analysts predict even faster growth in 2026. A 20% increase to $3.97 per share. These are not mere projections, my friend. These are signals. Whispers of a fundamental shift in the balance of power. The market, in its infinite wisdom, is beginning to recognize the true contenders.

AMD’s MI400 data center GPU, they claim, will boast almost double the computing power of its predecessor. A bold assertion, but one that aligns with their relentless pursuit of innovation. They are challenging Nvidia, the reigning champion, and doing so with a confidence that is… unsettling. The MI500, slated for next year, promises a thousandfold increase in AI performance. A truly audacious claim. One can almost hear the gears of the market grinding in anticipation.

Their server CPUs are also gaining traction, capturing a growing share of the market. A 3.5 percentage point increase to 27.8%. A modest gain, perhaps, but a significant one. It suggests that customers are beginning to recognize the value of AMD’s offerings. The demand for AI applications, of course, is accelerating this trend. The server CPU market, they predict, could generate over $60 billion in revenue by 2030. A tantalizing prospect.

If AMD captures half of this market, driven by the deployment of its Epyc processors, its server CPU revenue could hit $30 billion. Given their current revenue of $34 billion, this would be a transformative development. A game-changer. A signal that the old order is crumbling.

And the valuation? Significantly more reasonable. A more honest reflection of their potential. The market, it seems, is beginning to reward AMD’s accelerating growth. Intel, however, remains trapped in a cycle of expensive multiples and disappointing results. It’s a cautionary tale. A reminder that even the mightiest empires can fall.

Therefore, the choice is clear. AMD. A company that is not merely surviving, but thriving. A company that is not afraid to embrace the future. A company that, in this chaotic and unpredictable world, offers a glimmer of hope. A most intriguing investment, wouldn’t you agree?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-01-30 04:33