The market, as always, is a grand illusion. Everyone chases the shimmering mirage of growth, conveniently forgetting that most trends expire faster than a plate of oysters at a bachelor party. Still, occasionally, a genuine opportunity presents itself—a company that manages to extract profit from the chaos, like a particularly resourceful pickpocket. We’ve identified two such specimens, though whether they’re worth the current enthusiasm is, as always, a matter of calculation…and a dash of optimism.

Sandisk: Riding the Memory Wave

It seems the world has developed an insatiable appetite for data. Artificial intelligence, you see, isn’t powered by inspiration; it’s fueled by memory chips. And when demand outstrips supply, prices, predictably, begin to resemble the ambitions of a nouveau riche. Micron and Samsung, the usual suspects, are struggling to keep pace. This, naturally, creates a delightful situation for those who can deliver.

Sandisk, a pure-play memory manufacturer, finds itself in a rather enviable position. It’s like being the only proprietor of a well in the desert. Analysts predict a doubling of revenue in the coming fiscal year—a feat usually reserved for magicians and purveyors of questionable financial instruments. The stock has already enjoyed a spirited rally—a bit unsettling, perhaps, like watching a promising young gambler win a few early hands. But consider this: the shortage isn’t merely a temporary inconvenience. It’s a structural issue, and Sandisk, with a bit of luck and competent management, stands to benefit for quite some time. A mere eight times forward earnings? A tempting proposition, even for a seasoned cynic.

ASML: The Gatekeeper of Silicon

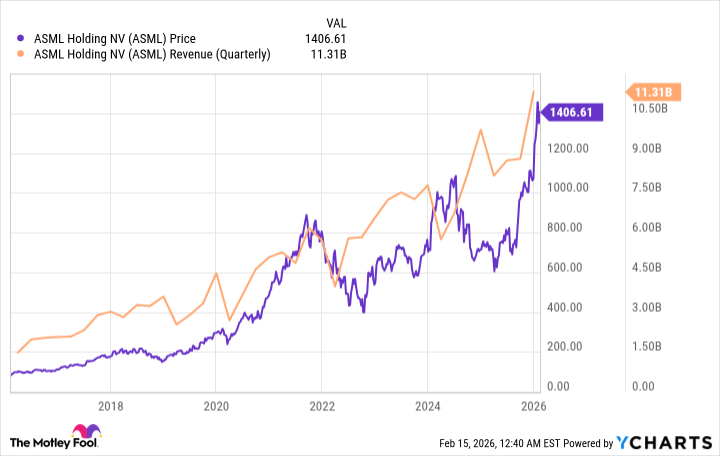

Now, let us turn our attention to ASML, a Dutch company that most people haven’t heard of. Yet, it holds a rather crucial position in the semiconductor industry. They don’t just make the equipment needed to manufacture chips; they effectively control access to the most advanced technology. It’s a bit like owning the only bridge across a particularly important river. Their ultraviolet lithography machines sell for around $400 million apiece—a sum that would make even a Russian oligarch pause for thought.

Naturally, this creates a certain…dependence. Taiwan Semiconductor Manufacturing, Samsung, and Intel all rely on ASML’s wares. Sometimes, a potential customer hesitates, perhaps contemplating the wisdom of spending a small fortune on a single machine. This can lead to occasional revenue dips, a minor inconvenience for a company that effectively dictates the pace of technological progress.

But here’s the crux of the matter: no technology company can afford to fall behind. The race for innovation is relentless, and ASML, with its patented technology, holds a significant advantage. Global Market Insights predicts a substantial growth in the AI hardware market, and ASML is poised to benefit handsomely. The stock has already had a good run, but given the company’s position and the underlying trends, it may still have room to climb. A prudent investment, perhaps, for those who appreciate a company that understands the art of extracting value from scarcity.

Of course, the market is a fickle mistress. Fortunes are made and lost with alarming regularity. But as any seasoned trader knows, identifying the companies that control the essential building blocks of the future is a good place to start. And these two, despite the current enthusiasm, warrant a closer look.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Best TV Shows Featuring All-White Casts You Should See

- Umamusume: Gold Ship build guide

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- Actors Who Refused Autographs After Becoming “Too Famous”

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

2026-02-19 23:23