Now, listen closely, because this is a story about tiny slivers of silicon, and how they might just turn a few humble dollars into a mountain of gold. Or, at least, a very respectable hill. You see, without these little marvels – these ‘thinky bits’ as I like to call them – we wouldn’t have our whizzing, buzzing contraptions, our cloud-filled skies, or those artificial brains everyone’s so terribly excited about. And without those, well, the future would be frightfully dull, wouldn’t it? Those self-driving carriages and robot butlers would remain nothing more than a silly dream.

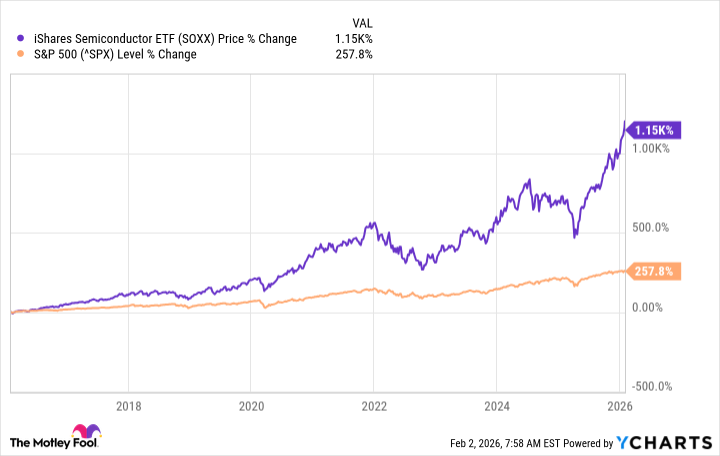

The clever chaps at iShares Semiconductor ETF (SOXX +5.34%) have noticed this, you see. They’ve gathered up thirty of the most dominant chip-making companies and stuffed them into one convenient package. And, remarkably, over the last ten years, this package has grown by a whopping 1,150%! Four times more than the rather pedestrian returns of the S&P 500. A truly scrumptious result, wouldn’t you say?

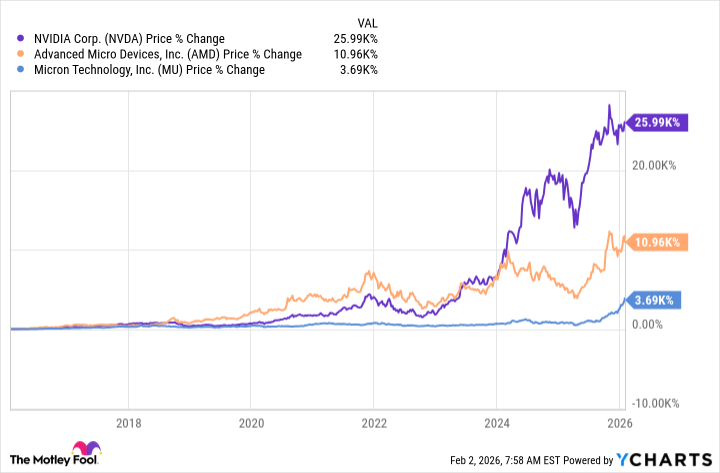

Micron Technology (MU +3.17%), Advanced Micro Devices (AMD +8.32%), and Nvidia (NVDA +8.01%) are the biggest sweetmeats in this ETF’s jar. They’ve been the main engines of its success, and I suspect they’ll continue to be. Let’s have a closer look at how they might help turn a steady $500 a month into a small fortune, over time, of course. It’s a long game, this, not a sprint.

A Trio of Tumultuous Titans

Now, this ETF is a bit of a specialist. It only invests in companies that actually make these thinky bits, and those who supply the insatiable appetite of the AI beast. That means it lacks a bit of diversification. It’s like putting all your eggs in one, very high-tech, basket. A sensible investor, therefore, should only consider it as part of a broader portfolio. A bit like a delicious side dish, not the entire feast.

These three companies – Micron, AMD, and Nvidia – account for a considerable chunk of the ETF’s holdings – a whopping 23.6%, if you please:

| Stock | iShares ETF Portfolio Weighting |

|---|---|

| 1. Micron Technology | 8.82% |

| 2. Advanced Micro Devices | 7.43% |

| 3. Nvidia | 7.37% |

Micron provides the high-bandwidth memory, the little pathways that allow these thinky bits to whizz and zoom. Nvidia and AMD, meanwhile, embed these semiconductors into their latest graphics processing units – the brains of the AI operation, if you will. And all three are seeing a surge in demand, not just from data centers, but from those pocket-sized brain boxes – smartphones – and personal computers, where AI is slowly creeping in.

Nvidia’s GPUs are currently the top dog, the fastest, the most powerful. But AMD is brewing up a challenger, a new data center rack called Helios, fitted with their latest MI450 GPUs. It’s a bit like a smaller, faster racing car trying to overtake the leader. It might just close the gap, you see.

These three companies are the reason this ETF consistently outperforms the market. Over the last decade, even the worst performer – Micron – soared by a staggering 3,690%! That’s almost 37 times the original investment. A rather tasty return, wouldn’t you agree?

But there are other players, too, other companies that might contribute to the ETF’s future success:

- Broadcom: Their AI accelerators are becoming popular alternatives to GPUs, because they can be customized to suit specific needs. It’s like having a tailor-made brain, rather than an off-the-shelf model.

- Taiwan Semiconductor Manufacturing: This is the biggest chip factory in the world, manufacturing around 90% of all advanced chips. They’re the engine room, the workhorses of the entire industry.

Turning Pennies into Pounds

Since its inception in 2001, the iShares Semiconductor ETF has delivered a compound annual return of 12.2%. But over the last decade, that figure has accelerated to a remarkable 27.3%, thanks to the insatiable demand for chips from cloud providers and AI developers. It’s a bit like feeding a hungry monster, really.

Here’s how long it might take the ETF to turn a consistent investment of $500 a month into $1 million, based on different average annual returns:

| Monthly Investment | Compound Annual Return | Time To Reach $1 Million | Total Deposits |

|---|---|---|---|

| $500 | 12.2% | 25 years and 2 months | $151,500 |

| $500 | 19.7% (midpoint) | 18 years | $108,500 |

| $500 | 27.3% | 14 years and 2 months | $85,500 |

Now, it’s not realistic to expect this ETF – or any fund – to deliver such a blistering return forever. The law of large numbers will eventually kick in. For example, Nvidia is currently a $4.6 trillion company. But to maintain that 27.3% growth rate for another decade, it would need to become a colossal $51 trillion behemoth. The entire U.S. economy, by comparison, was only $30.6 trillion in 2025. A rather ambitious goal, wouldn’t you say?

But even if the ETF’s annual return reverts back to its more modest long-term average of 12.2%, it could still turn $500 a month into $1 million in 25 years. A respectable outcome, wouldn’t you agree?

I believe the ETF could deliver accelerated returns for at least the next few years, driven by the incredible demand for chips for AI. Nvidia’s CEO, Jensen Huang, estimates that data center operators could be spending $4 trillion annually on AI infrastructure by 2030. A huge opportunity for his company, and for other market leaders like AMD and Micron.

And even when the AI build-out eventually slows down, I think newer innovations like quantum computing, robotics, and autonomous vehicles will pick up the slack. Each of those technologies will require a substantial amount of computing power, taking semiconductor demand to new heights. A rather thrilling prospect, wouldn’t you say?

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 13:53