Now, Chewy, the online purveyor of pet provisions, has had a bit of a wobble, hasn’t it? A proper tumble, really. The shareholders, bless their optimistic little socks, have been staring at a rather dismal picture for the past five years. It zoomed upwards during the Great House-Sitting Boom (that’s what we’re calling the pandemic now, aren’t we?), then plummeted faster than a dropped biscuit. It peaked, then… well, let’s just say it’s been doing a very slow-motion faceplant ever since, even after a feeble attempt to scramble back up in 2024. A bit disheartening, wouldn’t you agree?

But here’s a curious thing. Just when everyone’s about to give up and feed their goldfish to the neighbor, this scrappy little company might actually be worth another peek. It’s not exactly shooting for the moon, mind you, but it’s building a rather clever contraption, and it seems to be… working. The numbers are starting to jiggle in a way that suggests something rather marvelous might be brewing.

A Slow-Growing, Solid Sort of Business

For those unfamiliar, Chewy delivers pet food, toys, treats, and even the occasional medicinal potion, all directly to your door. It’s a peculiar beast, this company. It exists only in the digital realm, no brick-and-mortar shops cluttering up the high street. Quite odd, really.

And yet, it works. It does have to contend with that enormous Amazonian jungle, of course, but Bloomberg Intelligence suggests Chewy and Amazon share roughly the same one-third slice of the online pet supply pie. A tidy little share, wouldn’t you say?

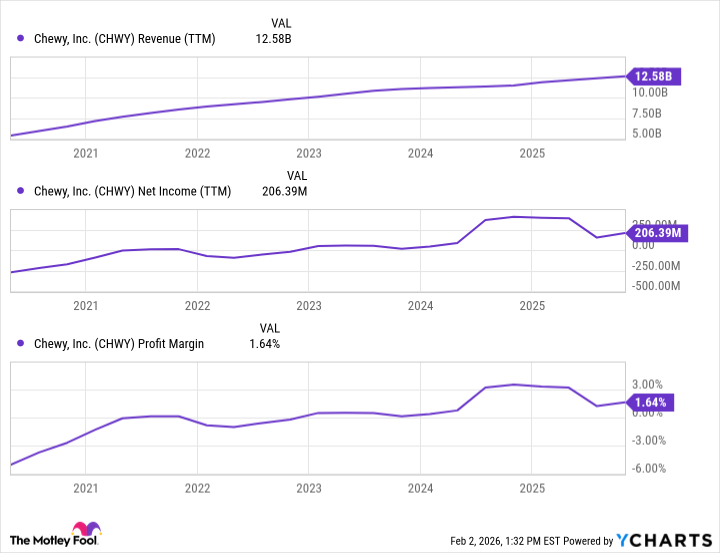

It’s growing, albeit at a modest pace. Last quarter, revenue nudged up 8.3% to $3.1 billion. Not a spectacular explosion, but a steady, reliable sort of growth. Like a tortoise, perhaps, rather than a hare.

But the real reason Chewy is starting to look interesting isn’t the growth, it’s the fact that it’s finally, finally, crawled out of the red and into the black. And it seems determined to stay there. And it’s doing so at a pace that’s far quicker than its overall revenue is increasing. A clever trick, that.

The analysts, those clever chaps, expect this trend to continue. They always do, don’t they?

But the true secret sauce, the thing that really solidifies the argument that this swing to profitability is permanent, is rather remarkable. You see, a whopping 83.9% of that $3.1 billion in revenue came from customers who’ve signed up for regular, automatic deliveries of pet food and treats. That’s up from 80% last year, and 76.4% the year before that, and even higher than the previous year’s 73.3%.

That’s right. Millions of pet owners are willingly handing over nearly $600 a year to Chewy without even thinking about it. The power of convenience, my dear reader, is a truly wondrous thing. It’s far cheaper to keep a loyal customer than to hunt for a new one, so expect Chewy’s profits to continue outpacing its revenue now that it’s comfortably covering its fixed costs.

Time to Hold Your Nose and Dive In?

The market, however, seems to be suffering from a rather nasty case of the grumps. Chewy’s shares are still down from their June peak, and recently hit a new 52-week low. The bears are clearly in charge, growling and snapping at the heels of any potential buyers.

But step back for a moment and consider the bigger picture. The stock’s forward price/earnings ratio is a relatively modest 22, and that’s based on a price that’s a full 60% below the analysts’ average 12-month target of $46.19. The tide could easily turn, and with very little warning. A sudden surge, a delightful upswing… it’s entirely possible.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2026-02-05 02:24