The energy market, ever tumultuous, offers an experience not unlike the life of a trader – marked by cautious optimism, a constant gaze at fluctuating numbers, and the occasional sense of helplessness. Chevron (CVX), it seems, offers a peculiar paradox. Even as oil prices have drifted downward, this stalwart of the industry seems to defy the tide, like a ship steadily sailing while the sea darkens. For those of us who seek solace in steady returns, the 4.3% dividend yield it offers shines like a flicker of hope in the otherwise gloomy market landscape.

Chevron’s Quiet Armor

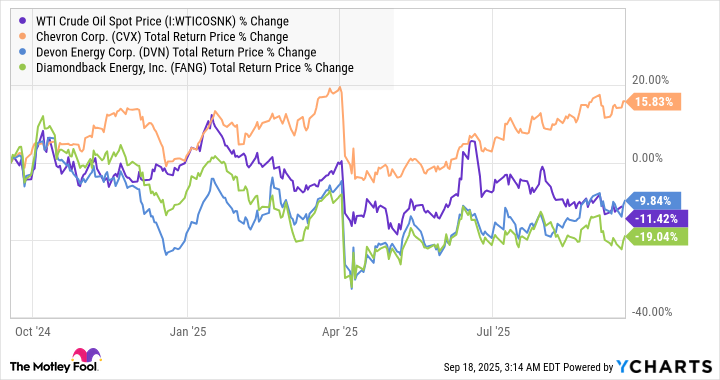

In the world of stocks, comparisons are made often – like lovers measuring their affection against the moonlight, or perhaps against one another. If we look at Chevron alongside its peers, such as Devon Energy and Diamondback Energy, the picture becomes clearer. While the others wane with the falling oil prices, Chevron carries on, a quiet survivor, almost unaffected by the cruel winds of the market.

It is here, in the space between these numbers, that we find the essence of Chevron’s strength – its quiet ability to provide, even when the market seems intent on draining resources. The company, unlike its more one-dimensional counterparts, spans across both upstream and downstream operations, seamlessly blending exploration and production with refining and marketing. This integration, almost poetic in its simplicity, allows Chevron to weather storms with a stability that others cannot claim. It is the grace of diversification, perhaps, that keeps it afloat – providing a modest cash flow that enables dividends to continue despite the storm of oil price declines.

Then there is the $53 billion acquisition of Hess Corporation, an investment that shifts the gaze of the company to international waters, to the rich veins of oil in Guyana. These assets, with their lower break-even costs, offer Chevron a certain kind of security. There is also the Bakken in North Dakota, adding to the company’s growing presence in the Permian Basin. It is this calculated expansion, this gradual buildup of strength, that hints at a future not entirely dictated by the whims of oil prices.

The Investor’s Dilemma

As a trader, I cannot help but smile at the concept of security in the face of such volatility. Chevron, while never immune to the falling price of oil, stands as a fortress – albeit one with a few cracks in its walls. The company’s blend of downstream assets, combined with international resources, shields it from a drastic downturn. Yet, even amidst the calm, there remains that lingering possibility, that elusive hope – oil prices could rise again. The potential for upside is there, hidden in the folds of market uncertainty.

But as we both know, these possibilities rarely unfold as one imagines. We traders continue to play our hand, adjusting to the reality that the market is, as it always has been, a collection of hope, speculation, and more than a little disappointment. And yet, we continue. What else can one do but continue to trade, continue to wait for a glimpse of that perfect moment when things align, even if only for an instant?

And so, like the market itself, we move on, our hopes tempered by experience, yet not entirely extinguished. Perhaps, in the end, that is what Chevron offers – not the promise of untold riches, but the quiet assurance that, despite the odds, one can persist. And for many of us, that may be enough. 🌿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

2025-09-22 14:13