The energy sector is currently about as popular as a turd in a punch bowl. Oil prices took a nap after their wild post-pandemic sprint, and now everyone’s sighing like disappointed accountants. But volatility in energy isn’t a bug-it’s the entire point of the business. That’s why Chevron (CVX) isn’t just another oil company. It’s a survivalist with a dividend addiction, and in this line of work, that’s a winning combination.

What does Chevron do?

Chevron operates like a pragmatist at a poetry reading. It’s integrated-meaning it’s involved in every dirty, glamorous, and boring part of energy: digging it up (upstream), shoving it through pipes (midstream), and turning it into plastic bags and regret (downstream). This isn’t diversification for diversification’s sake. It’s a hedge against the universe’s tendency to ruin plans. When oil prices crash, refining margins might save the day. When refining tanks, maybe pipelines will limp forward. It’s not pretty, but neither is survival.

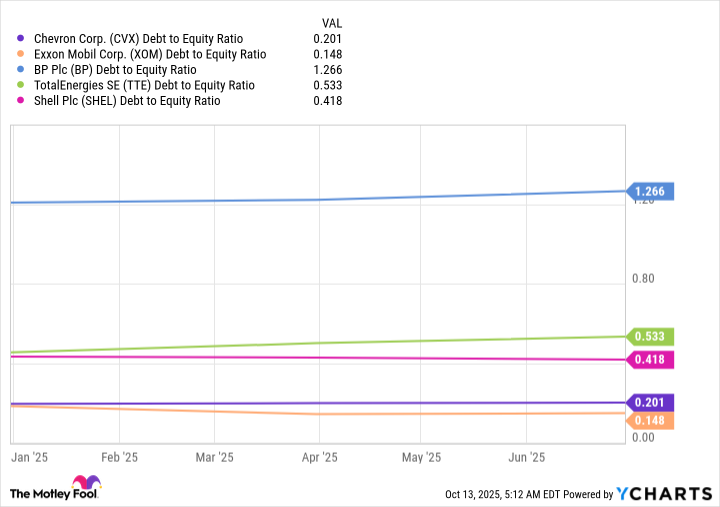

Then there’s the balance sheet. Chevron’s debt-to-equity ratio is around 0.2. To put that in perspective: ExxonMobil’s is 0.15. They’re both built like tanks, but Chevron’s tank has slightly more rust. This isn’t a flaw. It’s a feature. When oil prices crater-as they will-the company can borrow money to keep the lights on and dividends flowing. And when prices rebound-as they always have-the rust gets scrubbed off. So it goes.

Chevron’s 38-year streak of dividend increases isn’t a parlor trick. It’s a statement. Exxon has 43 years of raises, sure, but Chevron’s dividend yield is nearly 4.6%. Exxon’s? 3.6%. That extra point isn’t just numbers. It’s a raise in your cosmic paycheck. You could chase higher yields in riskier stocks, but those often end with “bankruptcy” and “regret.” Chevron isn’t safe. It’s just safer than most things that pay this well.

Chevron’s got a very attractive risk/reward profile

Exxon’s balance sheet is shinier, but it’s still made of the same rusty metal. Both companies get gut-punched when energy prices dive. Chevron just takes the hit and hands you more cash. The energy sector averages 3.2% yields. Chevron’s is 4.6%. Call it a 25% bonus in a world that rarely gives freebies. Or call it compensation for the existential dread of owning oil stocks in 2024. Either works.

Yes, Chevron has its own special hell. Venezuela’s political circus. A delayed acquisition that’s about as smooth as a three-legged race. But these aren’t fatal wounds. They’re just bruises. The company has spent decades navigating oil crashes, wars, and the invention of TikTok. It keeps going. So do its dividends.

All energy stocks come with risk

Every energy stock is a ticking time bomb. Chevron’s just has a slower timer. The sector’s volatility isn’t a flaw-it’s the price of admission. But Chevron’s mix of resilience, yield, and balance sheet discipline makes it the bomb you’d least mind carrying in your pocket. If you’re looking for safety, go elsewhere. If you want cash while the world burns, Chevron’s your friend. So it goes. 🚰

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-10-15 17:50