They say you get what you pay for. Which is mostly true, unless you’re talking about hope. Hope is free, or nearly so. And Norwegian Cruise Line? Well, it’s cheap. Relatively. When you stack it up against the bigger boats – Royal Caribbean, Carnival – and even Viking, with all their river-bound seriousness – NCL looks like a bargain. So it goes.

Pick a number, any number. NCL will likely be the lowest. The cheapest. But cheap isn’t always good. It just…is. We said the same thing a year ago. Didn’t work out then, did it? The market has a funny way of proving you wrong. Or, more accurately, of proving you optimistic.

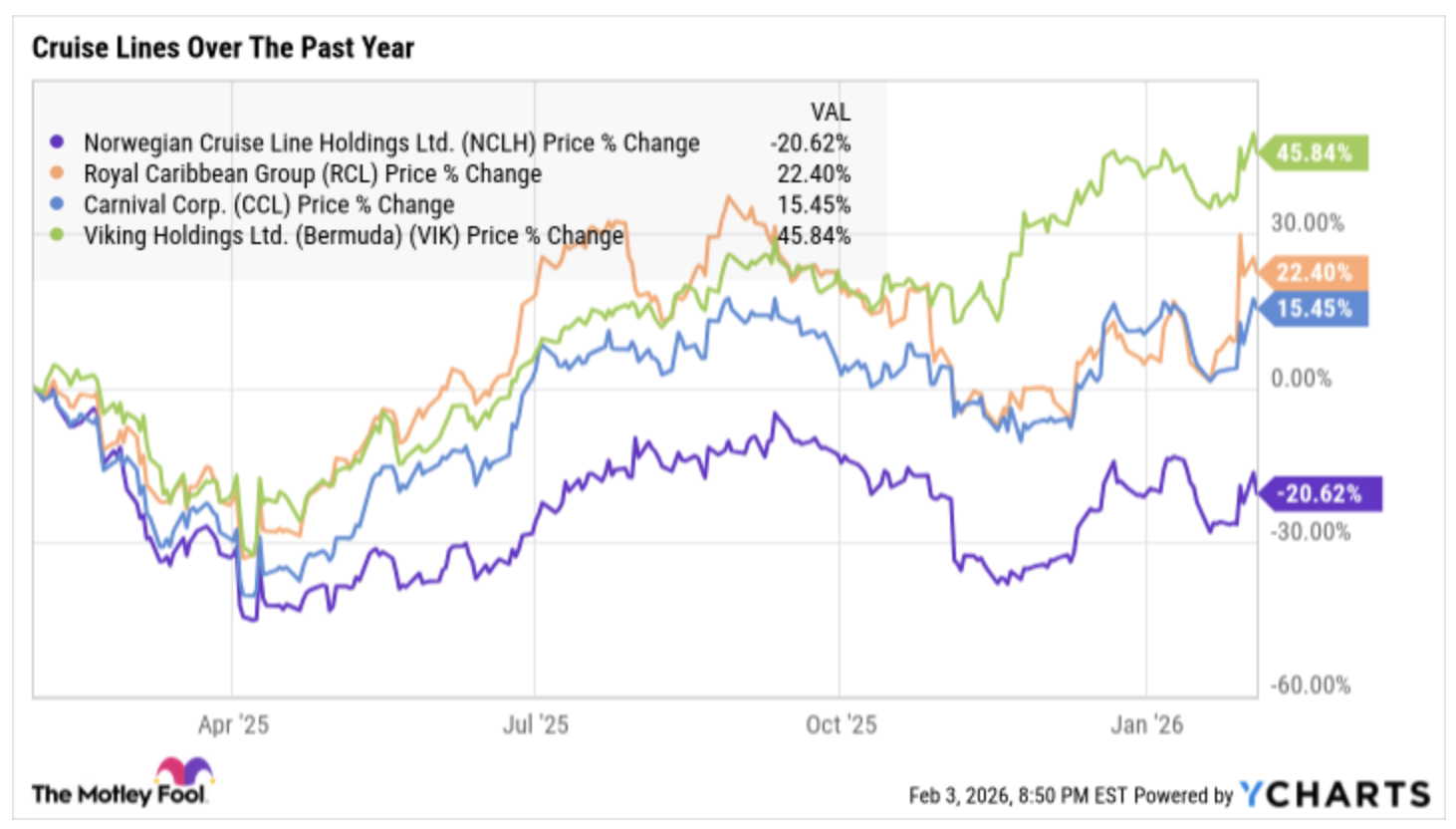

NCL isn’t just lagging. It’s actively, demonstrably, falling behind. A chart proves it. Which is a sad thing to need proof of, but this is the world we live in. It’s the only cruise line stock going down while the others are, shall we say, bobbing along. It’s a lonely place to be, at the bottom of a graph.

A 20% slide when everything else is going up? That’s not a rising tide lifting all boats. That’s a leak in the hull. Textbook cheap, they call it. Forward earnings? NCL wins the limbo contest. Carnival, Royal Caribbean, Viking – they’re all looking down on NCL. It’s a humbling sight, really.

- NCL: trading for less than nine times forward earnings.

- Carnival: 12 times forward earnings.

- Royal Caribbean: 18 times forward earnings.

- Viking: 22 times forward earnings.

Let’s look at revenue. NCL is still the cheapest. Market cap divided by revenue? The numbers tell the story. It’s like comparing pocket change to a small fortune. It’s not necessarily bad, just…different. So it goes.

- NCL: 1.1.

- Carnival: 1.7.

- Royal Caribbean: 4.9.

- Viking: 5.3.

That’s just the tip of the iceberg

A value investor might get excited. Single-digit P/E ratios do turn heads. Don’t let it make you dizzy, though. The most frustrating stocks are the ones that seem too cheap to be true. NCL appears to be a trap. It trades at multiples below its peers, but it also lags in margins. It’s like a slightly dented lifeboat. It’s cheaper, yes, but it might not get you as far.

Viking is growing faster, Carnival and Royal Caribbean pay dividends. NCL? It just has a low price. It’s a surrender, not a victory. White flags can also be red flags. It’s a simple equation, really. Lower price, lower expectations. So it goes.

I’m not giving up on NCL entirely. The industry is buoyant, and even the weakest ship might eventually rise with the tide. Viking is setting the pace, and Carnival and Royal Caribbean are benefiting. NCL is in a similar position. Top-line growth is improving, and Wall Street is optimistic. But optimism is a fragile thing. Like a glass of water on a rocking boat.

Can NCL prove itself? Can a strong report lead to sustainable gains? Can the laggard turn things around? The market is waiting. It’s waiting for NCL to stop being so cheap. If that happens, you won’t mind paying up for something good. And if it doesn’t? Well, there are always more boats. So it goes.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2026-02-04 16:32