Okay, so Chamath Palihapitiya. Let’s be honest, the man’s SPAC adventures were… a learning experience. Like that time I tried to assemble IKEA furniture without the instructions. But, credit where it’s due, the guy sees things. And lately, he’s been seeing copper. Not as a charming home décor accent, but as the next big thing. Which, coming from a Silicon Valley guy, is a little like a plumber endorsing kale smoothies. Unexpected.

Palihapitiya, you might recall, spent some quality time at AOL and Facebook (now Meta Platforms, because branding is everything, apparently). He’s basically a professional networker who figured out how to monetize other people’s good ideas. Now he runs Social Capital and co-hosts a podcast, which is basically like a digital water cooler for people who think disruption is a personality trait. And on that podcast, he dropped a prediction: 2026 will be the year of copper. Not AI stocks, not crypto, copper.

Palihapitiya’s Bold Prediction: Beyond the Hyperscalers

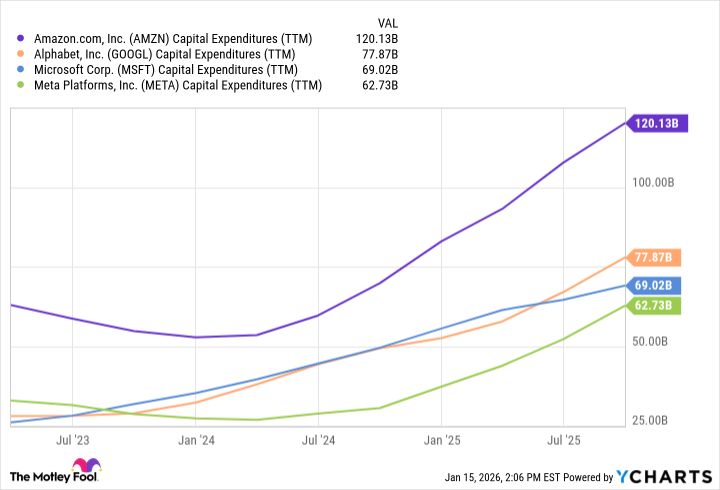

Everyone on CNBC is currently obsessed with the hyperscalers – Microsoft, Alphabet, Amazon, Meta. They’re all betting the farm on AI, and rightly so. But it’s the same herd mentality that drove the Beanie Baby craze. Everyone piles in, then wonders why their basement is full of polyester bears. Palihapitiya, to his credit, is looking a little deeper. He’s thinking about the actual stuff that makes this AI magic happen. Like, the boring, unglamorous stuff. The plumbing of the digital world.

And that plumbing, it turns out, requires a lot of copper. Apparently, building a data center isn’t like building a sandcastle. It requires, you know, actual materials. And Palihapitiya’s grand vision for 2026 is to invest in the reddish-brown metal. Honestly, it’s a refreshing change of pace. Like ordering a salad at a tech conference.

Why Copper? Because AI Eats Electricity

Here’s the deal: AI is hungry. Not for world domination (yet), but for electricity. The Pew Research Center says data centers already gobble up 4% of the US’s total power. By 2030, they’re expected to increase that by a casual 130%. That’s like going from a diet soda to a six-pack a day. And all that power needs to flow through something. Enter copper. It’s the superhighway for electrons.

These hyperscalers aren’t just writing code; they’re building massive infrastructure. Alphabet recently dropped $4.75 billion on Intersect, a company that makes data centers more energy efficient. Amazon is making deals with Rio Tinto to secure copper supplies. It’s like they’re preparing for the digital apocalypse. Or, you know, just anticipating a lot of server load.

Palihapitiya thinks copper is poised for a “parabolic” run. Which, in investor-speak, means “buy now before it’s too late.” I’m not saying he’s right. I’m just saying it’s a more interesting prediction than “the cloud will continue to exist.”

How to Actually Invest in Copper (Without Becoming a Miner)

Okay, so you’re intrigued. You want to get in on the copper craze. You don’t want to start a mining operation (too much dirt). What do you do? Well, you could go with Freeport-McMoRan (FCX +1.80%) or Southern Copper (SCCO +2.56%). They’re the blue chips of the copper world. Solid, reliable, slightly boring.

Or, you could go the ETF route. The iShares Copper and Metals Mining ETF (ICOP +1.42%) gives you exposure to a basket of copper-related companies. It’s like a diversified copper smoothie. And if you really want to get granular, the United States Copper Index Fund (CPER 0.64%) tracks the spot price of copper. It’s up 30% over the last year, which is double the S&P 500. So, yeah, it’s already priced in a bit. But, hey, momentum is momentum.

My advice? Dollar-cost average. Buy a little copper every month. It’s a good way to diversify your portfolio and add a bit of a hedge against inflation. And if Palihapitiya is right, you’ll be sitting pretty when the copper bubble finally pops. Or, at least, you’ll have a solid, reddish-brown asset to show for it. It’s a pick-and-shovel play, folks. And in the AI gold rush, sometimes the pick-and-shovel is the smartest investment.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 00:03