The Street has a way of chewing up dreams and spitting them out like cheap cigars. Remember SPACs? Those “blank check” companies that once flooded Wall Street with promises as empty as a politician’s handshake? For a while, they faded into the shadows, like old gamblers nursing their losses at the back table of some smoky casino. But Chamath Palihapitiya-Wall Street’s self-anointed “SPAC king”-has decided to deal himself another hand.

Palihapitiya isn’t just any player; he’s the guy who walks into a room and makes everyone glance nervously at their watches. A former exec at AOL and Meta Platforms turned billionaire VC, he built his reputation betting big on disruptors. Now, with his latest $250 million SPAC, American Exceptionalism Acquisition Corp, he’s hinting at something grand. Something tied to AI, defense, energy, and decentralized finance. It smells like ambition mixed with desperation, the kind of cocktail you sip when you’re either brilliant or broke.

What’s in the Cards for American Exceptionalism?

In the S-1 filing, Palihapitiya lays out four pillars: artificial intelligence, decentralized finance, defense, and energy production. On paper, it reads like corporate jargon, the sort of thing you’d find scribbled on a napkin after too many martinis. But there’s more here than meets the eye. These aren’t random buzzwords-they’re threads stitching together the fabric of America’s future economy.

AI is booming, sure, but it doesn’t come without baggage. Think of it like a runaway train dragging half the country behind it. The power grid-the lifeblood of this digital revolution-is groaning under the weight. Hyperscalers like Microsoft, Alphabet, Amazon, and Meta are throwing billions at data centers, each one guzzling electricity like a drunk sailor on shore leave. Meanwhile, Uncle Sam is shoveling cash into projects like Project Stargate, a $500 billion effort to digitize the nation. Someone needs to keep the lights on, and I think Palihapitiya knows exactly where to look.

Amperon: The Palantir of Climate Tech?

If you want my guess-and you probably do-I’m putting my chips on Amperon. This Houston-based startup acts as an operating system for the power grid, using AI to predict demand, renewable output, and wholesale prices with eerie precision. It’s not flashy, but it’s smart. Like Palantir Technologies, which turns chaos into clarity for governments and corporations, Amperon does the same for energy. It takes messy inputs-weather patterns, surging demand-and spits out actionable insights.

And let’s talk partners. Amperon’s got connections: Microsoft, National Grid, Acario. These aren’t casual acquaintances; they’re deep-pocketed allies who could turn Amperon into the backbone of the energy economy. If Palantir dominates defense and enterprise intelligence, Amperon could own the grid. And the grid touches everything-from crypto miners chasing cheap power to defense systems reliant on resilient energy sources. That’s a total addressable market wider than the Pacific Ocean.

It all fits neatly into Palihapitiya’s vision: a company sitting at the intersection of AI, defense, DeFi, and energy. A company reshaping capitalism while riding the wave of megatrends. Sounds good, right? Almost too good.

But Let’s Not Get Carried Away

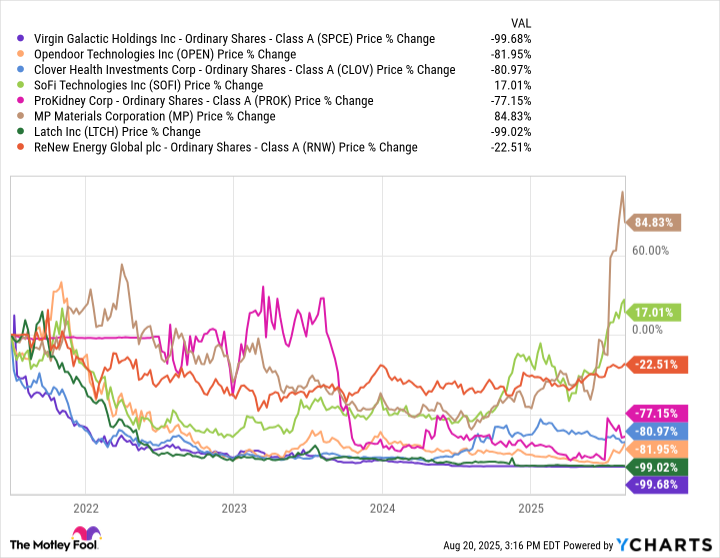

Here’s the rub: SPACs are about as reliable as a broken compass. Palihapitiya himself warns investors to embody Trump’s advice-“no crying in the casino.” Wise words from a man whose track record is as checkered as a chessboard. Sure, MP Materials and SoFi Technologies worked out okay, but what about Desktop Metal? Berkshire Grey? Proterra? Sunlight Financial? They’re either delisted or bankrupt, leaving investors holding scraps.

History tells us SPACs tend to underperform. A University of Florida study found they lag behind the broader market over the long haul. So while American Exceptionalism might dazzle with its thematic focus on AI, defense, crypto, and energy, seasoned players know better than to bet the farm on hope alone. Promise is a dangerous currency-it buys dreams but rarely delivers dividends.

Still, there’s something intriguing about Palihapitiya’s latest gamble. Maybe it works. Maybe it doesn’t. Either way, tread carefully. The only thing worse than losing money is losing your nerve. 🎲

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of First Steps

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-08-24 19:28