In the dusty corners of the crypto world, where fortunes are made and lost faster than a tumbleweed in a windstorm, Chainlink, that plucky little token, decided to strut its stuff. On a fateful Thursday, August 28, 2025, it leaped a staggering 4% to cross the hallowed ground of $25, a price point it hadn’t seen since the days when folks were still trying to figure out what a blockchain was. And while the rest of the crypto market was busy throwing a pity party-Bitcoin sliding below $110,000 like a sad sack at a dance-LINK decided to throw caution to the wind and dance like nobody was watching. It even flirted with $25.50 during the day, shaking off its seven-day losses like a dog shaking off water after a bath.

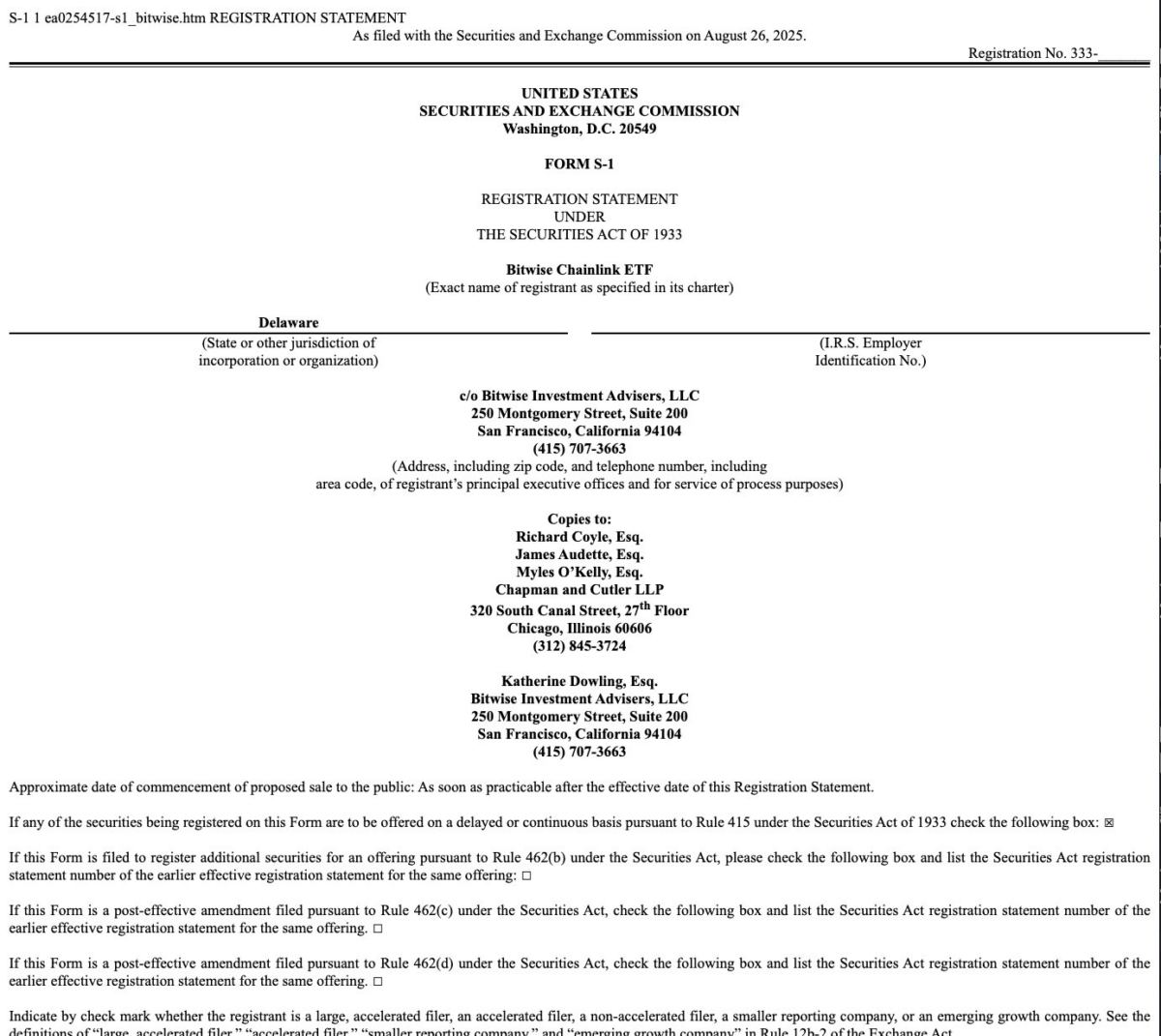

Bitwise Files Form S-1 with SEC to List Chainlink Spot ETF | Source: SEC.gov | Aug 26, 2025

Then came the news that sent the market into a frenzy: Bitwise, in a move that could only be described as bold, filed to launch a spot LINK ETF. And just when you thought it couldn’t get any better, the US Department of Commerce (DOC) decided to join the party, announcing it would publish official macroeconomic data on-chain using Chainlink and Pyth Network. Because why not? Who doesn’t want their government data served up on a blockchain platter?

MAJOR NEWS: The U.S. Department of Commerce is working with Chainlink to bring key government economic data on-chain ⬇️

– Chainlink Everything (@SmartContract) August 28, 2025

Now, the Bureau of Economic Analysis (BEA) is set to release critical indicators like Real GDP and the PCE Price Index directly across multiple blockchain ecosystems. It’s like they finally figured out that the internet exists!

In a blog post that could only be described as optimistic, Chainlink touted the transformative potential of this integration. Automated trading strategies, composable tokenized assets, real-time prediction markets, and DeFi risk management-oh my! All powered by good ol’ government data. Who knew Uncle Sam could be so tech-savvy?

Commerce Secretary Howard Lutnick, in a moment of uncharacteristic enthusiasm, declared this move as solidifying America’s status as the blockchain capital of the world. He even highlighted a 3.3% GDP growth as one of the first data points published on-chain. It’s like a tech-savvy fairy tale!

“This step shows how government data on-chain can fuel a new wave of transparency, innovation, and adoption,” said Mike Cahill, founder of Douro Labs and core contributor to Pyth.

For Chainlink, this deal is a milestone, a shiny trophy in its cabinet of government ties, following months of policy discussions that probably involved a lot of coffee and PowerPoint presentations.

Chainlink Price Forecast: Can Bulls Extend Rally Beyond $27?

As the dust settled from the intraday rally, LINK found itself perched just below a short-term resistance cluster around $24.70. The daily chart, a tapestry of hope and despair, showed that despite last week’s correction, the bulls defended the $23.50 region, where the 13-day SMA and MACD signal line decided to have a little party of their own.

The MACD histogram, flipping green like a traffic light, signaled renewed bullish momentum. Meanwhile, the 5- and 8-day SMAs were curling upward, hinting at a potential bullish crossover if the buying frenzy continued. It’s like watching a soap opera unfold!

Chainlink Price Forecast | TradingView Aug 28, 2025

If Chainlink manages to close above $25.50 and keep the momentum going, the next targets are $27.20 and $29.50, with the latter being a nostalgic nod to February’s local top. A break above $30 could set the stage for a retest of $32, opening the door to a broader continuation rally. It’s like a rollercoaster ride, but with more spreadsheets!

On the flip side, if it fails to hold above $24.20, the short-term outlook could take a nosedive, sending LINK back toward $23.00 support. A deeper slide could even retest the $21.50 region, where the 50-day SMA stands like a bouncer at a club, ready to keep things in check.

The technical picture suggests LINK has room to extend gains if buyers keep the pressure on. But with resistance overhead and the wider market weakness from Bitcoin weighing on sentiment, strategic traders might just sit back and wait for a decisive close above $25.50 before diving in. After all, who wants to jump into a pool without checking if there’s water first?

Best Wallet Presale Gains Momentum Amid Chainlink’s Government Data Deal

In the midst of this whirlwind, Chainlink’s landmark US government partnership could significantly boost investor demand for secure multi-chain solutions like Best Wallet (BEST). Because who doesn’t want a wallet that’s as secure as Fort Knox?

Best Wallet Presale

The project has already raised over $15 million in its presale, offering users low transaction fees, attractive staking yields, and priority access to decentralized applications. With built-in multi-chain compatibility, Best Wallet is emerging as the go-to choice for traders navigating the wild waters of multiple blockchain ecosystems.

With discounted entry tiers still available before the next price increase, early participants can now secure BEST tokens directly via the official Best Wallet site. It’s like finding a dollar bill on the sidewalk-unexpected and delightful!

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-08-28 23:22