In the grand theater of finance, where fortunes dance with mischief, the winds of market sentiment settle, wafting hope upon the whispered dreams of traders. Recent tempestuous days have quelled, and lo! There flickers a sign-yes, the promise of a journey towards that alluring $30 realm if only fate remains kind. Perhaps it’s the universe compelling us to believe in serendipity, or maybe just good old market mechanics.

Open Interest Data Points to Renewed Trader Commitment

As the numbers ebb and flow, our dear Chainlink finds itself amidst a renaissance of sort! Futures positioning has rekindled a flame, rising from the ashes of a minor last week’s panic-quite the dramatic twist! The total open interest, now soaring back above a sculpted $180 million, brings a remarkable 12% leap! Traders cautiously dip their toes, dipping back into the mid-range pools, perhaps nursing the bruises of earlier ventures. After all, who doesn’t love a refreshing splash in the shallow line?

This stabilization in open interest signals returning speculative enthusiasm, albeit with a comical twist-less risk-taking than in the dizzying days of October. Indeed, should we witness an ascendance in this interest alongside robust funding rates, we could be in for a theatrical display of volatility! Our protagonist coin might just ascend, buoyed by the sturdy boat of steady demand.

Market Data Shows Healthy Liquidity and Growing Participation

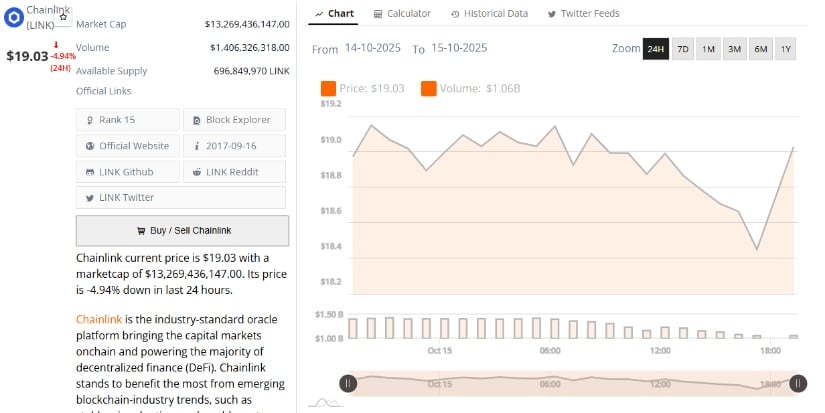

According to the economic sages at BraveNewCoin, Chainlink boasts an enviably stout market cap of $13.2 billion! A staggering $1.4 billion in trading volume within the day-oh, to be so popular! Although the broader DeFi realm experiences its dizzying ups and downs, our dear Chainlink stays buoyant, held afloat by a sturdy network utility and that delightful integration of oracles. Talk about friends in high places!

Trading dances within an enchanting $19.03 corridor-a pas de deux of accumulation and distribution! Like a well-rehearsed ballet, week over week, inflows waltz higher, revealing that from both the institutional grandmas and retail cousins, everyone’s scrambling with their chips as they prepare for the potential breakout. Who knew financial theatrics could be this thrilling?

Technical Indicators Suggest Building Bullish Momentum

Moreover, TradingView, like a crystal ball of sorts, reveals the LINK/USDT pair is experiencing glimmers of momentum recovery. The Chaikin Money Flow (CMF) has taken the hint, reading at 0.14, signaling that capital is cautiously tiptoeing back into the frolicsome market after a minute cooling-down. A breathing space, indeed! With positive CMF values strutting around, buying is slowly but surely winning the battle over selling-talk about investor confidence with a splash of bravado!

Yet, the Moving Average Convergence Divergence (MACD), quite the drama queen, hangs just below its signal line with a negatively contracting histogram. It’s like the muffin-top of a soon-to-be delicious cake-bearish momentum is fading, folks! Prepare yourself for a potential bullish crossover if the volume dances with delight! A close above $19.50 may herald the start of a playful reversal phase-oh the joy of coming attractions!

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-15 23:32