Ah, the sweet scent of optimism wafts through the market air, as Chainlink pirouettes upward, buoyed by a classic chart pattern that whispers of a potential trend reversal. Trading volume, like a loyal friend, remains steadfast, lending its weight to this delicate recovery.

Analysts, those ever-watchful hawks, now peer through their binoculars, eagerly anticipating a confirmed breakout. Projections flirt with the tantalizing figure of $14.45. Yet, amidst the mixed signals of technical indicators and the steady hum of trading volumes, Chainlink’s fate hangs in the balance, dependent on whether buyers can keep the momentum alive above those pesky resistance levels.

Double Bottom Pattern: A Prelude to Potential Breakout

In a recent post on X, our dear market analyst, Crypto Joe (@CryptoJoeReal), has unearthed a Double Bottom pattern on the 1-hour Chainlink/USDT chart. This formation, often heralded as a beacon of hope, suggests a reversal from the dreary downtrend to a jubilant uptrend. The two troughs, affectionately dubbed “Bottom 1” and “Bottom 2,” have nestled themselves around the $12.60–$12.80 range, establishing a robust support level. Who knew bottoms could be so supportive?

After the second low, Chainlink’s price prediction rebounded, strutting towards the neckline resistance near $13.50. A breakout above this neckline is the golden ticket to confirming the Double Bottom setup. The chart, in a moment of enthusiasm, also indicates a volume increase on the right side of the pattern, validating buyer interest. This surge in volume supports the notion that LINK is on the verge of a trend reversal, provided the momentum doesn’t take a coffee break.

As the price flirts with the 200-period moving average, hovering around $13.96, traders are on high alert for potential resistance. A decisive close above this dynamic level could send bullish sentiment soaring, paving the way to Crypto Joe’s coveted target of $14.45. This target, a common measurement approach, adds the height of the pattern to the breakout level. Simple math, right? Or is it just wishful thinking?

Mixed Sentiment: A Tale of Volume and Indicators

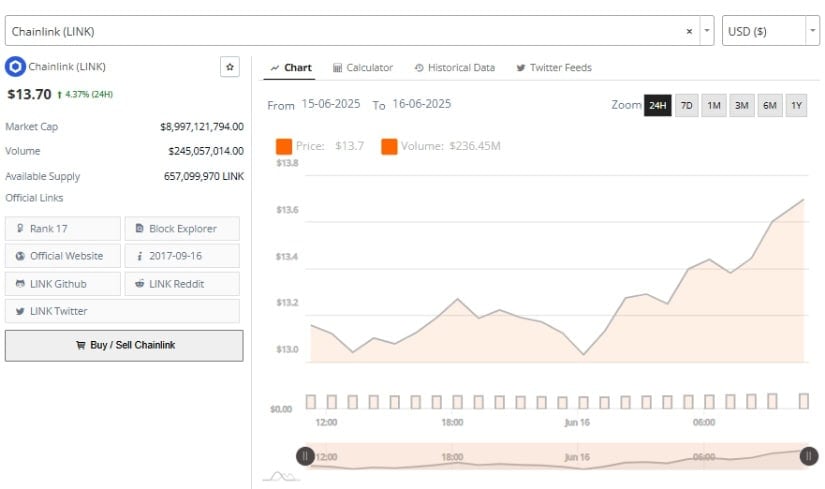

According to the wise sages at Brave New Coin, the shifting sentiment is reinforced, revealing LINK’s steady daily volume of $236.45M. This figure highlights a consistent transaction activity during the current uptrend, devoid of any wild speculative surges. The sustained volume suggests that LINK’s gains are rooted in genuine market interest rather than fleeting hype. Who knew the market could be so mature?

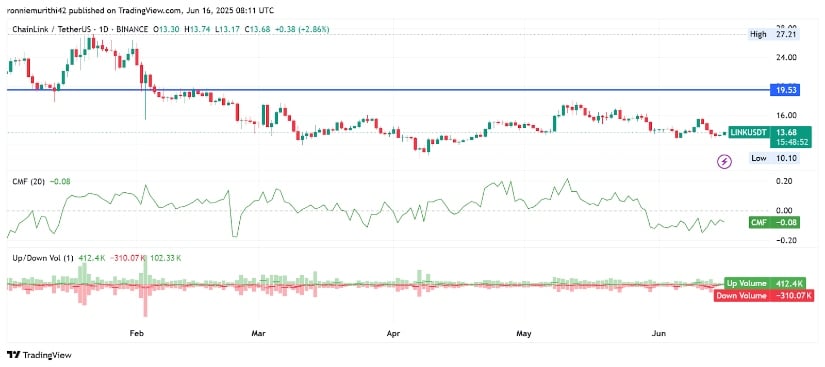

On the daily chart, Chainlink is attempting to solidify its recent gains, now trading around $13.68 with a 2.86% increase. Yet, despite this upward movement, technical conditions hint that the recovery remains as tentative as a cat on a hot tin roof. The broader trend shows that LINK Price Prediction is still languishing below the significant resistance level of $19.53, which has loomed like a dark cloud since March 2025. Recent price action is trying to establish a higher low, hinting at a potential trend reversal, though the move remains as unconfirmed as a rumor at a family gathering.

The Chaikin Money Flow (CMF) indicator currently sits at -0.08, reflecting a rather lackluster capital inflow. This reading suggests that buying pressure may not yet be robust enough to sustain a long-term recovery. Historically, LINK rallies with stronger momentum when CMF turns and holds above the zero line. The current figure hints at either cautious buyer interest or larger holders distributing into short-term strength. A classic case of “I’ll take my profits, thank you very much!”

In terms of trading volume, recent sessions show an up volume of 412.4K LINK compared to a down volume of 310.07K LINK. This reflects modest accumulation but not a dramatic shift in market participation. Without a sharp rise in volume accompanying upward price moves, the possibility of a sustained breakout above $14.50 remains as uncertain as a cat in a room full of rocking chairs. Analysts are watching for an increase in activity as a sign that the market may be preparing to challenge higher resistance levels.

Chainlink Price Prediction: Analysts Highlight Risks Despite Bullish Setup

In addition to Crypto Joe’s optimistic outlook, analyst @Isabella32331 also shared insights on X, highlighting a note of caution. According to her post, “Each circle marks a major spike or crash. The recent breakdown dragged the price down to $13.16. Consistent lower highs = weakening bullish momentum. The market is at a critical turning point—the next move could be decisive.” Her observation emphasizes that despite recent gains, the overall structure still shows signs of pressure from previous bearish momentum. A classic case of “don’t count your chickens before they hatch!”

This cautionary tone aligns with broader technical patterns observed on higher timeframes. LINK’s chart history indicates difficulty sustaining rallies above key resistance zones. Without confirmation from technical indicators and broader market sentiment, any breakout attempts could face rejection. The upcoming sessions are likely to determine whether Chainlink can continue toward its $14.45 target or revert to its prior consolidation range between $12 and $13.50. The suspense is palpable!

As Chainlink Price Prediction approaches key technical levels, traders remain attentive to both volume signals and price structure. A confirmed breakout and follow-through above $14.00–$14.50 may offer validation for the bullish scenario, but until then, price action remains in a sensitive zone, like a tightrope walker without a safety net.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-06-16 22:58