Ah, the Chainlink price prediction for 2025-much like the existential musings of a Russian nobleman staring into the abyss of his own soul-has become a topic of feverish speculation. The token, trapped in the cruel embrace of fate (or, more accurately, a tight range between $16.5 and $18.5), lingers in quiet desperation. Yet, beneath this stillness, the winds of change whisper of a grand reversal, as if the market itself were preparing for a Tolstoyan epiphany.

A Tale of Two Prices: LINK’s November Gambit

As of this writing, the Chainlink price hovers near $17.95-a figure as unremarkable as a minor character in a Russian novel. Yet, beneath this facade of mediocrity, an ascending wedge pattern, much like the slow unraveling of a doomed romance, has been shaping LINK’s destiny since late 2023. Will it break free? Or will it collapse into the abyss of $13.50-$14.50? Only time-and perhaps a few overly confident analysts-will tell.

This wedge, much like Tolstoy’s prose, is both intricate and tedious. A recent rejection near its midpoint in September led to profit-taking-because nothing inspires panic like the faintest whiff of success. Now, LINK teeters on the edge of a symmetrical triangle, threatening to plunge into the support zone. But fear not! Historically, such descents have been followed by dramatic rebounds-because the market, like Tolstoy’s characters, thrives on suffering before redemption.

November: The Month of Reckoning (or Just More Waiting)

If the Chainlink price forecast holds (a big “if,” much like Anna Karenina’s marriage), November could be the turning point-the moment when LINK shakes off its lethargy and ascends toward $27.86, the year’s high. Beyond that? Perhaps $46 by mid-2026-because why aim low when you can dream big? 🚀

Simple plan for Chainlink $LINK:

– Buy the dip at $15.

– Take profits at $46.– Ali (@ali_charts) October 25, 2025

The pattern suggests accumulation-much like a miser hoarding gold-before a grand upswing. This aligns perfectly with the market’s tendency to reward patience, or at least punish impatience slightly less.

The Ecosystem: Where Partnerships Flourish Like Mushrooms After Rain

While LINK’s price meanders like a lost aristocrat in St. Petersburg, its ecosystem thrives. In October, Chainlink partnered with S&P Global-because nothing screams “bullish” like aligning with financial institutions that still use fax machines. 📠

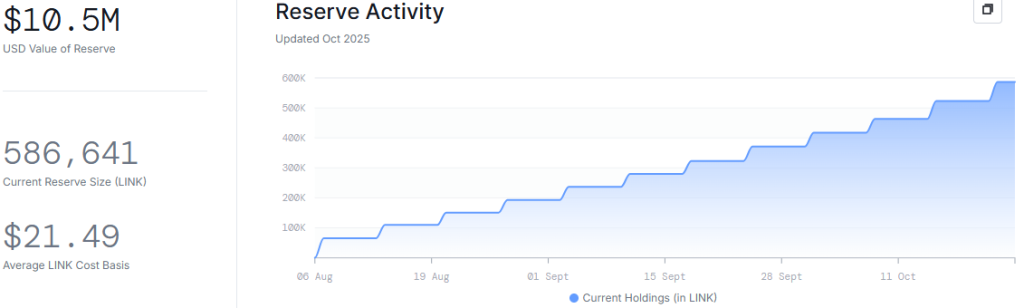

Meanwhile, the Chainlink Reserve-a pool of funds as mysterious as the motivations of Tolstoy’s characters-has grown to 586,641 LINK ($10.5 million). Is this confidence? Or just institutionalized hoarding? The world may never know.

Supply Metrics: The Silent (But Dramatic) Shift

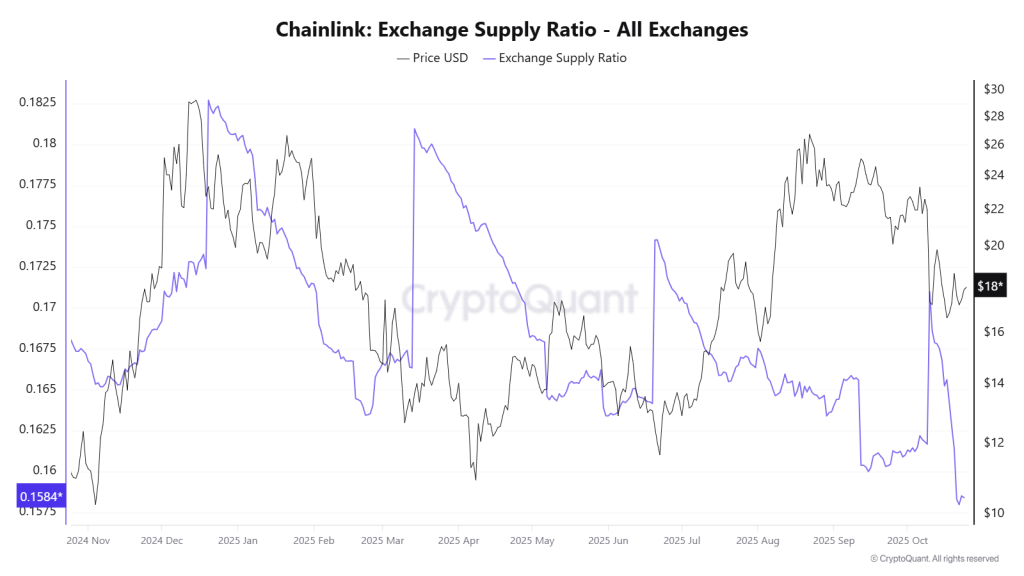

On-chain data reveals a decline in Exchange Supply Ratio-meaning long-term holders are withdrawing their tokens like disillusioned nobles retreating to their country estates. This could lead to a supply shock-because nothing fuels a rally like scarcity and desperation.

If this trend continues, LINK may surge-not because of fundamentals, but because traders will have no choice but to bid it up. Ah, the beauty of market mechanics! Truly, the stuff of literary tragedy-or comedy. 🤡

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top gainers and losers

- HSR Fate/stay night — best team comps and bond synergies

2025-10-25 15:08