As an analyst with over two decades of trading experience under my belt, I’ve seen bull markets and bear markets come and go. The recent surge in Chainlink (LINK) price is certainly catching my attention, but I’m not entirely convinced it’s here to stay just yet.

The whale activity has stabilized, suggesting a neutral stance from large investors. This could indicate caution regarding the sustainability of the rally. However, the rapid increase in RSI suggests that while buying momentum remains strong, the asset is approaching a critical threshold where upward movement may begin to face resistance.

In my humble opinion, Chainlink still has room for moderate gains in the short term, but traders should keep a close eye on the RSI as it nears 70. If buying pressure continues and a Golden Cross forms, we might see significant upward momentum, with targets at $27.46 and potentially $30.94.

But remember, even the most seasoned traders can’t predict the market with absolute certainty. As they say in my hometown of Wall Street, “Don’t count your LINKs before they hatch!

The price of Chainlink (LINK) has climbed more than 8% within the past 24 hours, and trading activity has skyrocketed by an impressive 106%, resulting in a whopping $1.04 billion in total volume.

Regardless of the significant fluctuations in price, the activity of whales (large-scale investors) seems to have leveled off. Specifically, the count of wallets holding between 100,000 and 1,000,000 LINK has stayed consistent at 527, following a previous high of 534.

LINK Whales Keep the Neutral Stance

As a crypto investor, I’ve noticed an impressive rise in the number of wallets holding between 100,000 and 1,000,000 LINK. On December 18, there were only 510 such addresses, but by December 27, this figure had climbed to a monthly high of 534. This surge in ‘whale’ activity suggests a strong accumulation phase, which indicates heightened interest from large investors during that period.

Monitoring the behavior of these whales is essential, as their transactions, whether buying or selling, significantly impact market trends. Typically, when they acquire more of an asset, it suggests optimism about its potential and may lead to additional price increases, since their large transactions generate a positive momentum in the market.

Based on my personal observation of the cryptocurrency market over the past few years, I have noticed that the number of LINK addresses peaked at 534 and has since dipped slightly to 527. This recent stabilization in numbers indicates to me that large investors are neither aggressively buying nor selling their LINK holdings. In my experience, such a steady trend can suggest a neutral sentiment among these investors, which could mean they are not particularly optimistic or pessimistic about the future of this cryptocurrency at this time. However, it’s essential to keep in mind that the market is dynamic and subject to sudden changes, so I will continue to monitor the situation closely for any potential shifts in investor sentiment.

Despite a 8% increase in price over the past day, the absence of continued buying by large investors might indicate caution about the longevity of the current market surge. For the LINK price to keep climbing, renewed enthusiasm and heightened activity from these big players could be needed to offer further backing.

Chainlink RSI Signals Possible Recovery

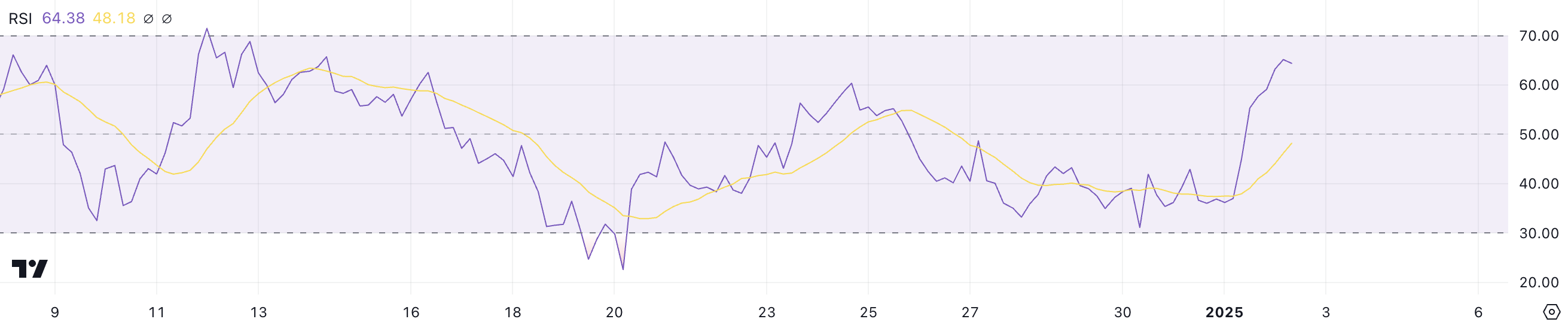

The relative strength index (RSI) of Chainlink has significantly spiked, climbing from 36.9 to 64.3 in a single day. This swift rise indicates a substantial change in momentum, which is likely due to robust buying activity in response to the recent price surge.

The Relative Strength Index (RSI), a frequently employed momentum indicator, evaluates the rate and intensity of price fluctuations on a scale ranging from 0 to 100. It offers insights into whether an asset is excessively bought (overbought) or sold (oversold). Readings over 70 typically indicate overbought conditions, potentially hinting at a forthcoming reduction in price, while readings under 30 usually signify oversold conditions and may forecast a subsequent rise.

With a Relative Strength Index (RSI) of 64.3, Chainlink is approaching the overbought zone. This suggests that although buying momentum remains robust, the asset could soon encounter resistance as it reaches a significant level where further growth might slow down. In the immediate future, this RSI level implies that LINK still holds potential for modest increases, but traders should keep an eye out for signs of fatigue as it gets closer to 70.

If the purchasing force persists, the Relative Strength Index (RSI) might shift towards overbought levels, suggesting a possible short-term pause or adjustment prior to more price action. On the other hand, if the RSI starts to level off or decrease, it could hint that the momentum is slowly losing steam.

LINK Price Prediction: Can It Reclaim $30 In January?

In simpler terms, the signal from Chainlink’s Exponential Moving Averages (EMA) suggests that a Golden Cross could happen shortly. The Golden Cross is an optimistic sign for traders, as it takes place when a short-term EMA moves above a long-term EMA, implying a potential upward trend in the market.

Should the Golden Cross occur and the present upward trend persist, it’s plausible that the LINK price may experience strong upward push. The value might attempt to surpass the resistance level around $25.99, and if it does, it could open paths for additional increases. Notable growth milestones at approximately $27.46 and potentially $30.94 could indicate substantial advancement for this asset.

However, the increased whale behavior and rising Relative Strength Index indicate that the current rise might not be completely durable, potentially setting up an opportunity for a turnaround.

As a seasoned cryptocurrency trader with over five years of experience under my belt, I’ve witnessed countless market fluctuations and learned to read between the lines when it comes to price movements. Based on current trends, if the uptrend for LINK were to weaken and selling pressure intensifies, I would anticipate a correction in its price action.

In such a scenario, the immediate support level at $21.32 could be tested. If this crucial support fails to hold, it might signal a deeper retracement, with the price potentially dropping further to $20.02. This kind of move would indicate a significant pullback in the market, and I’d advise cautious traders to tread carefully during such times.

Read More

2025-01-03 04:14