As a seasoned crypto investor who has weathered numerous market cycles and learned from my fair share of triumphs and tribulations, I find myself cautiously optimistic about Chainlink’s (LINK) recent surge. The 20%+ increase in the last 24 hours is certainly eye-catching, pushing LINK to its highest levels in three years. However, as someone who has seen the market ebb and flow, I can’t help but notice the stable whale accumulation and the RSI suggesting potential challenges for this uptrend.

Chainlink (LINK) price is up more than 20% in the last 24 hours, reaching its highest levels in three years. The recent surge pushed LINK to approximately $28, breaking past key resistance levels and signaling renewed bullish momentum.

Although the price surge is substantial, there’s been a steady buildup by large investors (whales), and the Relative Strength Index (RSI) of LINK indicates potential obstacles for the uptrend. Whether LINK can maintain its upward momentum or encounter its robust support at approximately $26.9 will significantly influence its near-term direction.

LINK Whales Stay Away Despite the Price Surge

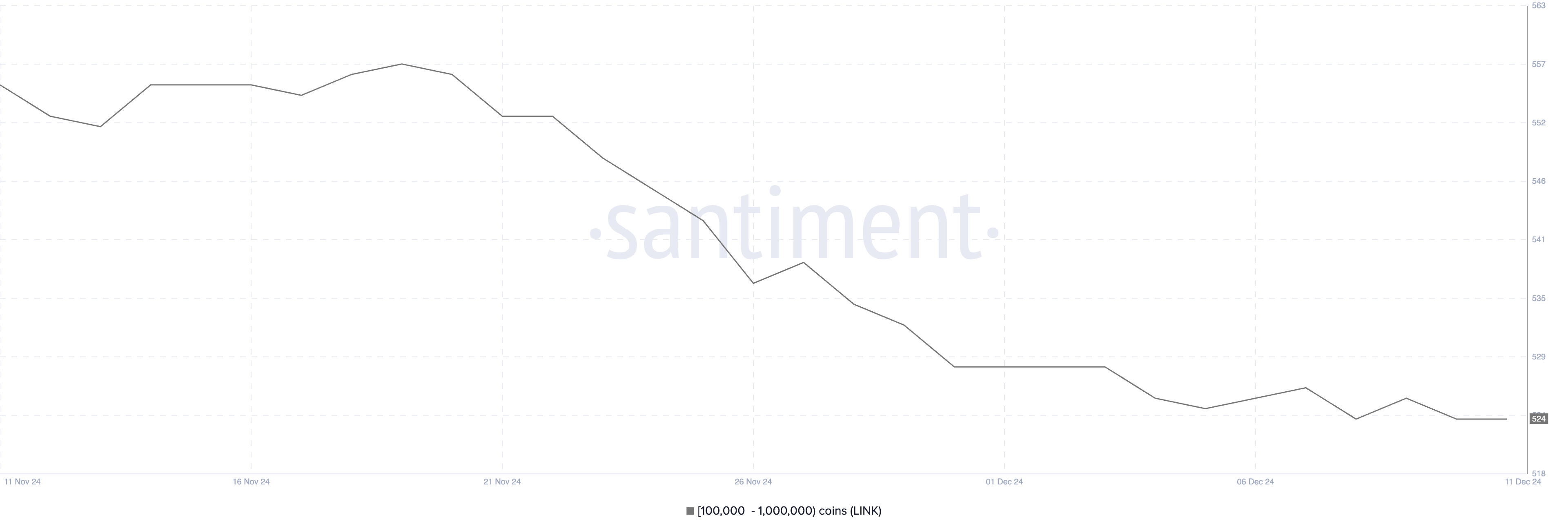

Despite the recent price surge, driven by Trump’s World Liberty Financial, the number of whales accumulating LINK has remained stable. Currently, 524 wallets hold between 100,000 and 1,000,000 LINK, a figure nearly unchanged from one week ago when it stood at 525.

After experiencing a significant decrease in whale activity, it seems that the current state is one of stability. Since November 19th, the number of wallets holding comparable amounts of LINK has been steadily decreasing.

Monitoring the behavior of whales (large investors) is crucial as they have the power to sway market dynamics substantially. Frequently, their repeated buying or selling tends to set off significant price fluctuations. The recent increase in the number of these whales, after a period of decrease, might suggest a change in investor sentiment towards the market.

The decline might indicate less certainty or selling from the ‘whales’, but this current halt could be signaling a period of price stabilization or even a potential short-term turnaround.

Chainlink RSI Is Testing To Break the 70 Level

Currently, the Relative Strength Index (RSI) for Chainlink has dropped slightly from momentarily reaching 70 to 66. However, this represents a substantial rebound from its December 9th level of 32, suggesting robust upward trajectory in the last seven days, indicating strong positive momentum.

Yet, maintaining Relative Strength Index (RSI) consistently above 70 seems elusive, which suggests a possible barrier in its ongoing upward trend. This raises doubts about the robustness of the price increase.

The Relative Strength Index (RSI) is a tool that quantifies how quickly and intensely prices are moving to identify if an asset is overbought or oversold. A reading above 70 usually signals that the asset might be overbought, potentially indicating it could encounter selling activity. Conversely, a reading below 30 generally indicates the asset may be oversold, which can suggest possible buying opportunities.

For Chainlink, a value of 70 seems significant; if the Relative Strength Index (RSI) manages to stay above this mark over several days, the price may keep ascending further. Nevertheless, its inability to sustain above 70 lately hints that the current upward trend might be weakening, possibly resulting in a temporary halt or even a slight decline in the short term.

LINK Price Prediction: Can It Reach $35 Next?

As a crypto investor, I’ve noticed that the latest spike in LINK’s value has pushed it up to approximately $28, which is its highest since January 2022. However, if the current upward trend takes a downturn, my analysis suggests that a strong support level might be found around $26.9.

If it doesn’t maintain that level, the price of LINK might drop down to $22.4 or even $19. These points mark substantial pullbacks from its recent advancements and serve as crucial support levels. They are vital in preventing a more severe adjustment as the market assesses the robustness of the ongoing bull run.

Conversely, should the upward trend persist, the LINK price is currently just under 8% shy of touching the $30 threshold once more, a level it hasn’t breached since last November.

As a crypto investor, I’m excited about the possibility of our digital asset breaking past the resistances at $28 and $29. If this happens, it might open up a path towards more growth, with $35 potentially being the next milestone on our journey upward.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-12 21:46